Is the weakness of the Swedish krona overdone?

Elections for Swedens‘ Riksdag take place on September 9. The EU Commission has criticized the vote as voter anonymity could be damaged by the fact that party voting lists are laid open. Voting intentions will be revealed when a voter takes the voting list of his chosen party into the voting cabin. Thus, anonymity is restricted to the choice of a specific candidate on the voting list. As a result, and for this first time in Sweden’s history, OSZE election observers have been sent to monitor the voting process.

Fears that Russian or other organizations might try to manipulate the vote and that the right-wing, anti-establishment “Sweden Democrats“ (SD) might do well in the vote have hit the Swedish krona in recent weeks.

We think current political concerns over Sweden are exaggerated. Even should the SD emerge from the election with the largest voter share, its path to administrative power will be blocked by the other parties. Sweden’s next Prime Minister will emerge from the “moderate” parties but this could well boost the chances of a more consequential victory for the SD in 2022.

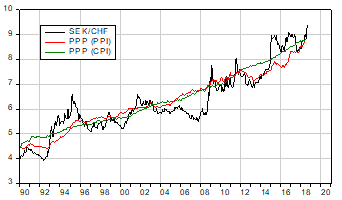

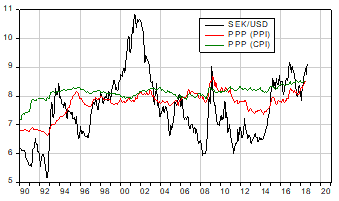

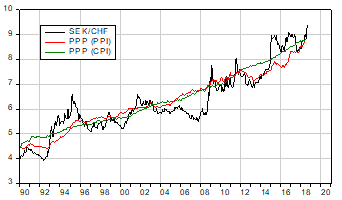

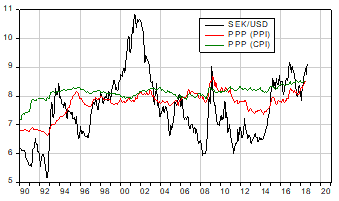

Purchasing power parity (PPP) calculations indicate the Swedish krona is significantly undervalued against both the US dollar and the Swiss franc. This is clear from the two graphs in the next column. The undervaluation is around 6-7% using either consumer or producer prices to measure PPP.

The weakness of the SEK is exaggerated and thus allows for investment opportunities.

Swedish krona per Swiss franc since 1990

Source: Thomson Reuters / Datastream und eigene Berechnungen

Swedish krona per US dollar since 1990

Source: Thomson Reuters / Datastream und eigene Berechnungen

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.