Brexit – It’s “five minutes to midnight” and sterling is undervalued

Hoping to avoid a loss of face, the UK and the EU can be expected to continue to negotiate right up to the last minute. Both sides want to avoid a “hard Brexit“ – i.e. a Brexit without agreement on the future UK-EU relationship – and this mutual interest means such an outcome can be avoided. Sterling is clearly undervalued and attractive on a medium-term basis. By contrast, UK stocks have an attractiveness rating which is only average.

Whoever doesn’t negotiate up to the last minute risks a “loss of face”. This risk is one which neither Mrs. May nor her EU counterparts want to take. We therefore don’t expect a formal agreement on an orderly Brexit before January and it could come even later. It’s worth noting that the EU share of British exports is 43% and the EU share of British imports is 54%. The treatment of Northern Ireland is proving very difficult to resolve. But there is now agreement on some 90% of the other issues at stake in the negotiations.

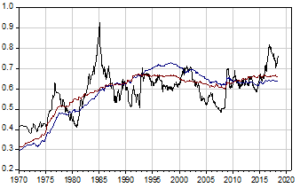

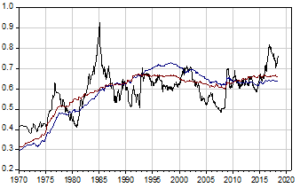

The British pound seems already to have “priced in” a lot of negative news. This is indicated by Aquila’s Purchasing Power Parity model as shown in the graph. The model’s current estimates of fair value for the pound against the US dollar are 0.638 (using producer price indices in blue) and 0.659 (using consumer price indices in red). In terms of sterling, the equivalent dollar exchange rates are 1.568 and 1.517 respectively. We see the chief risks for the pound as being (i), a political crisis in the UK and (ii), a general investor “flight to safety” into the US dollar. But we expect sterling will tend to rise against the dollar once current Brexit uncertainty has been removed. Assuming a deal can be agreed, we could see a hike in UK interest rates in the first half of 2019.

The pound is clearly undervalued against the dollar

Pound appreciation could hit the value of UK stocks in local currency terms, as this would impact negatively on the sterling value of UK corporate profits. In general, the UK equity market is relatively defensive among the world’s equity markets but it’s relative attractiveness is only average.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.