Executive Summary

- The Atlanta Fed's forecast model shows a significant decline in US gross domestic product for the first quarter. However, the model is highly susceptible to fluctuation and is characterized by a number of special effects.

- We have also reduced our expectations for US economic growth.

- Germany relaxes the debt brake for defense and infrastructure spending. This improves expectations for the entire region. Inflation is falling, but remains above the 2% target in most economies.

- Political changes could have an inflationary effect.

- A divergent trend can be seen in government bonds: US yields are falling, while they have risen in the European markets. As debt in Germany is set to rise, investors are demanding higher yields.

- The celebratory mood on the US stock markets has come to an abrupt end and has given way to uncertainty. European markets are booming.

- The US dollar is moving slightly lower again.

- The gold price reaches new highs against all currencies. We remain constructive on the yellow metal.

Our macroeconomic assessment

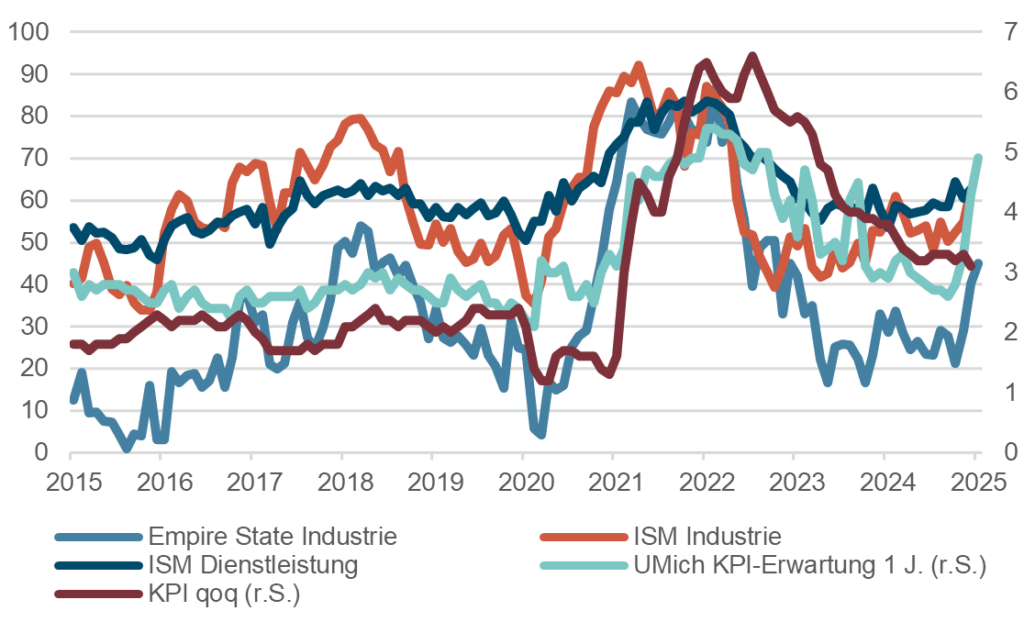

Business cycle

- Despite the high level of uncertainty, the US economy remains in good shape. Gross domestic product (GDP) grew by 2.3% in the fourth quarter. The US Federal Reserve recently lowered its growth forecast to 1.7%, reflecting the increased uncertainty.

- Labour market conditions have normalized, but remain solid. However, Elon Musk's efficiency improvement program is increasing the number of redundancies and private companies are also contributing to the rise.

- The German Bundestag and Bundesrat have approved the relaxation of the debt brake for defense spending and the establishment of a special fund of EUR 500 billion for infrastructure investments.

- The KOF sentiment barometer is also expected to rise again in Switzerland.

- The macroeconomic projections for Europe and Switzerland therefore show a positive growth trend for the next two years, while the forecast for the USA signals a slowdown.

Leading indicators, consumer price index in %

Source: Bloomberg Finance L.P.

Monetary policy

- In the USA - as in some other countries - inflation is still falling, but is approaching the long-term target of 2%. The US Federal Reserve expects the 2% target to be reached by 2027.

- We expect inflation to remain well above the 2% target in the coming months. Numerous leading indicators point to a significant surge in inflation in some cases.

- In particular, the central bankers are focusing on the effects of the announced reciprocal punitive tariffs.

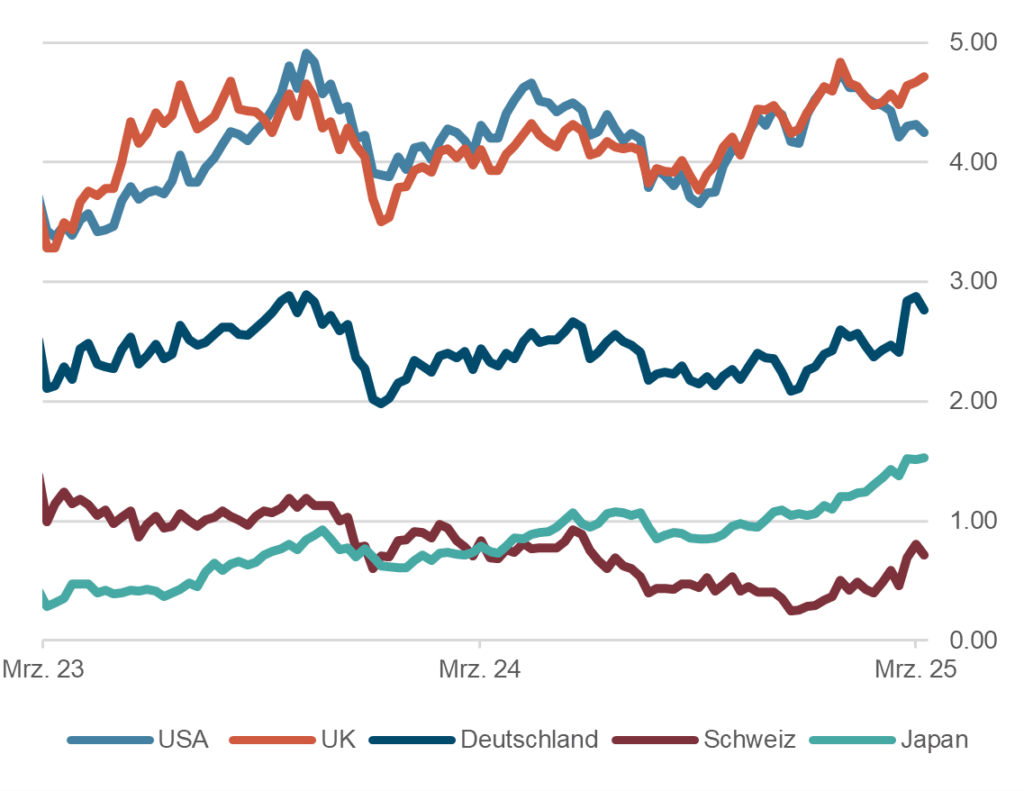

- The SNB has lowered its key interest rate for the fifth time in a row - by 25 basis points to 0.25%. This is in response to weak economic growth and very low inflation of 0.3% as well as a strong Swiss franc.

- The British central bank left its key interest rate unchanged at 4.50% and warned of inflation risks due to external factors such as punitive tariffs.

- Market participants expect the European Central Bank (ECB) to ease its monetary policy by 0.25 percentage points at its meeting on April 17.

Our investment policy conclusions

Bonds

- Yields on 10-year government bonds are currently at 4.3% in the USA, 2.8% in Germany and 0.6% in Switzerland. The feared rise in US yields as a result of the measures announced by the Trump administration has not (yet) materialized. On the contrary: nervousness on the stock markets (US recession?) has recently caused US yields to fall.

- The deterioration in consumer confidence in the USA and statements by politicians pointing to a "forced recession" can also be seen in credit spreads - although historically, spreads have only risen slightly to date.

- In Europe, the picture is different: yields have risen significantly due to the announcement of new, debt-financed fiscal programs (armaments, infrastructure).

- We continue to regard the asset class as only moderately interesting and would prefer securities with a high credit rating ("investment grade" and government bonds) and at most medium duration if investment is required.

Interest on 10-year government bonds, in %, 2 years

Source: Bloomberg Finance L.P.

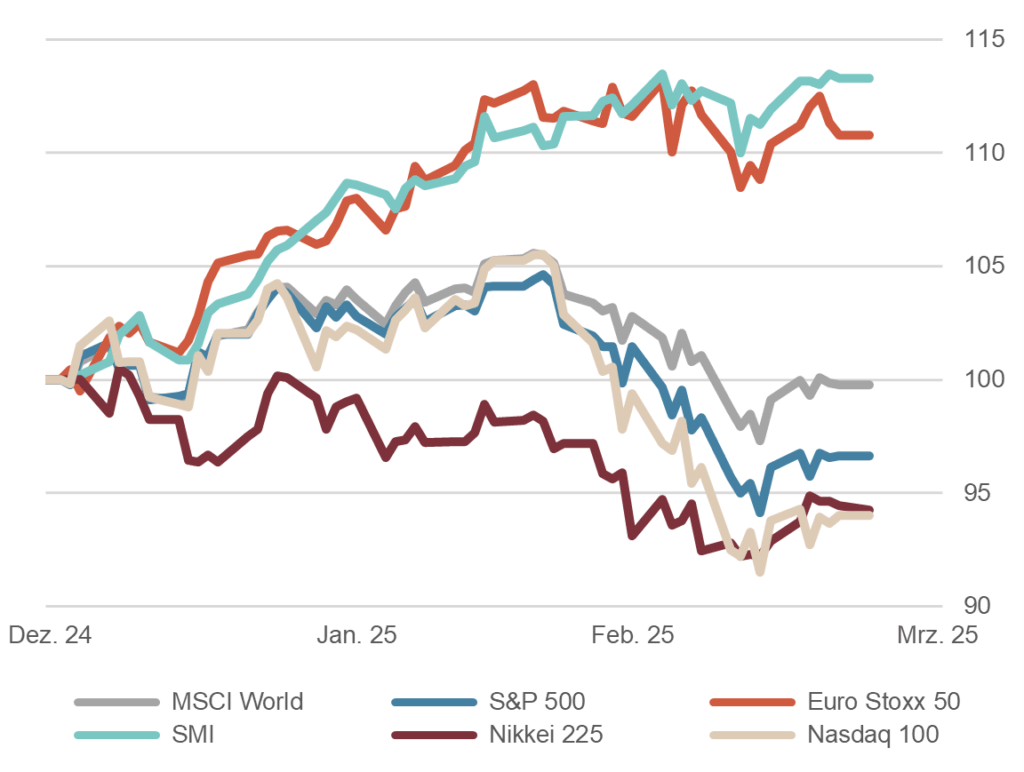

Equities

- The celebratory mood on the US equity markets has come to an abrupt end. The Trump administration's "change of sides" in Ukraine and the tariffs that have now been effectively imposed (and likely subsequent retaliatory measures) on various trading partners are causing noticeable uncertainty on the US markets. Although Wall Street continues to see its expectations of a new "golden age" under Trump's leadership confirmed, some growth indicators in the US are slowly beginning to turn around.

- In contrast, the outperformance of the European equity markets is striking. However, it is mainly Anglo-Saxon investors who have become involved and are fueling the imagination for the European markets. In addition, contrary to the fundamental data, the euro is seen as having potential for appreciation.

- Overall, we remain cautiously positive for the further course of the equity markets. The rotation from growth sectors to more defensive areas could continue, as could the shift of investment capital from the US to Europe.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

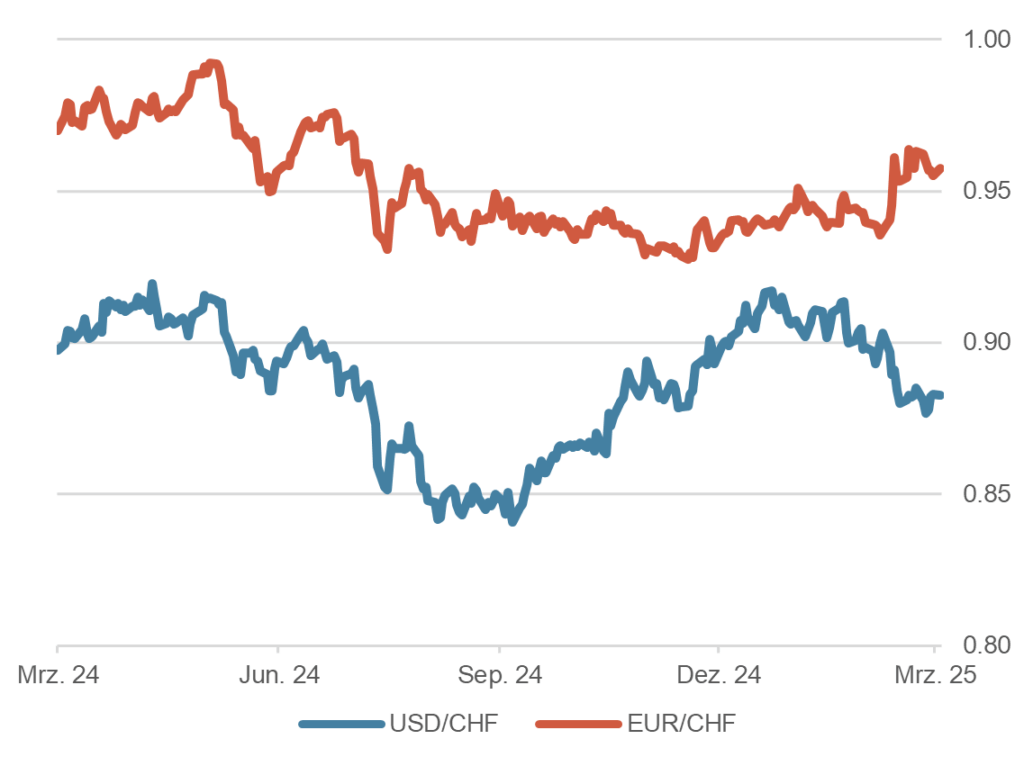

Forex

- Following the upswing in the fourth quarter of 2024, the US dollar lost some ground again in the course of the first quarter of 2025. In our opinion, the interest rate differentials and the differences in central bank policies between the US dollar and the major currencies have been sufficiently factored into exchange rates. However, statements from the Trump administration that the US dollar is overvalued and thus puts American exporters at a disadvantage are unsettling. Holders of US dollars (e.g. foreign central banks) should be taxed. However, it is difficult to imagine that the USA would want to give up the privilege of being the global trading currency.

- The EUR/CHF exchange rate has been quoted at around 0.94 for several months, but has now risen significantly to 0.96 due to developments in Europe. The scope for interest rate cuts by the SNB is limited. We only expect a renewed dip into negative CHF interest rates in an extreme emergency.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.