The Italian government’s finances could spiral out of control. Italian government bonds are unattractive

Italy is staying in the Eurozone. But the new Italian government takes a cavalier view as to the spending programs it can afford. This spells trouble for bonds. Italian government bonds are unattractive, but Italian equities seem reasonably valued.

Italy is systemically important

After the US and Japan, Italy has the world’s third largest volume of government debt outstanding. So Italy is even more important within the world financial system than was Lehman Bros. a few years back.

An exit from the Eurozone is unlikely for now

When the euro was introduced in 1999, 81% of all Italians supported it. Now the figure is only 59%.

Despite this, incoming Finance Minister Giovanni Tria has said he has no intention of trying to engineer an Italian exit from the Eurozone. This would anyway be very difficult to achieve, not least because of Italy’s constitution. A Eurozone exit would probably need a popular vote. Italy‘s cooled enthusiasm for the European project could push the EU into taking a tougher line in the UK’s EU exit negotiations. Brussels‘ bureaucrats may see advantages in handing the UK an exemplary punishment to deter others considering a life outside EU institutions. That’s said, Italy’s current debate concerns its membership of the Eurozone rather than its membership of the EU.

Italy’s new coalition looks unstable

taly’s government comprises two parties which represent very different regions and are far apart philosophically. The vote which brought the government to power was the product of the Italian economy’s chronic depression.

The Italian Lega Nord wants to cut taxes. The Movimiento 5 Stelle‘s key supporters in the South want a universal minimum income without conditions. While these two groups have more differences than things in common, they share contempt for the liberal establishment and jointly support such slogans as “Italy First” and a philosophy which attributes all fault to external factors.

Graph 1 shows the extreme division between Italy’s North and South with reference to the unemployment rate. Unemployment correlates well with the voting results for 5 Stelle and Lega Nord.

Graph 1: Italy’s unemployment rate by region

Source: BBC, ISTAT https://www.bbc.com/news/business-43247500

Italy now offers political satire

Italian President Matarella has confirmed Mr. Savona as Minister for European Affairs – a surprising choice as just a few days before he had ruled out Savona as Finance minister on grounds of his hostility to the Eurozone. That earlier refusal almost prevented the installation of the new government.

Italy’s plans for government spending are unrealistically high

Italy’s plans for government spending are unrealistically high. The automatic minimum income and planned tax cuts alone could boost government spending and the government’s deficit by EUR 100bn, or by around 4% to 5% of GDP.

In turn, this would imply an irresponsible and unsustainable increase in the deficit from 2.3% of GDP now to around 7%. That said, one should recognize that the chances of an (albeit tentative) attack on Italy’s excessive regulation are now relatively good. Structural reform is a core part of Lega Nord’s legislative program.

Caution on Italian government bonds

We think the next three months could well see markedly higher yields in Italy as investors demand compensation for the risks involved in Italy’s budgetary plans. In view of this, caution is warranted even though we believe the ECB would eventually intervene without restraint in order to prevent any chance of an Italian government default. The ECB is unlikely to respond immediately to a widening of spreads because of its desire to manage investor expectations/influence policy makers. But wider spreads could later be used as the justification for ECB rescue measures. In other words, widening spreads would eventually prompt the ECB to take action as opposed to the ECB acting a priori to prevent a future widening of spreads. After the “rescue call” on Italian spreads (as the ECB acts to stabilize the situation) Italian bonds might temporarily be interesting investments, assuming that ECB intervention is linked to meaningful policy changes being forced on the Italian government.

An incremental yield of “only” 2.3 % is not enough to compensate for current risks.

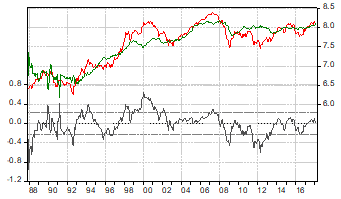

Italian equities are fairly valued

Aquila’s equity valuation model suggests that the MSCI Italy index for Italian shares is fairly valued. (See graph 2). The fair value line and MSCI Italy index value are in green and red respectively on the right hand logarithmic scale. The implicit over/undervaluation is shown in grey on the left hand scale.

Graph 2: Italian shares are fairly valued

Source: Thomson Reuters, Datastream, eigene Berechnungen

Patience should pay off

Italy‘s equity market is neither cheap nor expensive when measured against profits or bond yields. But Italian shares, especially bank shares, could come under near-term pressure as Italian bond spreads widen. Despite our assessment of fair value there is no need to hurry. Patient investors should wait for a better time – when Italian equities are trading at a substantial discount to fair value – to establish positions.

In the North of Italy industrial production is running strongly and the manufacturing sector in Italy’s North is both competitive and profitable etc., etc…

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.