Russia has begun its invasion of Ukraine. Explosions are reported from various cities. Stock markets are correcting worldwide and safe havens are being sought by investors.

Russia launches invasion of Ukraine

Russia began its invasion of Ukraine on Thursday night. According to Kremlin leader Wladimir Putin, the aim is to protect the people of Ukraine, “who have been suffering mistreatment and genocide for years”. Meanwhile, explosions are being reported from various cities caused by cruise missiles and rockets. According to official reports, Russian troops have entered Ukraine in several areas by land, air and sea. However, the situation is extremely unclear at the moment. Military successes are being reported by both the Russian and Ukrainian sides.

New sanctions will follow

Nato has called a special summit for tomorrow Friday. Already, numerous heads of government including US President Biden, German Chancellor Scholz and British Prime Minister Johnson have announced new and far-reaching sanctions.

Stock markets under pressure, safe havens sought

Moscow’s announcement has unsettled the investment community which lead to significant declines in global stock markets. While the strongly export-oriented German stock index DAX lost almost 5% of its value on Thursday, the English index FTSE 100 did much better with -3%. The reason is the significantly higher weighting of the energy and commodities sector in the index. Meanwhile, the price of crude oil reached its highest level since 2014 at over 100 US dollars per barrel, as new sanctions could also hit oil trade with Russia.

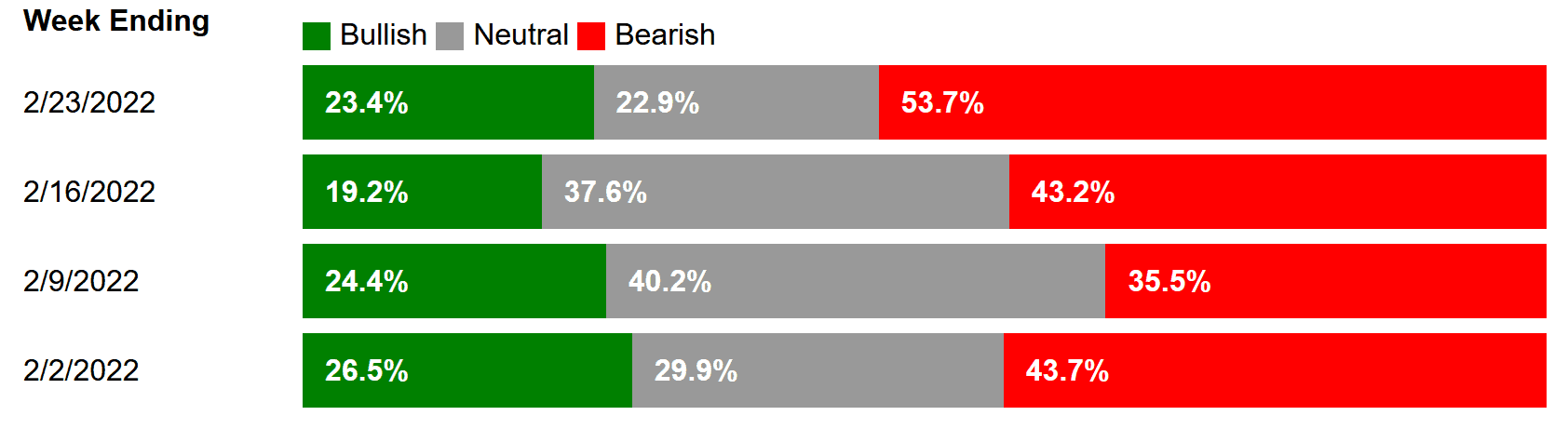

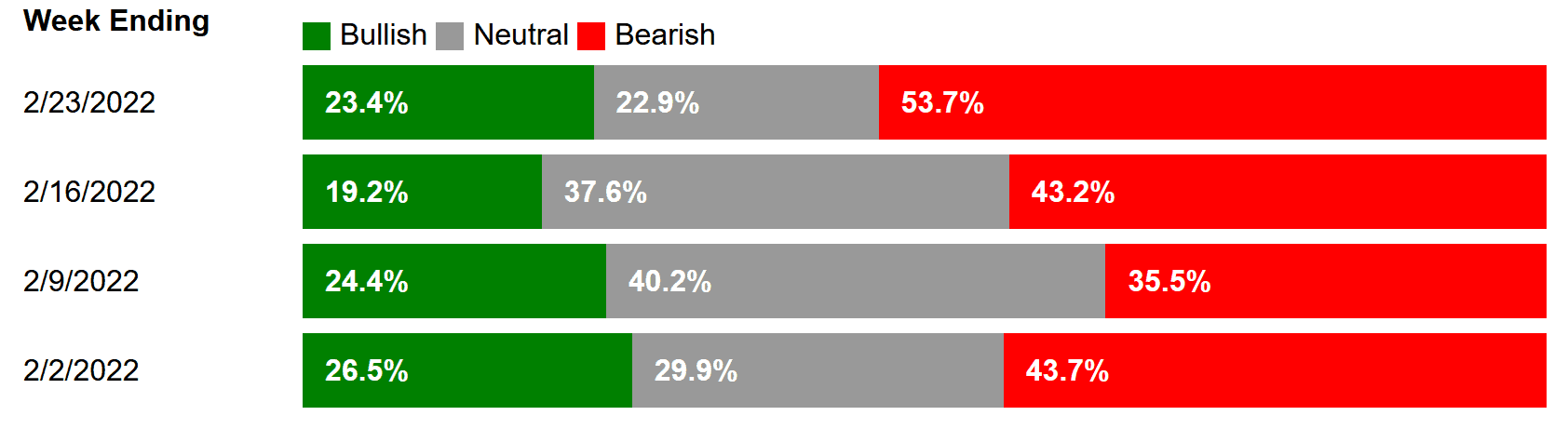

Safe havens such as gold, the US dollar and the Swiss franc are also in demand. Investor sentiment has thus clouded again, although it has already been cautious for several weeks, as the “AAII Sentiment Survey” shows: the highest number of pessimistic investors (bears) since 2013.

AAII Sentiment Survey

Source: https://www.aaii.com/sentimentsurvey

Source: https://www.aaii.com/sentimentsurvey

Do not lose sight of strategic asset allocation

Major movements and corrections in global stock markets are no exception. However the recent past has shown that political uncertainties in particular only have a short-term influence on the development of asset prices. During the two most recent events, the annexation of Crimea and Brexit, the European stock market Stoxx Europe 600 corrected by 5% and 8% respectively. Currently, the index is already down by more than 7%. The European stock market thus seems to have already priced in lower growth expectations and a low appetite for risk. Investors should therefore not overreact but rather reflect on their personal strategic asset allocation.

Diversification more important than ever

In the past, stress in the financial markets triggered by geopolitical events led to only short-term setbacks in diversified portfolios. In addition to a neutral equity allocation, we continue to recommend overweighting gold as a safety anchor in portfolios. Non-traditional asset classes can also have a volatility-dampening effect in the current environment.

We will be happy to update you with a more comprehensive analysis and recommendations early next week.

Contact: Nicolas Peter, Head of Investments

Telephone: +41 58 680 60 42

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.