Asset managers think ChatGPT is hype

While individual independent asset managers speak of price opportunities, the majority of those surveyed tend to be more gloomy in their forecasts. More than 50 percent of external asset managers also think that text software based on artificial intelligence is completely overrated.

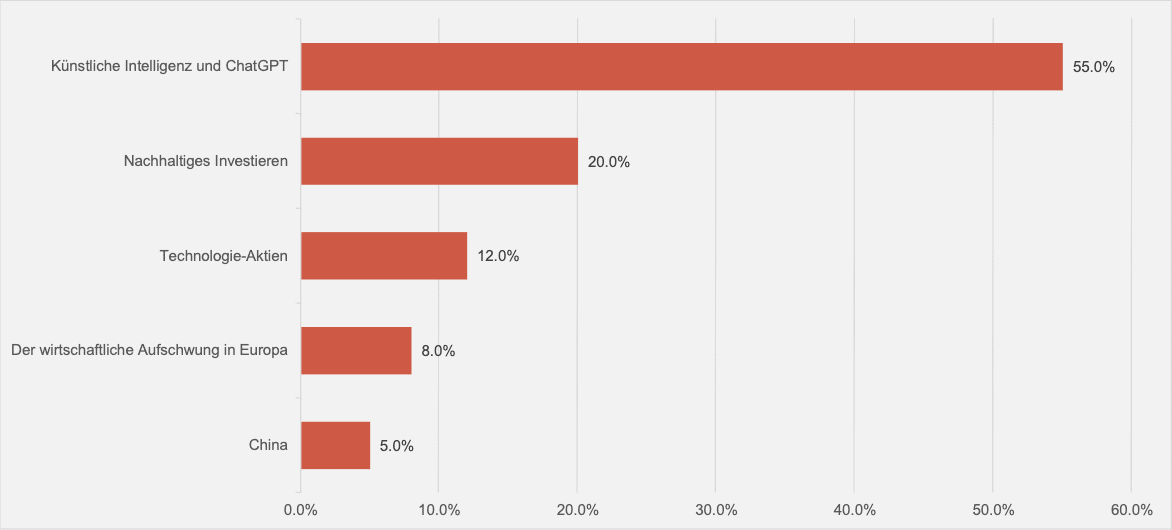

Independent asset managers in Switzerland consider the topic of ChatGPT to be the greatest hype, i.e. the greatest exaggeration. A good 55 percent of respondents are of this opinion. Sustainable investing is now considered the second biggest hype, followed by technology stocks (see chart below).

The main reason for this assessment is probably the fact that although everyone is talking about the text-based dialog system based on artificial intelligence (AI), no one really knows how it could be used in a targeted manner - at least this is the dominant opinion among independent asset managers. Accordingly, there is also a certain reluctance to invest in corresponding AI companies.

This information is derived from the Aquila Asset Manager Index (AVI), which the Swiss Aquila Group is published every three months in cooperation with finews.ch. The index summarizes various forecasts and assessments by independent asset managers in Switzerland. 150 firms participated in the latest survey.

Alternatives to tech stocks

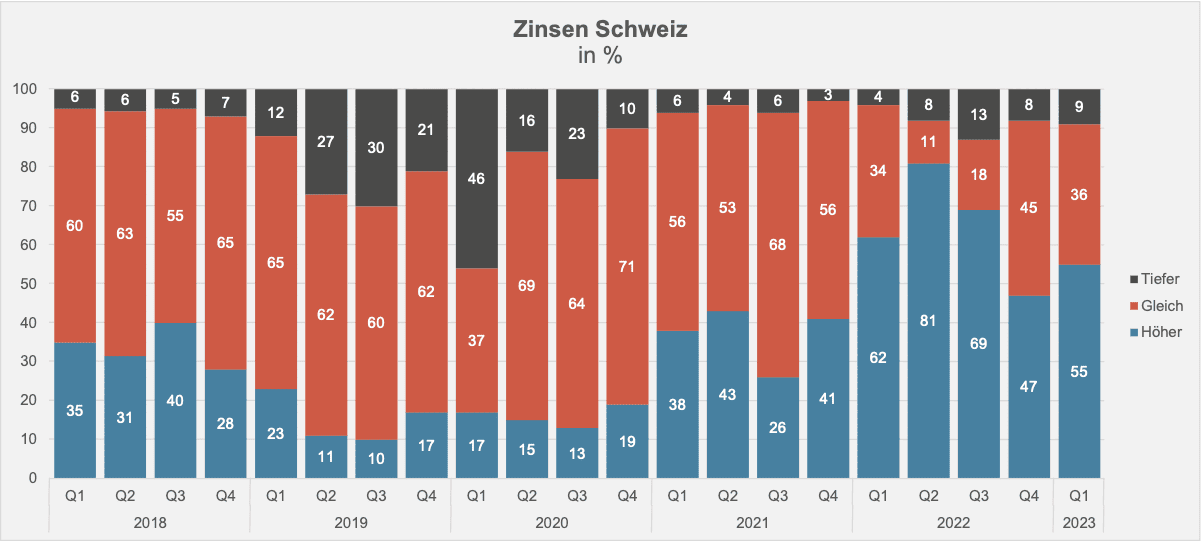

The investment behavior described is also partly attributable to the latest interest rate expectations. For example, respondents expect interest rates to rise further in Switzerland, Germany and the USA. Under these premises, there are some other asset classes worth examining besides (risky) technology stocks.

With regard to Switzerland, 55 percent (three months ago: 47 percent) of the survey participants currently expect interest rates to continue rising (see chart below); in the USA, the figure is as high as 64 percent (three months ago: 47 percent). In Europe, 64 percent of respondents continue to expect interest rates to rise.

Think in terms of variants and scenarios

"The interconnectedness of the international financial markets is greater than ever, and the current financial market turmoil will also be with us for a while. Risks in the system are not easy to see through," says Markus Gnehm, partner at the Winterthur-based asset manager Swiss Wealth Consulting. "It is therefore all the more important to pursue a strategy geared to one's own needs instead of choosing a standard portfolio. This allows one to think in terms of variants and scenarios. For this, a neutral and externally viewed assessment of the situation is essential," Gnehm continues.

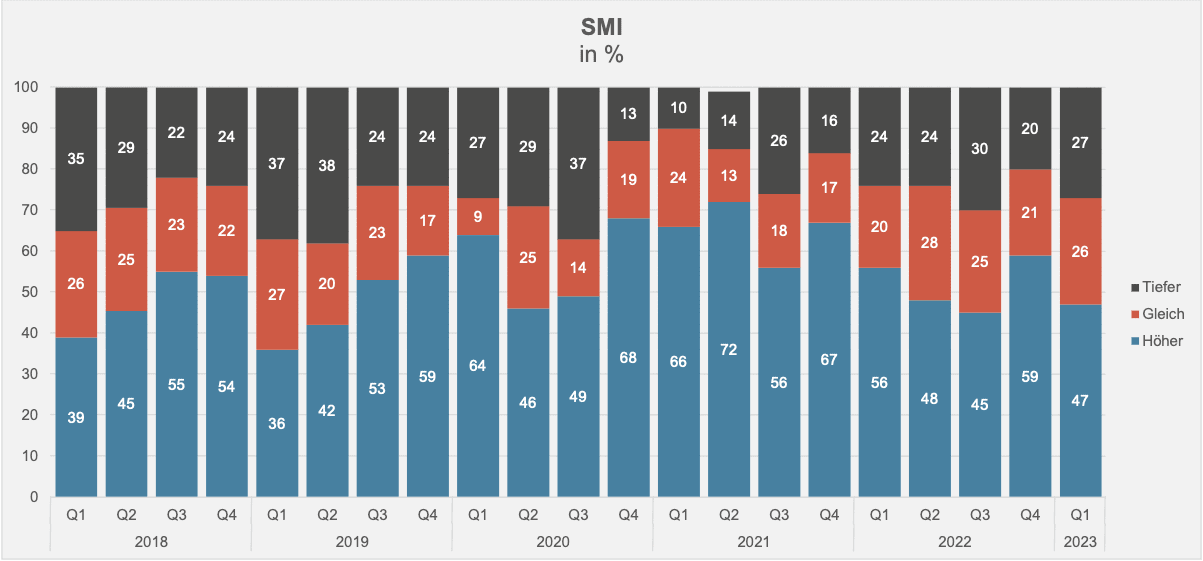

In view of the many uncertainties and risks in the current year, more independent asset managers now expect lower share prices in the next three months. This is the opinion of 27 percent, compared with just 20 percent three months ago. Only 47 percent expect higher share prices, compared with 59 percent at the end of December 2022 (see chart below).

"We are currently observing a strong divergence in the gap between the macroeconomy and the microeconomy. Despite the still very negative sentiment in the macro area, we are currently identifying very interesting buying opportunities in the context of corporate bonds from the SME segment and in the niche area, as yields have risen well into double digits in many places," says Peter Lippross, Senior Portfolio Manager at the independent asset manager Genève Invest.

Buying opportunities not seen since the financial crisis

"Corporate bond default rates are and will remain low as companies across the board continue to do good business and post solid numbers. This is currently creating buying opportunities the likes of which we have not seen since the financial crisis," Lippross added.

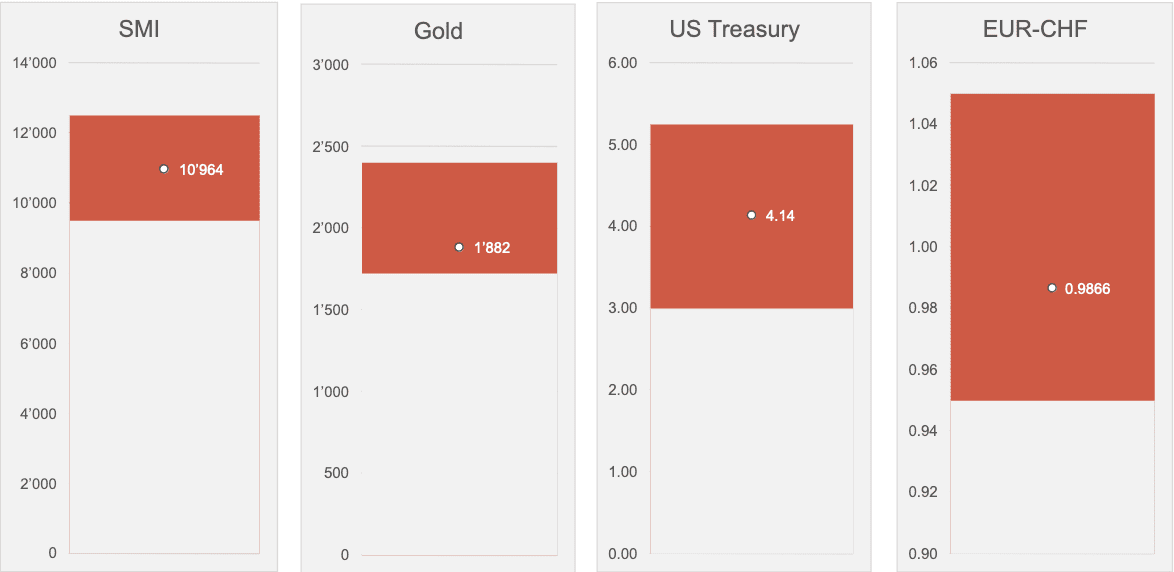

Three months from now (see chart below), the independent asset managers see the Swiss Market Index (SMI) at a level of 10,964 (currently: 11,241).

Independent asset managers are skeptical about gold; the various interest rate hikes by central banks have clouded the view of the yellow precious metal.

Is a correction looming in gold?

By the end of June 2023, the respondents expect the price to reach 1,882 dollars per troy ounce (currently: 2,007 dollars) - well below the 2,000 dollar mark again.

They estimate the yield on the 10-year U.S. Treasury at 4.14 percent in three months (currently: 3.43) and the euro-franc exchange rate at 0.9866 (currently: 0.9850).

The next AVI index will be published in July 2023.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.