Upcoming Bavarian elections might hurt the euro. Therafter, US mid-term elections could force a temporary reversal for the dollar.

Election turbulence in Europe could spell trouble for the Euro in October. The Bavarian state elections are scheduled for Oct. 14. The CSU and SPD may suffer such appalling losses that the continuation of Germany’s Federal coalition government is called into question. Thereafter, with US mid-term elections on Nov. 6, markets may move increasingly to focus on the potential for a power shift in Washington.

Sweden’s general election is scheduled for Sept. 9. Then, the new Riksdag will choose Sweden’s next Prime Minister Even if the anti-establishment Sweden Democrats (SD) wins the election, a candidate from this party would almost certainly be unacceptable to the other parties. A rebuff for the SD this time around could well boost its chances of eventual victory after the election in 2022.

Bavaria’s elections will take place on Oct. 14. These elections are significantly more important for the future of Europe, and in particular the EU, than those in Sweden. This is not really because Bavaria has more inhabitants than Sweden – 12.4 million to 9.9. million – but rather because results in Bavaria could force policy changes on Germany’s Federal coalition government and ultimately might pose a threat to the coalition’s survival.

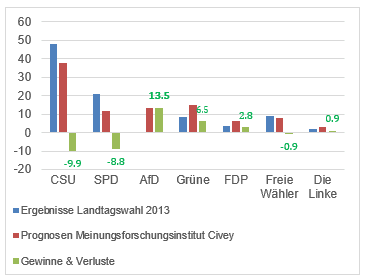

Following the 2017 Federal elections, the CDU/CSU and the SPD formed a defensive coalition to in order to protect their status as Germany’s ruling parties (even though public statements suggested the coalition was founded to prevent the rise of the AfD and to protect the European project.) The CSU, and even more the SPD, stand to lose seats on a massive scale. Graph 1 shows the result of the 2013 Bavarian elections as well as polling estimates for the result this time around.

Graph 1: Bavarian State elections in 2018

Source: http://www.faz.net/aktuell/csu-verliert-in-umfrage-weiter-an-zustimung-15757489.html

According to polling surveys the Greens could emerge as the second largest party in Bavaria with 15.1% of the vote. The CSU stands to lose around 10% of its voter share and the SPD around 9%. The FDP might once more be represented in the Parliament with a 6.1% voter share while the AfD could win 13.5% of all votes cast.

If these projections come to pass, speculation over the staying power of Germany’s Federal coalition government will intensify, as the CSU could be tempted to withdraw its support from the coalition in Berlin. Indeed, such a move is already being strongly canvassed by many CSU party members.

The Euro stands to lose from increased political uncertainty in Europe. If this happens, the chief gainers are likely to be the USD, the CHF and the GBP.

By repute, German politics are boringly predictable. But if unpredictability and extreme outcomes start to become the norm then financial and political analysis should be more rewarding for financial market participants.

Concerns that Germany’s politics are drifting too far to the right are overdone. Indeed, at the Federal level a slight overall shift to the left is discernable, with the left (Die Linke and Die Grünen) showing slightly larger gains than the right (AfD, FDP). But one thing seems clear: Chancellor Merkel is likely to be weakened by the Bavarian result, however it turns out.

Any Euro weakness as a result of the Bavarian election is likely to be temporary and will possibly have run its course by the end of October.

This is because political turbulence in Europe could soon be overshadowed by a political tornado in the shape of the upcoming US mid-term elections on Nov. 6. From mid-October, markets may well shift some focus back to the EU’s Brexit negotiations with the UK but increasingly those mid-term US Congressional elections are likely to dominate.

Tradition has it that the party of the US President often does poorly in the mid-term elections. Indeed, these often cause a change in Congressional control.

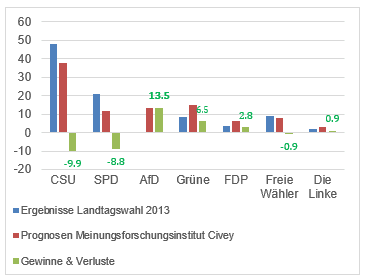

Graph 2 shows the development of support for America’s 2 major parties over the last 6 months as revealed in opinion polls. The latest data suggest a 47.4% support level for the Democrats (in blue) as against 40.3% for the Republicans (in red). Since November 2016 Democrats have led the Republicans by between 6% and 8%. The University of Virginia reckons that to take back control of the House of Representatives (“the House“) Democrats need a 5% voter advantage. (Source:http://www.centerforpolitics.org/crystalball/articles/generic-ballot-model-gives-democrats-early-advantage-in-battle-for-control-of-house/).

This 5% advantage is required because thinly populated states are dominated by the Republicans and the Democrat vote is inefficiently concentrated in cities. Thus, the Republicans have a 3.4% seat advantage in the House, even though Democrats had a 2.1% voter advantage in the 2016 elections.

Graph 2: Predicted voting shares in the US mid-term elections since March 2018

Source: https://realclearpolitics.com/epolls/other/2018_generic_congressional_vote-6185.html

A Democrat victory this November is far from certain. Democrats have no charismatic alternative Presidential candidate to match Donald Trump. So a Democrat victory, should this happen, would probably not be viewed as such but rather as a symbolic rejection of Donald Trump. We can probably rule out Democrats taking control of the Senate as only 1/3 of seats are up for election. But, were the Democrats to retake control of the House, calls for the impeachment of President Trump would probably become louder. Even so, this process would require a 2/3 majority in the Senate, something which is highly unlikely unless Donald Trump becomes so unpopular that the Republican party feels the need to dump him like a hot potato in order to protect itself against voter wrath in the 2020 Presidential elections. Since there is no evidence that Donald Trump is that unpopular, the Republican party is likely to remain loyal to him in spite of the ongoing scandals involving his Administration.

Given prospective uncertainty in Washington we believe any Euro weakness following the Bavarian elections is likely to give way rather quickly to a fresh bout of turbulence for the US dollar.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.