Executive Summary

- In Switzerland, consumption remains the mainstay of the economy, while foreign trade is slowing growth. Inflation is close to zero.

- Germany has probably overcome the recession and moderate growth of 1.3-1.4% is expected for the coming years. The EU-US trade agreement further improves the outlook.

- In the USA, the figures are contradictory and a shutdown is looming.

- The SNB and ECB are keeping their key interest rates unchanged at 0% and 2.0-2.4% respectively. Forecasts point to a slight rise in inflation.

- The Fed is continuing its cycle of interest rate cuts due to weaker labor market data and probably also political pressure. Further interest rate cuts are expected.

- The mood on the global bond markets is calm and yields are barely moving.

- The most important stock markets remain close to their highs as market breadth declines. Individual technology stocks are coming under pressure.

- The decline of the US dollar has been interrupted, but further weakness could follow in the medium term.

- Gold reflects the loss of confidence in the US dollar.

Our macroeconomic assessment

Business cycle

- The Swiss economy already suffered from the increase in US tariffs in the first half of the year. In the coming quarters, growth will continue to be shaped by US trade policy. We expect slightly lower growth of 1.2% in 2025 and 0.8% in 2026. Foreign trade will be the main drag, while consumption will remain the mainstay of the economy.

- The German research institutes have raised their growth forecasts for the current year slightly to 0.2%. For the next two years, they expect 1.3% and 1.4%. Special assets, which are gradually finding their way into production, are contributing to the forecast recovery.

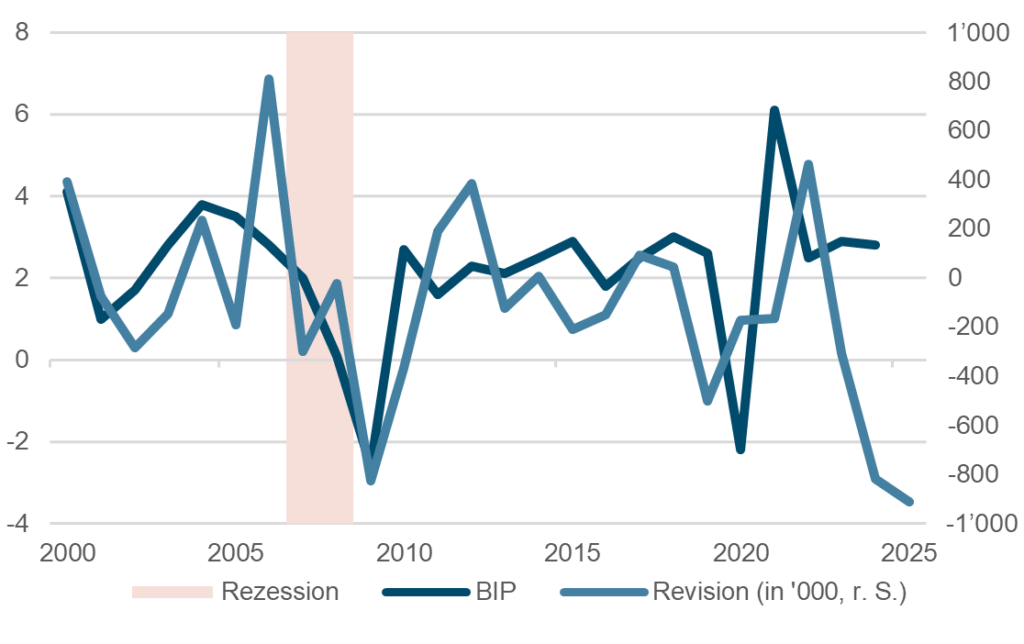

- In the US, the reduction in newly created jobs by 911,000 caused a stir. Yields fell by around 20 basis points following the publication. Finally, lower than expected producer prices also allowed the Fed to cut interest rates. The private consumption expenditure (PCE) index for August stood at 2.7% and the core rate at 2.9%, slightly higher than the previous year's figure. This means that nothing stands in the way of further interest rate cuts.

USA: Revision of newly created jobs (since 2000)

Source: Bloomberg Finance L.P.

Monetary policy

- In Switzerland, the Saron money market rate serves as the basis for financial products such as mortgages, loans, bonds and derivatives as well as a reliable indicator for further interest rate moves. In the run-up to the SNB's interest rate decision, yields for one- to six-month investments ranged closely between -0.05 and -0.07% and already predicted that the zero interest rate would remain unchanged.

- As expected, the ECB meeting on September 11 resulted in a zero decision. For 2026, the central bankers expect slightly lower inflation below 2% and weaker growth, both figures which, however, do not require a further interest rate cut.

- In view of the weaker labour market data, the economic slowdown has become the focus of attention for the US Federal Reserve. As a result, the Fed lowered the key interest rate for the first time this year, continuing the cycle of interest rate cuts that began a year ago. The key interest rate now stands at 4.25%. Further steps are expected.

- Monetary policy in Japan is too loose in view of the fact that inflation is well above the target level of 2% and runs the risk of fueling inflation further. An interest rate hike could therefore come sooner and the rate hike cycle could last longer than is currently priced in.

Our investment policy conclusions

Bonds

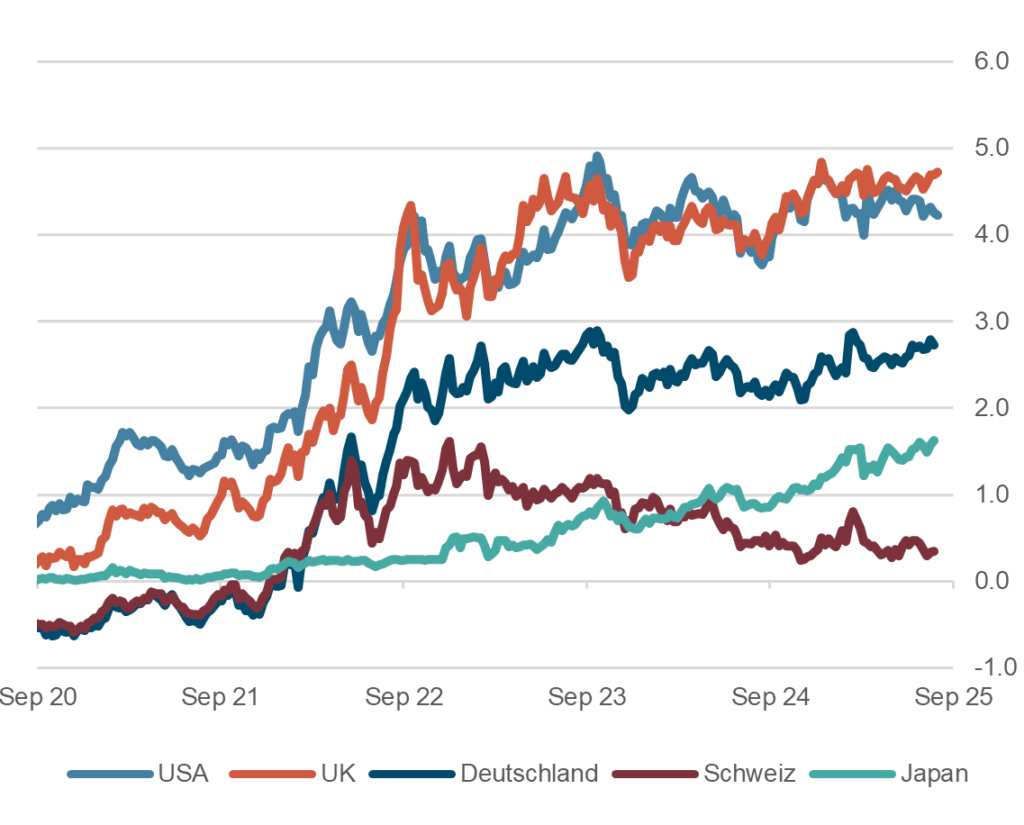

- Yields on 10-year government bonds are currently at 4.2% in the USA, 2.75% in Germany and 0.2% in Switzerland. These levels are surprising insofar as one would expect higher yields due to the deteriorating situation with increasing government debt.

- Quite a few analysts assume that the most important central banks, under the leadership of the Fed, could embark on a coordinated policy of yield curve control, which is already set out in the Trump administration's policy paper known as the "Mar-a-Lago Accord".

- In a new chapter of "financial repression", a politically imposed negative real interest rate, further pressure would be exerted on the Fed to lower key interest rates at the short end, while the central bank would have to act as a buyer of securities at the long end of the yield curve. This procedure is known as "Operation Twist" and has already been used in the past. Stephen Miran, newly elected to the FOMC committee, for example, advocates such an approach.

Interest on 10-year government bonds, in %, 5 years

Source: Bloomberg Finance L.P.

Equities

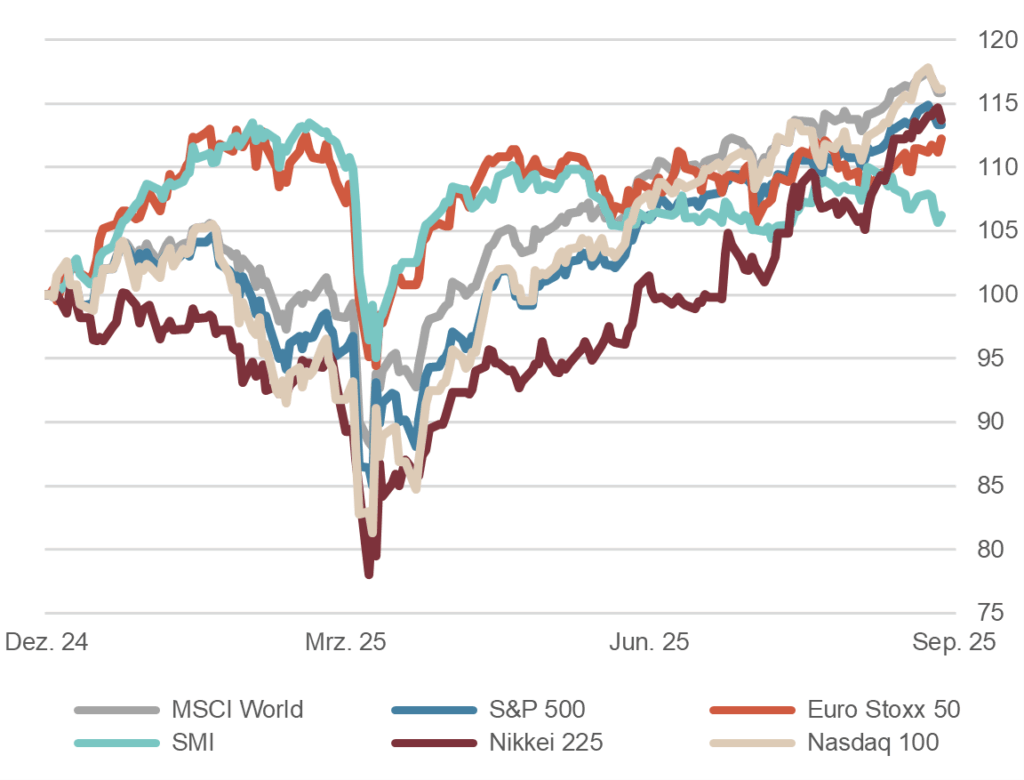

- The US stock markets have continued to rise in recent weeks. The Nasdaq and S&P 500 are up around 15%, while the Dow Jones and Russell 2000 are lagging somewhat behind. However, this only applies in USD terms; the picture looks much different in CHF terms (USD/CHF -12% since the beginning of the year). The latest rise was driven by renewed interest rate fantasies after the Fed opened the door to further rate cuts at its last meeting.

- In Europe, the markets continue to be friendly, albeit with a sideways trend since May. The SMI is lagging somewhat behind at +3%.

- At the moment, the stock markets seem to be completely ignoring the customs issue, or rather the dismantling of globalization. Nor does the persistently high inflation seem to be worrying the stock markets. We assume that tariffs and inflation will be reflected in more cautious investment by companies and more cautious consumers in the medium term.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

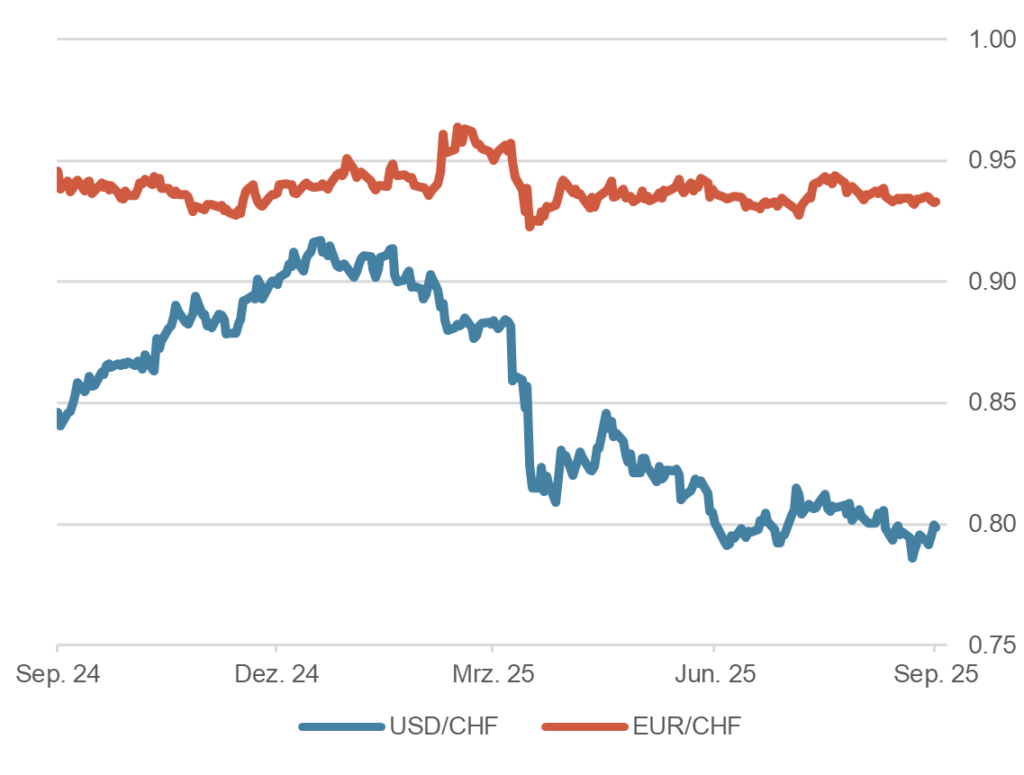

- The US dollar has lost around 12% against the Swiss franc over the course of the year and is now hovering around the important 0.80 mark.

- In the medium term, we expect the USD exchange rate to fall further. The extent of the loss of confidence in the global currency is increasing due to the USA's aggressive trade policy and the verbal attacks on the independence of the US Federal Reserve. In addition, the Trump administration explicitly wants a weaker USD.

- EUR/CHF has remained in a narrow range around 0.9350 for months, supported by a balance between political uncertainty in Europe and the SNB's cautious monetary policy stance as well as a stable interest rate differential. However, the escalation of the budget crisis in France has no longer led to an appreciation of the CHF.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.