Executive Summary

- World economic growth will exceed 3.5% this year.

- But we expect growth will slow in 2019.

- The world’s exporting countries are being hit by the President Trump’s protectionist measures.

- Over the medium term the Trump Administration’s pro-cyclical fiscal policy will seriously degrade US government finances.

- We expect 3-4 further rate hikes from the Fed until end of 2019.

- The ECB’s first cyclical rate hike is not expected before the summer of 2019.

- Yields on US government bonds have risen again.

- Despite the flatter yield curve we don’t expect a recession.

- 2018 equity performance tables are now led by the US. Emerging markets are at the bottom of the pack.

- We are maintaining our underweight position in equities, waiting for better opportunities to build up equity positions.

- The US dollar has again fallen back slightly. Gold remains under pressure.

Our macroeconomic assessment

Business cycle

- We have the following economic growth forecasts for 2018 and, in brackets, for 2019.

- World: 3.5% (3.3%), US: 2.7% (2.3%), Euroland: 2.1% (1.9%), China: 6.5% (6.2%) and Japan: 1.1% (1.0%). The Chinese economy is being hurt by President Trump’s import tariffs.

- We forecast some falling off in growth rates next year. The Fed is set to pursue a more restrictive monetary policy and the boost to the US economy from last year’s tax cuts will start to wear off. The US trade war against China will also tend to put a brake on America’s currently very high economic growth rate.

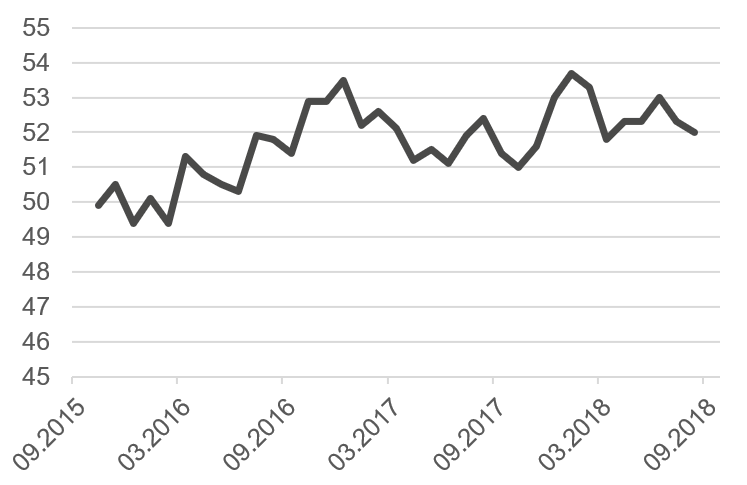

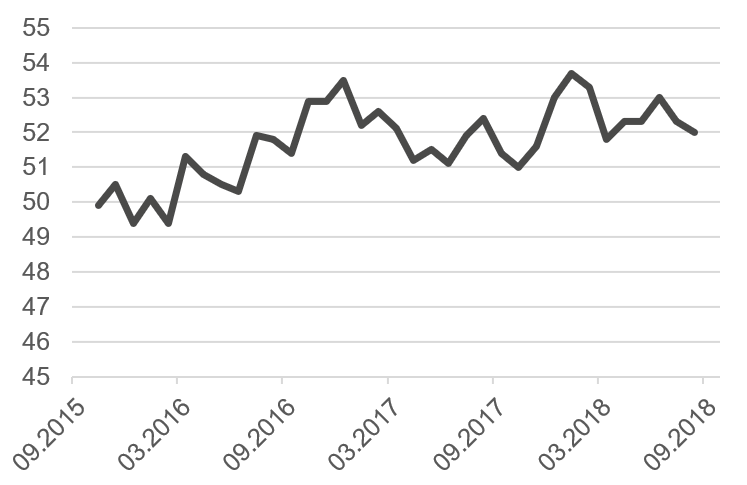

- China’s Caixin PMI has shown a weakening tendency for some months now. It seems that Chinese government efforts to slow down the strong growth of credit are having some effect.

Caixin Purchasing Managers Index for China since 2015

Source: Bloomberg

Monetary policy

- The US unemployment rate has now sunk below 3.9%. Clearly, the US economy has moved beyond “full employment” and is now growing “above capacity”. We expect US wage inflation to rise significantly in coming quarters. The American economy is “hot” and we expect the Fed to react with 3-4 further rate hikes until end of 2019. Attempts by President Trump browbeat the Fed towards more policy accommodation will not have much impact.

- The first cyclical rise in Euroland rates will not happen before the summer of 2019. The ECB’s bond purchase program will terminate at the end of this year. However, maturing bonds will still be reinvested into longer-dated issues thereafter.

- The SNB will only raise Swiss interest rates once the ECB has started to move Eurozone rates. The risks now associated with Italy are once again revealing the Swiss franc’s “safe haven” status.

- In general, the central banks should manage to move in the direction of monetary policy normalization in 2019. And the generous liquidity provision of 2018 will gradually fade from investor consciousness.

Our investment policy conclusions

Bonds

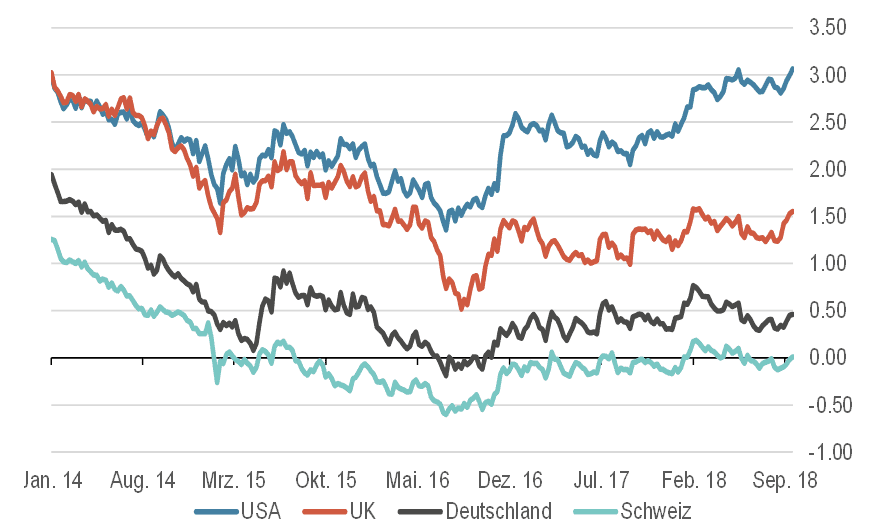

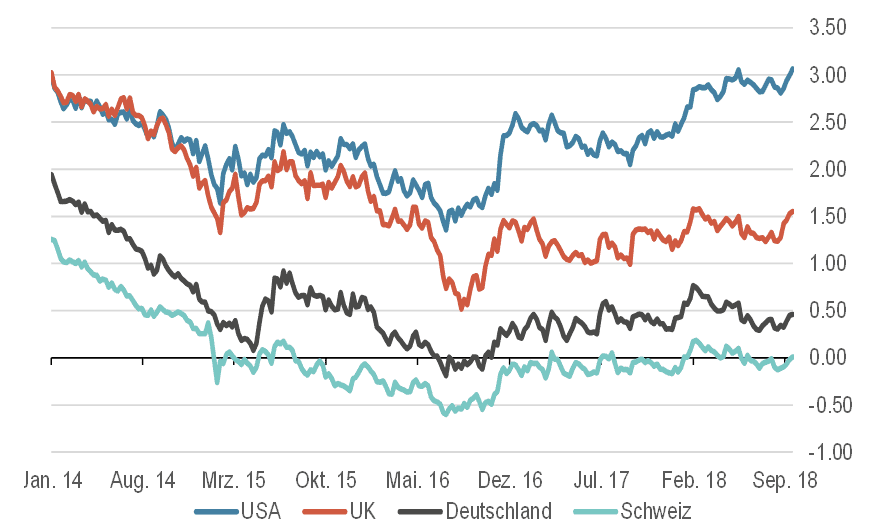

- Yields on 10 year US Treasuries now stand at 3.1%, and have therefore risen above the important psychological hurdle of 3%. The latest upward move reflects strong US labor market data, and especially signs of a pick up in wage inflation.

- The still very flat US yield curve seems to us to be suggesting the following: (i) inflation is not going to “surprise” on the upside, (ii) the Fed will be fairly cautious when it comes to further rate rises (“data dependence”) and (iii) this will lead to a “soft landing” for the US economy.

- Yields on 10 year German Bunds have also risen and now stand at 0.5%. The rising trend in yields applies as well to Swiss Government bonds, although here the pivot at which yields turn positive is still around 10 years out.

10 year government bond yields since 2014, %

Source: Bloomberg

Equities

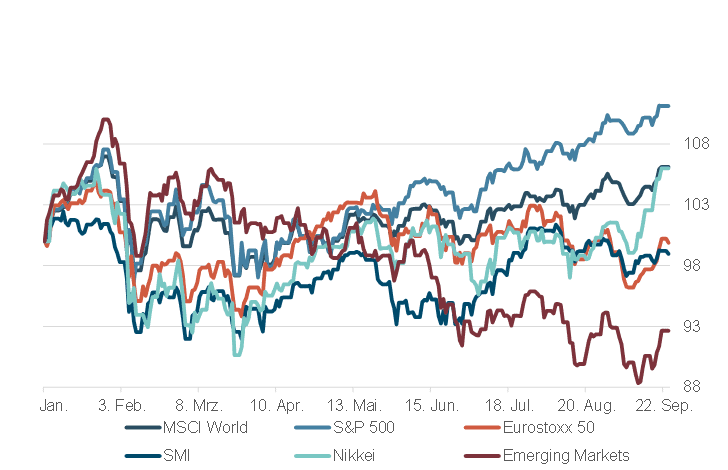

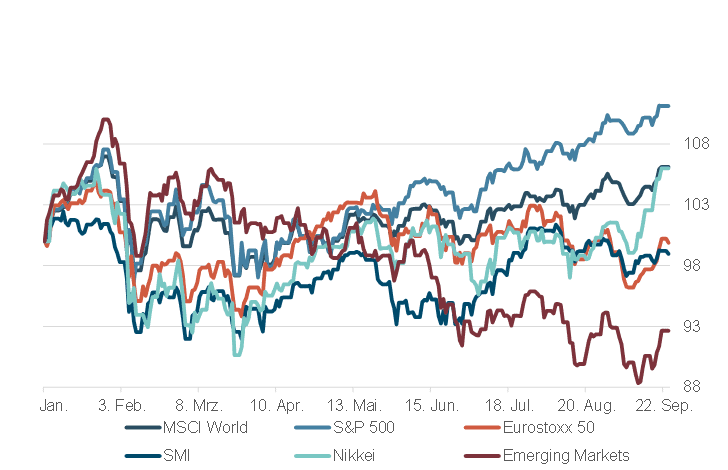

- The US stock market is leading this year’s equity market performance table, despite recent profit-taking in technology shares. Soon, the US third quarter corporate earnings season will begin. Investors have set the bar for these third quarter results quite high, expecting a similar strong growth in earnings to that reported for the second quarter.

- Many European stock markets are showing a slightly negative performance year to date, a reflection of Europe’s export dependence at a time of increased trade hostilities and her structural economic problems.

- Emerging market indices are generally showing a significantly negative performance on a year to date basis. While many of these developing economies have strong growth prospects over the long term, their stock markets are being adversely affected by the currently strong US dollar and by rising US interest rates. Overall, the indebtedness of many emerging market economies is now at a record high.

Equitiy markets, perfomance year do date

Source: Bloomberg

Forex

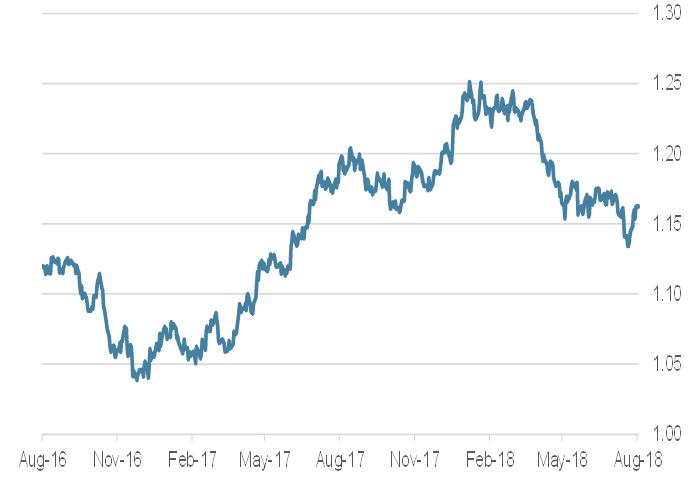

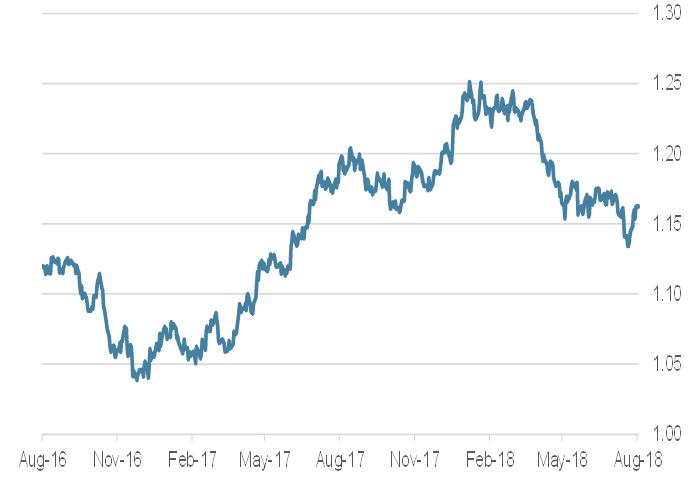

- In recent weeks the US dollar has lost some ground against most currencies. There has been some comment that the ECB’s first rate rise might be brought forward. Also, and despite the hostilities directed at them by the Trump Administration, Chinese officials have been “cooperative” in acting to fix the yuan at a slightly higher rate.

- The Swiss franc is a good barometer as to investor concerns regarding Europe’s structural problems. Right now, the franc is in strong demand and the Swiss National Bank (SNB) has had to purchase substantial amounts of foreign currency in order to brake the franc’s upward move. The SNB is in a bind: It’s economic stability mandate suggests higher rates are needed to cool the hot Swiss property market. On the other hand, the currency impact of higher rates could trigger a destruction of Switzerland’s export competitiveness. So the SNB has to leave rates where they are. An aggravation of Europe’s problems, for example concerning Italy or Brexit, could trigger further euro weakness, boosting investor demand for the Swiss franc still higher.

EUR/USD, last two years

Source: Bloomberg

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.