Executive Summary

- US GDP contracted slightly in 1Q25, but a strong recovery is expected for 2Q25. The high fluctuations in net exports are responsible for this.

- The SNB is lowering its GDP forecast for '25 and '26 slightly to 1-1.5%, but expects unemployment to rise only slightly.

- Escalating geopolitical risks and the USA's aggressive customs policy are putting pressure on global growth and could fuel inflation.

- The central banks deliver in line with expectations. The Fed warns of weaker growth and rising inflation. The ECB believes the inflation target has been reached and the SNB shows

- are reluctant to accept negative interest rates.

- The Israeli attacks on Iran have led to the familiar pattern of "flight to safety" on the bond markets.

- Following the significant recovery, things could now become somewhat more difficult on the stock markets.

- The depreciation of the USD is picking up speed again due to the continued withdrawal of capital from the USA.

- The scenario for gold is almost perfect. We remain constructive on the yellow metal.

Our macroeconomic assessment

Business cycle

- The real gross domestic product of the US shrank by 0.2% in the first quarter of 2025 on an annualized, seasonally adjusted and revised basis. The Atlanta Fed's forecasting model had predicted a much sharper contraction and is currently forecasting strong growth of around 3.5% annualized for the second quarter. This forecast is also likely to be too strong, but a return to the growth zone seems certain. The fluctuations are based on the change in net exports.

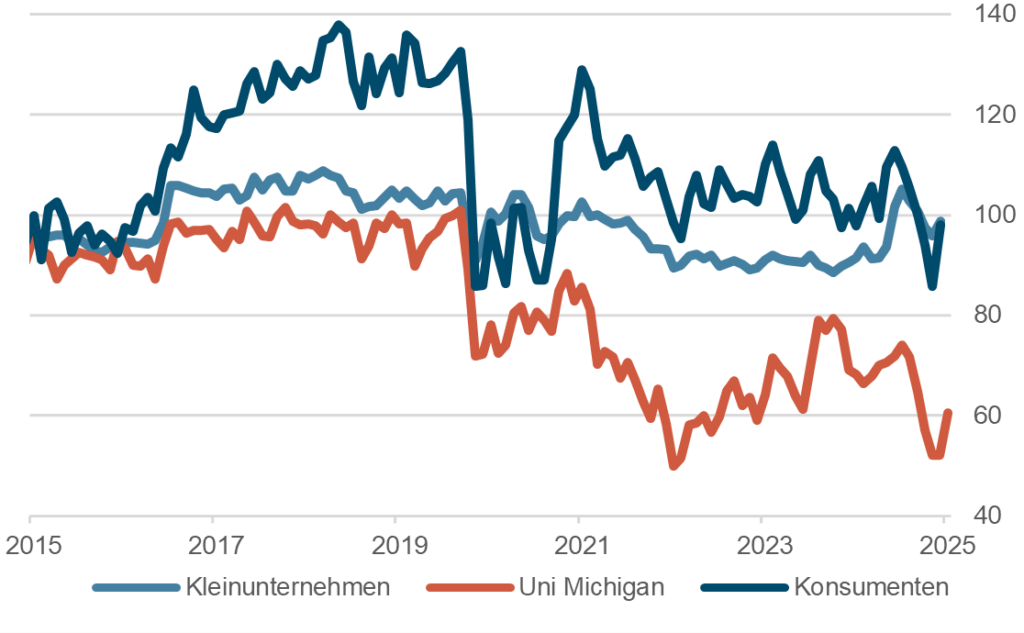

- Current economic data for the month of May is very divergent. In the US, for example, there is some evidence of the expected recovery, namely consumer confidence and sentiment data from the University of Michigan and small capitalized companies.

- Due to the customs policy, uncertainty is unusually high.

- On the occasion of its interest rate decision on June 19, the SNB estimated its GDP growth forecast for this and next year at 1% to 1.5%, which corresponds to a slowdown from the current 1.9% in the first quarter. Unemployment is expected to rise only slightly.

USA: Sentiment indicators (10 years)

Source: Bloomberg Finance L.P.

Monetary policy

- The US Federal Reserve left the key interest rate unchanged at 4.25% to 4.5%. While the economic data indicates a satisfactory environment for the time being, the latest Fed forecasts point to a significant slowdown in growth, rising unemployment but also rising inflation - a challenging combination for central bankers. With this decision, the Fed is once again demonstrating its independence from the government.

- Market participants expect up to two further interest rate cuts by the end of the year. In view of the expected inflationary pressure from rising energy prices and punitive tariffs, we do not expect any further interest rate cuts.

- The uncertainty of a possible surge in inflation as a result of the expected trade barriers is preoccupying central banks around the world and may lead to a general reluctance to ease monetary policy.

- On June 5, the ECB eased its three key interest rates - the deposit, main and marginal lending rates - by 0.25% each.

- On June 19, the SNB lowered the key interest rate by 25 basis points to 0 % - a reaction to the persistently low inflation and the continued strength of the Swiss franc.

- According to President Martin Schlegel, interventions on the foreign exchange market are still possible.

Our investment policy conclusions

Bonds

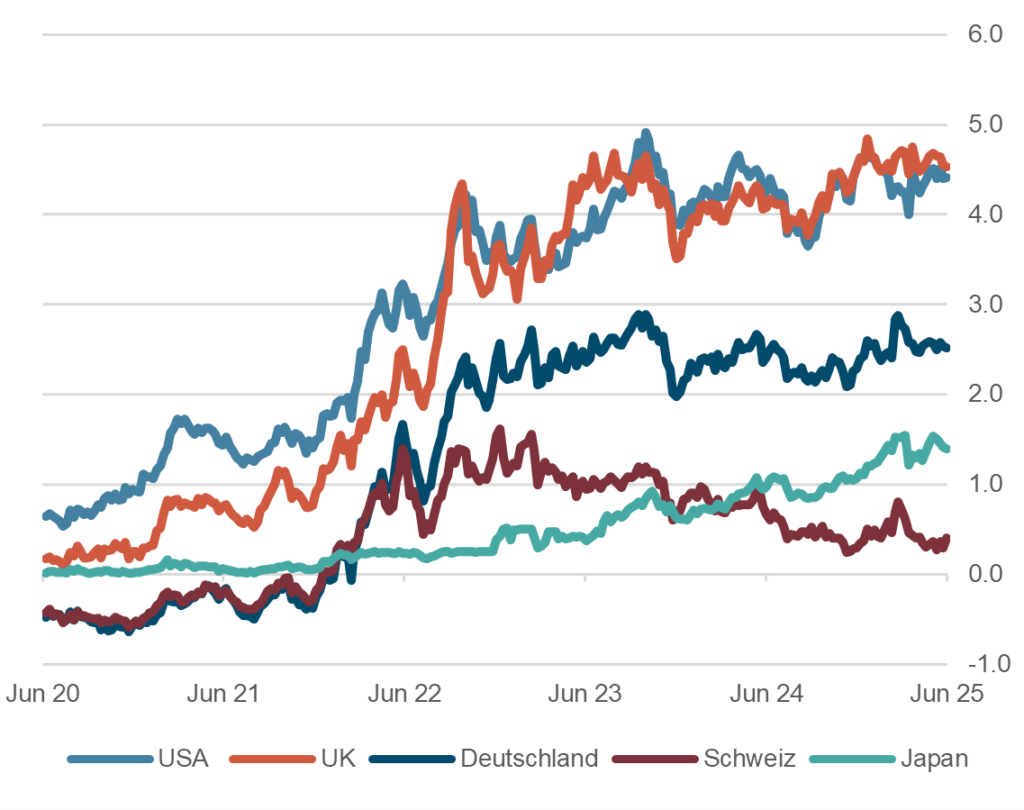

- Yields on 10-year government bonds are currently at 4.3% in the USA, 2.5% in Germany and 0.4% in Switzerland. The Israeli attacks on Iran have led to the familiar pattern of "flight to safety" on the bond markets. However, reservations about the Trump administration's planned measures remain overriding. In particular, the planned "Big Beautiful Bill", which provides for extensive tax cuts, is viewed very critically by economists. It would increase the deficit and national debt even more and further undermine confidence in US Treasuries.

- In Europe, the picture is different: yields have eased again somewhat despite the announcement of new debt-financed fiscal programs for armaments and infrastructure. The slight economic rays of hope and a little more fantasy regarding interest rate cuts by the ECB have depressed the yield curve overall.

- Spreads on high-yield, corporate and emerging market bonds have narrowed again.

Interest on 10-year government bonds, in %, 5 years

Source: Bloomberg Finance L.P.

Equities

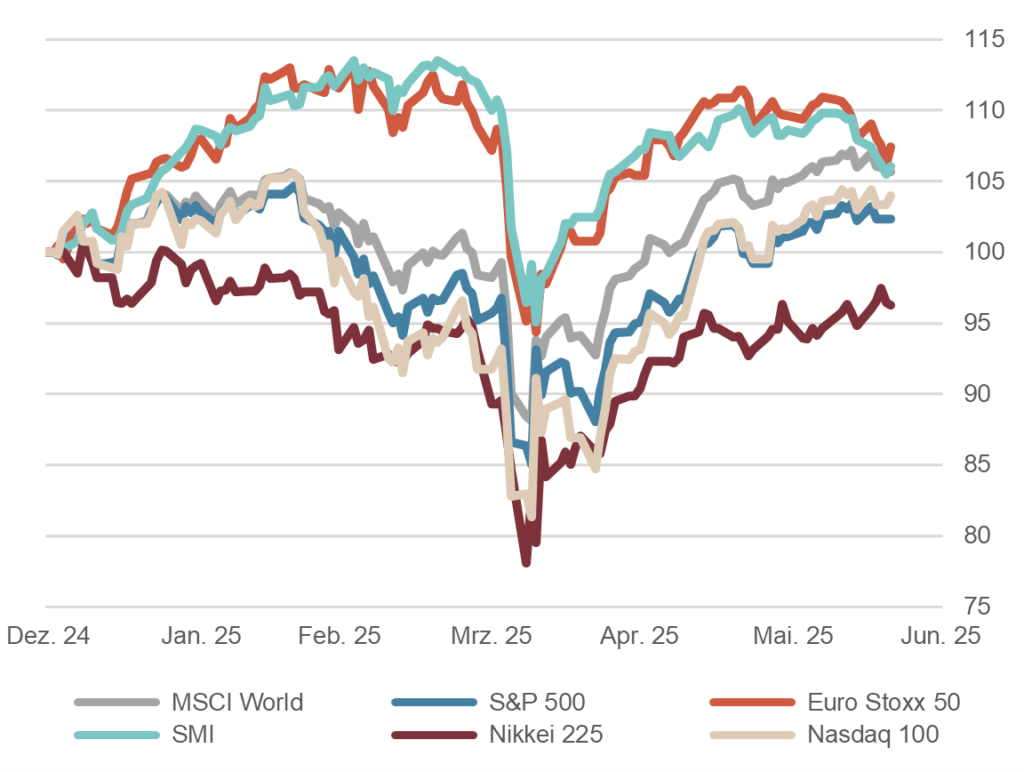

- Since the sharp slump at the beginning of April ("Liberation Day"), the stock markets have recovered significantly. The highs reached by the US stock indices in February are now within reach. From a technical perspective, however, things could become somewhat more difficult from now on, as the indices are largely overbought again and therefore no longer favorable in certain areas. Essentially, the whole rally was also "short covering" by hedge funds and CTAs. New buyers have not really emerged.

- The trade dispute between China and the USA has by no means been resolved, only postponed, and the 10% base tariff for many of the USA's trading partners appears to be definitive and will have a negative impact on the global economy.

- Overall, we remain cautiously positive for the further course of the equity markets. However, we note that the equity markets have become detached from macro data developments and are currently only reacting to headlines in the short term. There is a risk of misjudgement here.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

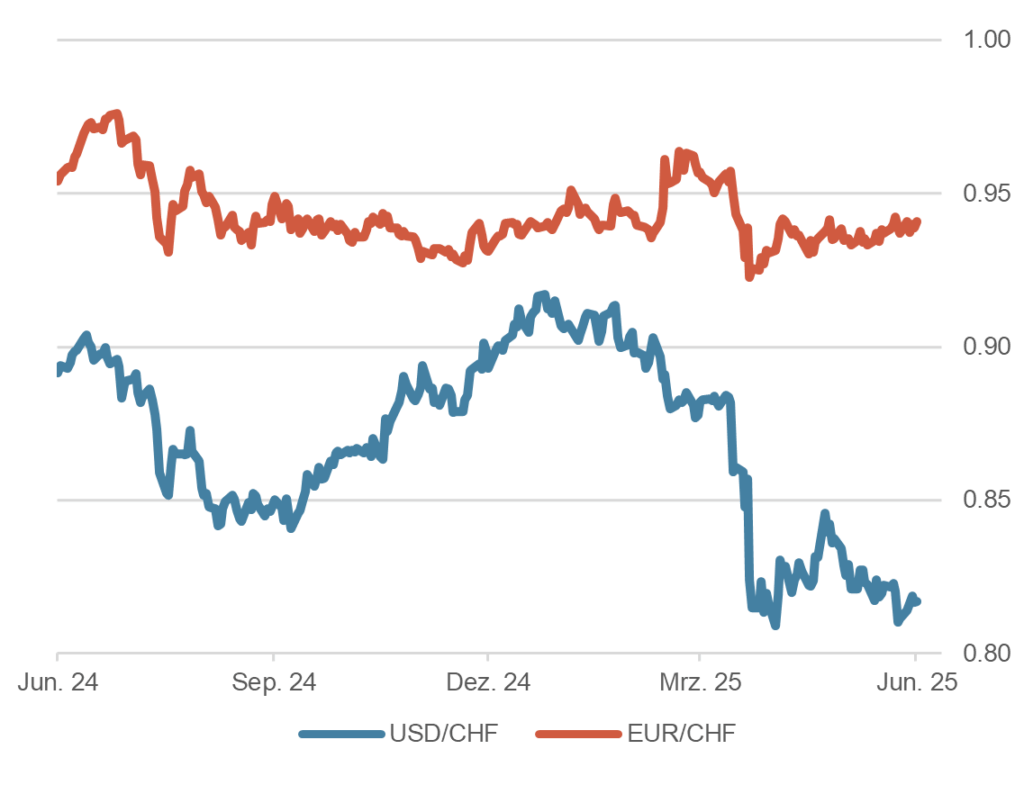

- Towards the end of the second quarter, the US dollar once again tested its lowest levels from mid-April. The ongoing withdrawal of capital from the US, due to rising deficits and the swelling US debt, is weighing on the greenback.

- In the medium term, however, the Trump administration's desire for a lower US dollar could fulfill itself. If this is accompanied by falling interest rates and constant inflation, this constellation would have a further negative impact on the currency. Secretly, however, it is probably hoped that negative real interest rates will allow debt to be elegantly inflated away "at the expense" of foreign creditors.

- The EUR/CHF exchange rate has stabilized around 0.94. The strong demand for the Swiss franc, particularly after the negative market reactions in April, appears to have subsided again.

Dollar and euro against franc, 1 year

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.