Executive Summary

- Most central banks are still raising interest rates while liquidity and the money supply are being cut back. At times, the stresses caused by monetary policy tightening is forcing some central banks to relax their policies temporarily. But the importance of such short-term countermeas-ures should not be overestimated.

- Overall, tighter monetary policies are having an increasing impact on the consumer and the economy.

- The fall in inflation rates is taking the pressure off from monetary authori-ties. The peak in the interest rate hike cycle is likely to be reached in the second half of the year.

- Yields in the major government bond markets have been rather stable as of late. Volatility has fallen significantly.

- Trends in stock markets are increasingly reminiscent of the Tech bubble of 1999/2000. We remain cautious in our positioning and neutrally weighted in the equity quota.

- Currency markets have been broadly stable. The Swiss franc continues to be in demand.

- Having risen earlier in the year, the gold price is now consolidating.

Our macroeconomic assessment

Business cycle

- The upcoming data for the 2nd quarter GDP shows a consensus esti-mate of 1.9% annualized growth for the US and a marginal growth rate above zero for the Eurozone.

- The Fed notes signs of economic weakening but is still struggling to bring inflation down to the target level. The planned increase in capital re-quirements for US banks faces criticism for potentially burdening banks and borrowers, limiting economic growth. The labor market remains tight, but US consumer data and FedEx's disappointing figures indicate a slowdown.

- Economic surprise indices are falling globally, suggesting a possible recession.

- Europe is already in a "mild" technical recession with negative economic expectations.

- China's economy is still struggling despite reopening, with low inflation and interest rates allowing loose monetary policy.

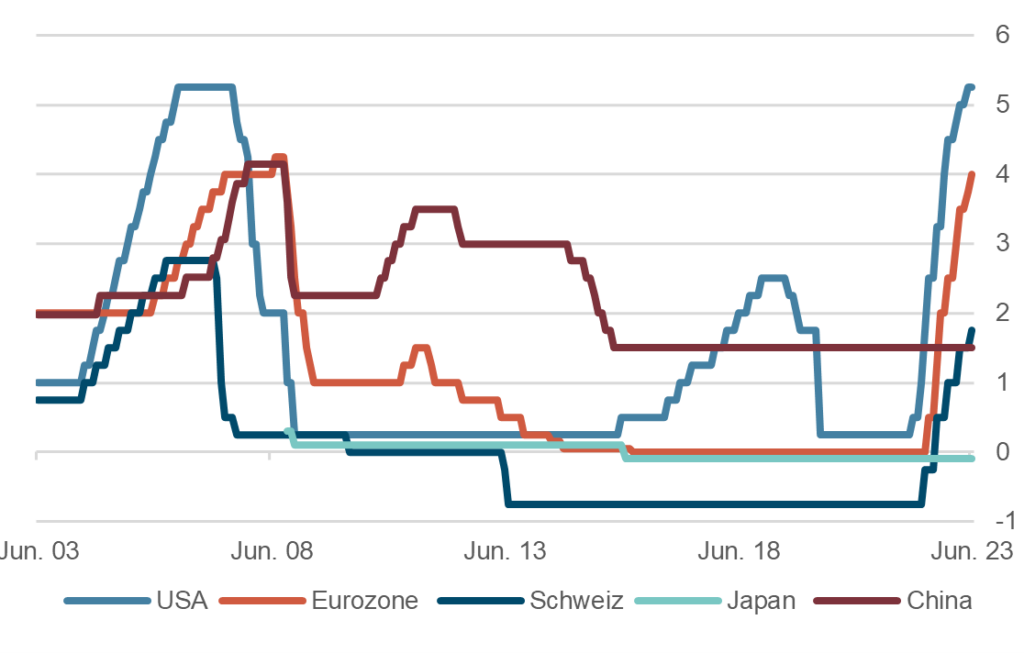

Monetary policy

- Bank of Canada and the Reserve Bank of Australia surprised markets as they raised their key interest rates by 25 basis points each, while the Bank of Japan and the US Federal Reserve left rates unchanged. The European Central Bank (ECB) increased all three key rates by 0.25%.

Central bank policy interest rates, last 20 years

Source: Bloomberg Finance L.P.

- Falling commodity prices initially eased inflationary pressures, but a recent rebound in cyclical commodities raises concerns about prolonged inflation.

- The People's Bank of China cut borrowing costs to bolster post-Covid recovery, but weak domestic demand may require additional government support.

- The Swiss National Bank raised rates to counter inflation, revising forecasts due to second-round effects and falling gas and crude oil prices.

- Norway and the UK also raised rates to tackle high inflation.

- The interest rate hiking cycle might approach its end.

Our investment policy conclusions

Bonds

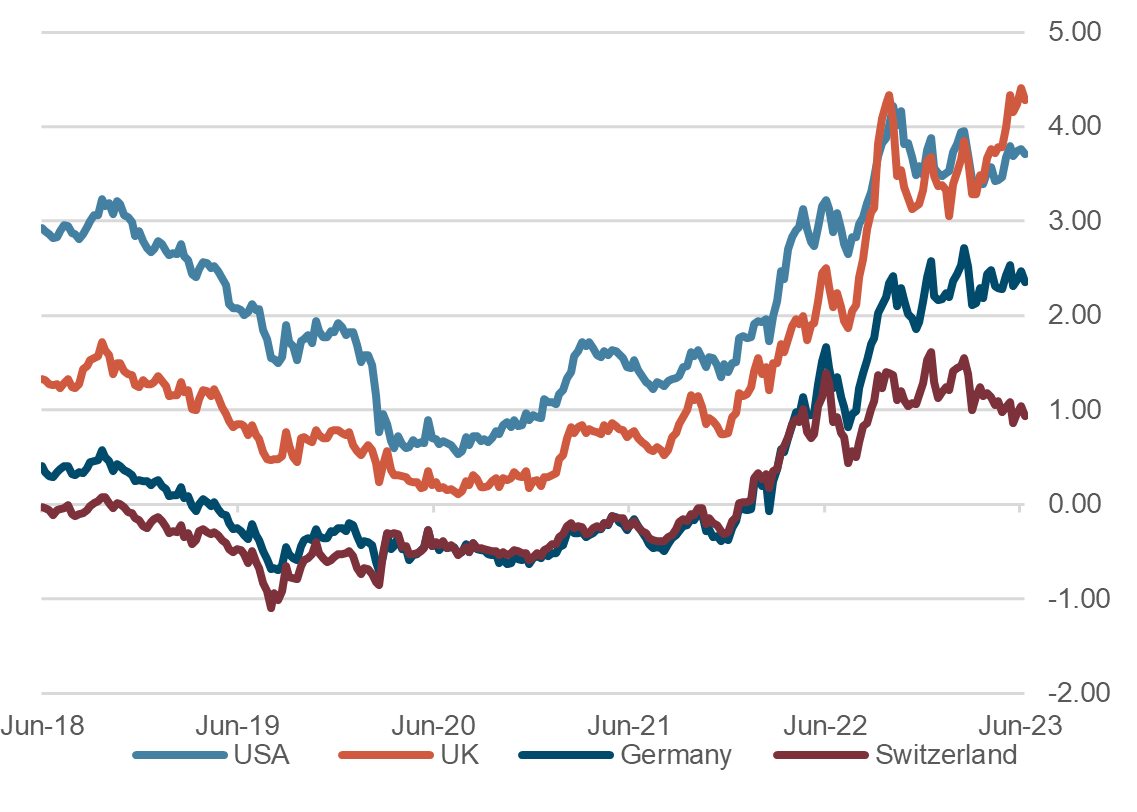

- Yields in major government bond markets are stable, with reduced volatility after resolving the debt ceiling dispute.

Currently, US 10-year bonds yield around 3.8%, German bonds yield about 2.5%, and Swiss bonds yield approximately 1.0%.

- Yield curves still show inversion, but it has slightly decreased in European markets. The US yield curve remains significantly inverted, with 2-year bonds offering around 1% higher yield than 10-year bonds. Corporate bond spreads have tightened, creating favorable conditions for high-quality issuances.

- Short to medium-term maturities are attractive for new investments due to higher yields.

- The market atmosphere is calm, encouraging cautious investment strategies and presenting selective opportunities for yield-seeking investors.

10 year government bond yields in %, last 5 years

Source: Bloomberg Finance L.P.

Equities

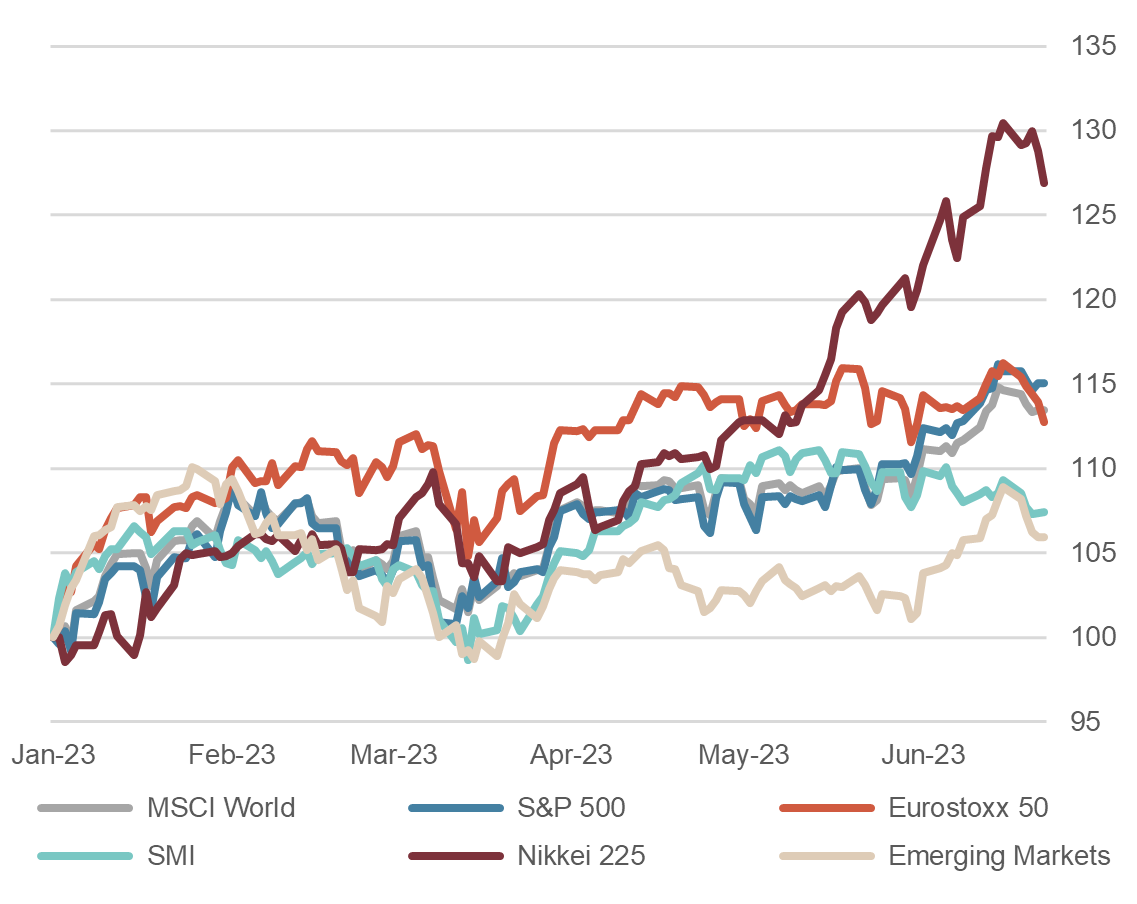

- Stock market trends increasingly resemble the 1999/2000 technology bubble, with the Nasdaq 100 price-to-earnings ratio surpassing 30x. Cy-clical indices have reached new highs in the past year due to market rallies.

- Institutional investors have been forced to exit their short positions and reverse their strategies. Retail investors' active participation, particularly in "0-DTE options," one-day calls on individual stocks and indices, has fur-ther narrowed an already weak market.

- Over 80% of the S&P 500's performance this year is attributed to five major tech stocks, indicating a potentially fragile recovery and flag-like chart patterns.

- Analysts from Wall Street are increasingly bullish in their recommendations. Despite concerning factors such as restrictive outlooks from FOMC members, potential growth setbacks, and geopolitical risks, stock markets continue to display nonchalance. The decreasing implied volatility in stock markets reflects highly positive expectations.

- Caution and a neutral equity weighting remain prudent approaches.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

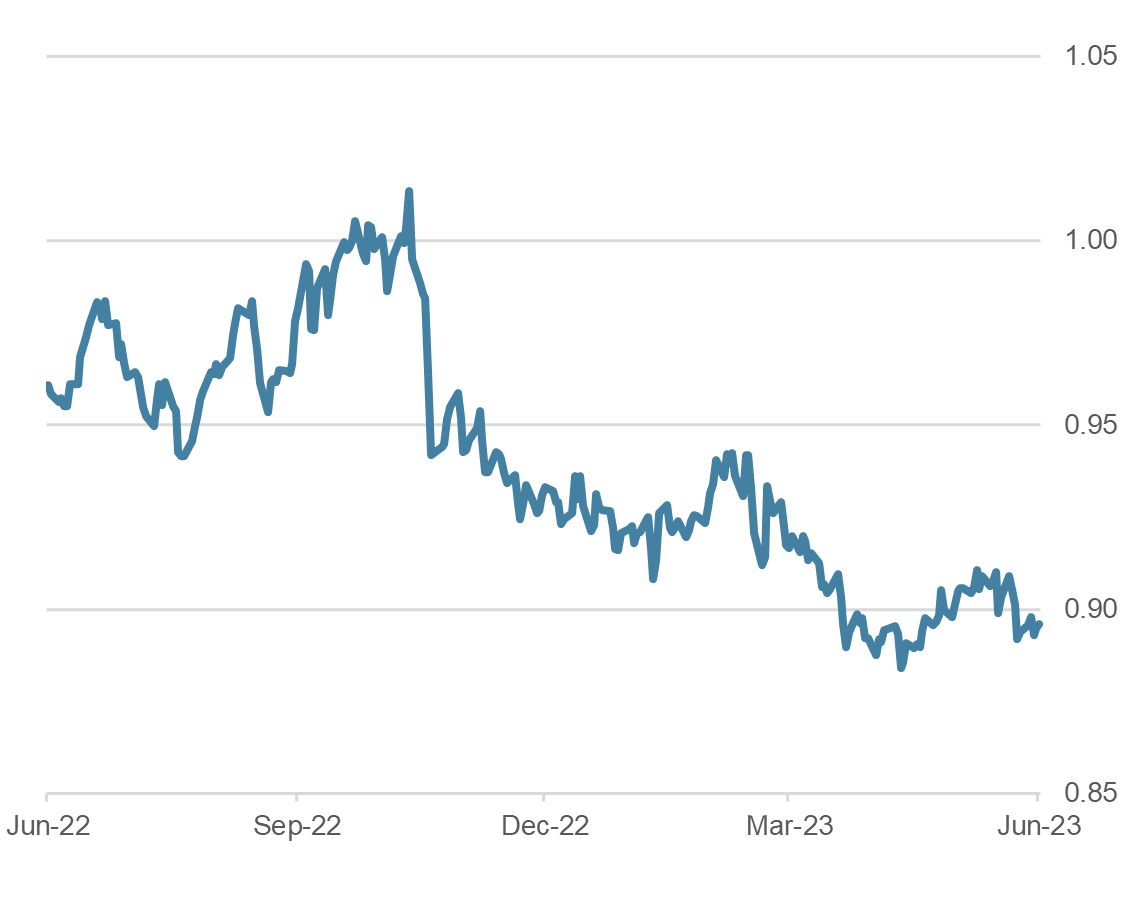

- The US dollar has recently firmed again, with the dollar index (DXY) gaining around 2%. Some analysts see this as a reaction to somewhat higher US yields following an FOMC meeting which surprised with its statements on the future more restrictive interest rate path.

- Surprisingly, discussions about the status of the USD as the global reserve currency have also died down again. And this despite a massive expansion of the US debt ceiling.

- The Swiss franc remains in demand against all currencies. The EUR/CHF now stands around 0.98. On balance, we assume that the franc will ap-preciate steadily due to its structural advantages over the euro, and we therefore continue to hedge EUR positions.

Dollar vs Swiss franc, last 12 months

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.