Executive Summary

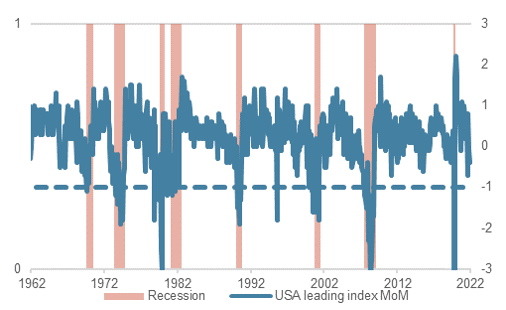

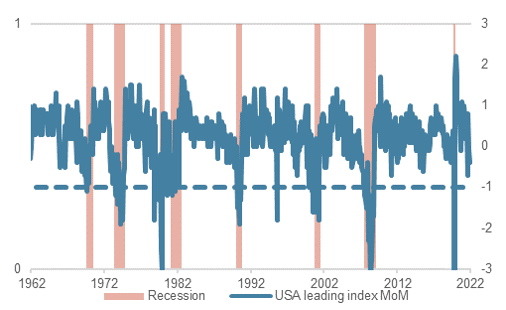

- While the probability of a recession is increasing we don’t think this will occur until at least next year.

- Growth momentum continues to weaken, but only slightly. There are no signs as yet of any weakening in the labor market.

- Inflation will remain well above central banks’ target levels for longer, becoming a burden for companies.

- In the face of high inflation central banks are increasingly prioritizing their mandate of price stability and are raising key interest rates sharply.

- The ECB is working on a new package to support peripheral Eurozone countries.

- Interest rate hikes by the Fed and other central banks have made the bond markets nervous.

- However, the likely rise in interest rates has now, in our opinion, been sufficiently priced into yield curves.

- The mixture of high inflation, rising interest rates and a possible recession is a toxic environment for the stock markets.

- The USD is performing inconsistently but gold remains resilient.

Our macroeconomic assessment

Business cycle

- We have adjusted our growth forecasts for 2022 slightly: World +3.2% (previously: +3.3%), US +2.6% (+2.7%), EU +2.5%, Japan +2.2%, China +4.2% (+4.4%), UK +2.8%, Switzerland +2.4%.

- According to a survey by Bloomberg, economists put the probability of a recession in the US within 12 months at 31.5%. The probability for the Eurozone is also around 30% with that for Switzerland slightly lower at 25%. Driving the slowdown are rising energy and food costs.

- The Purchasing Managers’ indices for Japan continue to rise and are in the growth zone at over 50 points. In Europe and the US, they continue to slide back from historically high levels, but are still above the growth threshold of 50. In China, these activity indicators are rising significantly again as the severe covid-related restrictions are relaxed but they remain below 50. For China, a further rise back into the growth zone is to be expected.

- The momentum of the global economy continues to weaken slightly but remains in the growth zone.

Monetary policy

- The Fed raised its key interest rate by a full 75 basis points at the June Open Market Committee meeting. At the press conference following that meeting, Jerome Powell unequivocally placed the fight against unwelcome high inflation and regaining price stability at the forefront of monetary policy.

USA – index of leading indicators, % change month-on-month, since 1962

Source: Bloomberg Finance L.P.

- Given its concern for price stability, the SNB is emerging from the slipstream of the ECB with an interest rate increase of 50 basis points. The SNB’s move is thus contrary to its previous communication to markets, namely that it would only follow the ECB in moving interest rates.

- At its regular monetary policy meeting in June, the ECB failed to announce measures to combat high (and now sharply rising) inflation in the Eurozone and in Germany. Increased interest rate premiums for Italy and Greece prevented the ECB from taking the necessary interest rate steps. Such “fragmentation” within the Eurozone is to be countered by measures, currently being worked on within the ECB, which should be authorized at the July policy meeting.

Our investment policy conclusions

Bonds

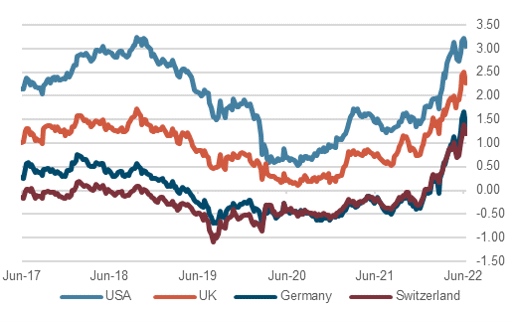

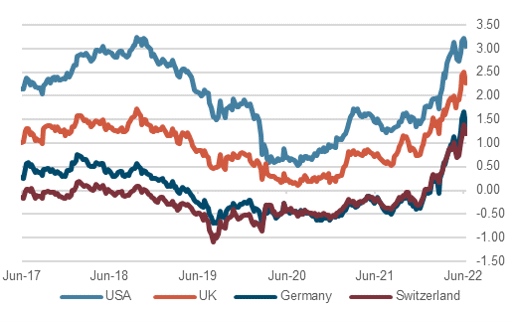

- The interest rate increases of the Fed and other central banks have made the bond markets nervous, with price losses, especially in the European markets, becoming accentuated. That said, we believe that yield curves are now pricing in the likely scale of upcoming rate increases.

- Not only have benchmark yields risen, credit spreads on investment grade corporate bonds have also risen to around 90 basis points.

- In the past, an increase in spreads of over 100 basis points was often the trigger for a change of course in monetary policy in the direction of easing. Thus, in 2013 Ben Bernanke announced that a planned reduction in bond purchases would not be pursued. In 2015, Janet Yellen postponed a widely anti-cipated first rate hike and, in December 2018, turmoil in the US bond market forced Jerome Powell to reverse course.

- However, we assume that central banks will stick to their plans for monetary tightening this time, at least for the time being. Even so, we already see interesting opportunities here and there in the higher yield levels that are now available.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

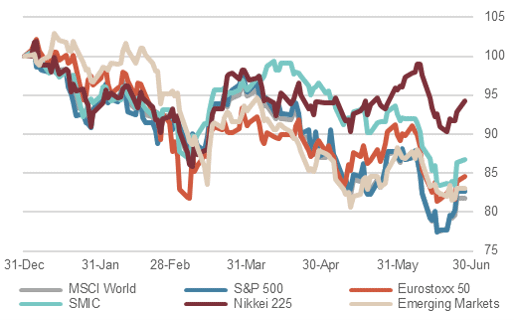

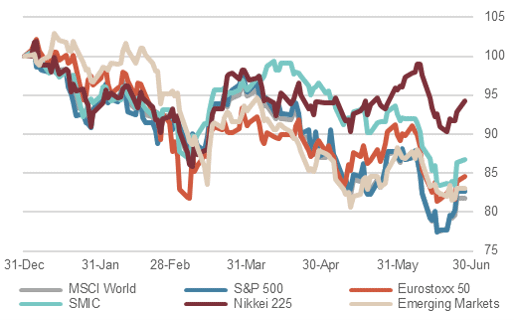

- The mixture of high inflation, rising interest rates and a possible recession represents a toxic cocktail for the stock markets. But we think that markets have broadly “priced in” the likely scale of upcoming interest rate hikes.

- Near-term, therefore, there is a good chance of a counter-reaction on the markets, as they are clearly oversold and sentiment is strongly negative. A significant support is coming from the companies themselves as they continue to buy in the context of their share buyback programs.

- But the Q2 reporting season, which starts in mid-July, will be challenging. Large-cap stocks probably have the best chance to surprise positively, as their size, operational advantages and balance sheet strength give them much more (pricing) power and their business models are intact. But the outlook for many smaller companies is weaker, as is being reflected in their stock prices.

- Given continued high volatility, we remain conservatively positioned and recommend a neutral to slightly underweight equity allocation.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

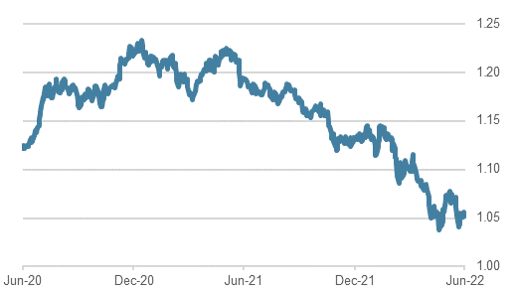

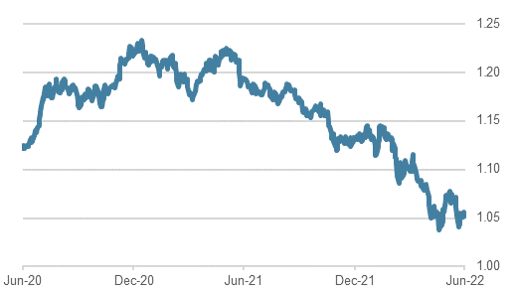

- With markets focusing on an increasing likelihood of a recession in the US given the Fed’s interest rate policy, the previous upward trend of the US dollar has run out of steam.

- The Fed’s projected interest rate path (the “dot plots”) is now seen by some economists as likely, if implemented, to induce a recession. Some think that this could prompt the Fed to change course even as early as this autumn (perhaps just before the November elections?).

- But the strength of the dollar is still very evident against the Japanese yen. The Bank of Japan’s adherence to yield curve control (YCC) has led to a marked weakening of the yen. Quite a few analysts assume that a large part of current tensions within the financial system can be attributed to this.

- The Swiss franc has strengthened following the SNB’s recent bold interest rate decision and is likely to trade around parity with the EUR in the coming months.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.