Executive Summary

- The troubled US regional banks and the emergency takeover of Credit Suisse by UBS unsettled market participants. The write-down of AT1 securities by CS led to a sharp decline in the price of the asset class.

- It was only the loss of confidence that led to the distress of companies that were fundamentally soundly financed. Governments and central banks are endeavoring to restore confidence.

- Negative effects on the still robust economy cannot be ruled out. Companies and consumers are threatening to become more cautious.

- The monetary policy of the central banks is coming into even sharper focus.

- Due to the uncertainties related to the U.S. banking sector, investors sought safe havens. These included the government bonds of the major economies, but also gold, which at times traded at over $2,000 per ounce.

- The equity markets are proving resilient, but we remain cautious in our assessment and neutral in our equity allocation.

- In FX markets, movements are relatively small despite stress in the financial system.

Our macroeconomic assessment

Business cycle

- The difficulties of regional banks, including bankruptcies and rescue attempts, are unsettling the markets and could lead to a banking crisis that clouds the economic outlook.

- Despite good capitalization and liquidity supply, confidence in the banking sector is battered. At the same time, massive global interventions are supporting sentiment and securing savings deposits, but consumer sentiment could still decline.

- The economy remains robust in terms of growth and demand for labor, but rising uncertainties could soon change the situation and lead to looser monetary policy by the Federal Reserve.

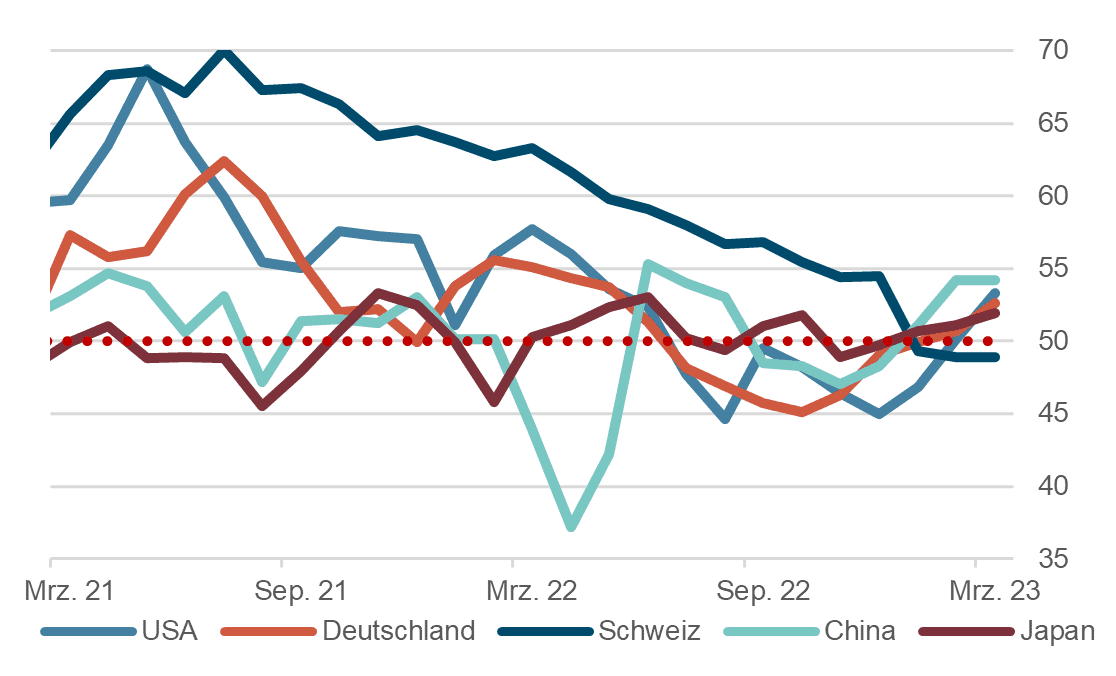

- The March manufacturing survey readings fall largely below the 50-point growth threshold, but the mixed index of industry and services is in the growth zone.

- Existing home sales in the USA are recovering strongly. In China, the real estate market remains a factor of uncertainty, but investment appears to be recovering, reinforcing a positive assessment for China and the region.

Monetary policy

- Central banks in the EU and Switzerland raised their key interest rates by 50 basis points to combat inflation, while the Fed only made a moderate increase.

Composite purchasing managers' indices, 2 years

Source: Bloomberg Finance L.P.

- Market participants do not expect further interest rate hikes in the USA, but rather interest rate cuts.

- Nevertheless, an inflation target of 2% remains in focus for central banks.

- The government and central banks have provided sufficient liquidity to cope with the uncertainties in the banking sector.

- Going forward, the Fed could proceed with both rising interest rates and quantitative easing to fight inflation on the one hand and calm the markets on the other.

Our investment policy conclusions

Bonds

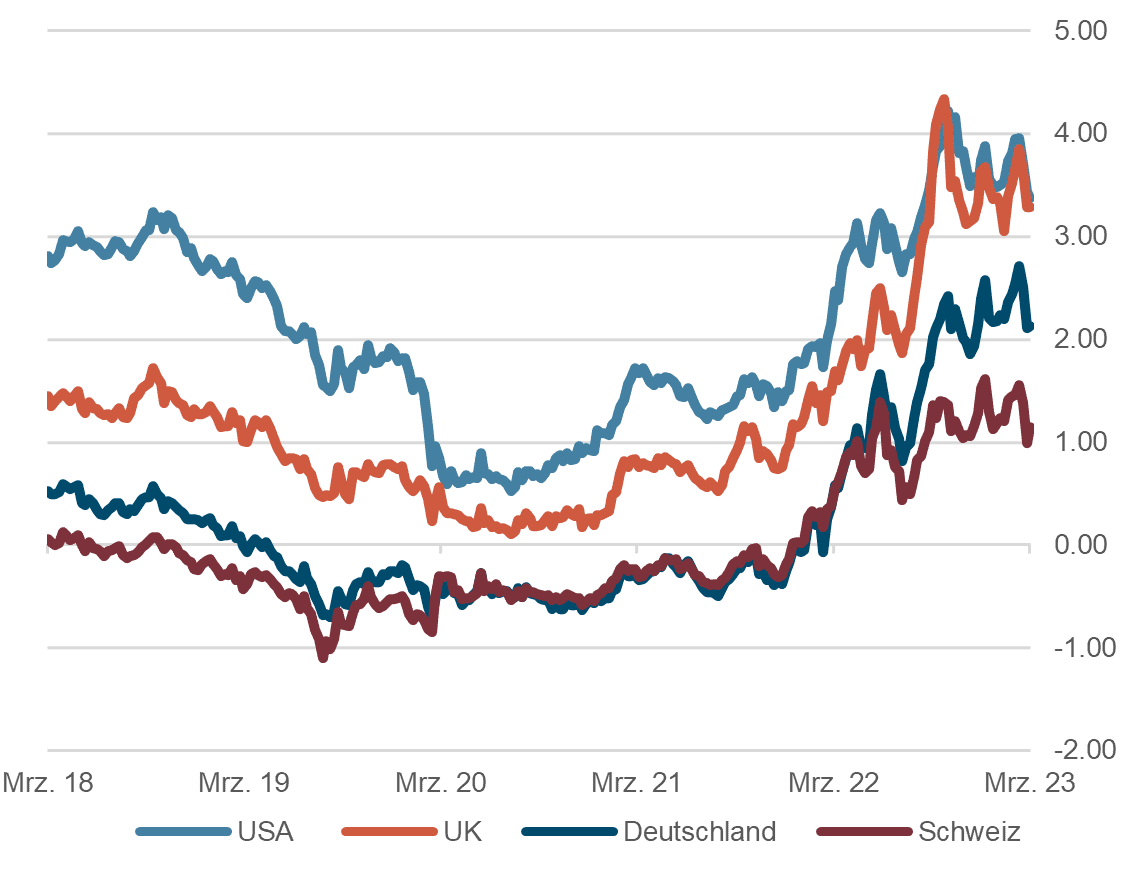

- In recent weeks, yields in all major currency areas were very volatile and fell significantly overall.

- Currently, 10-year government bonds in the USA are at just under 3.4%, in Europe at around 2.2% and in Switzerland at 1.2%. A renewed global banking crisis (CS, Silicon Valley Bank) as well as a liquidity crisis led to a flight into safe US government bonds, especially at the short end of the yield curve.

- Volatility in the bond markets reached levels reminiscent of the global financial crisis of 2007/8. At present, the debate on inflation control is overshadowed by fears of a renewed crisis and its impact on the economy. As a result, the Fed Fund futures curve is showing signs of another interest rate cut (FED pivot) in the course of the second half of the year.

- There was a widening of credit spreads for investment-grade and high-yield corporate bonds.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

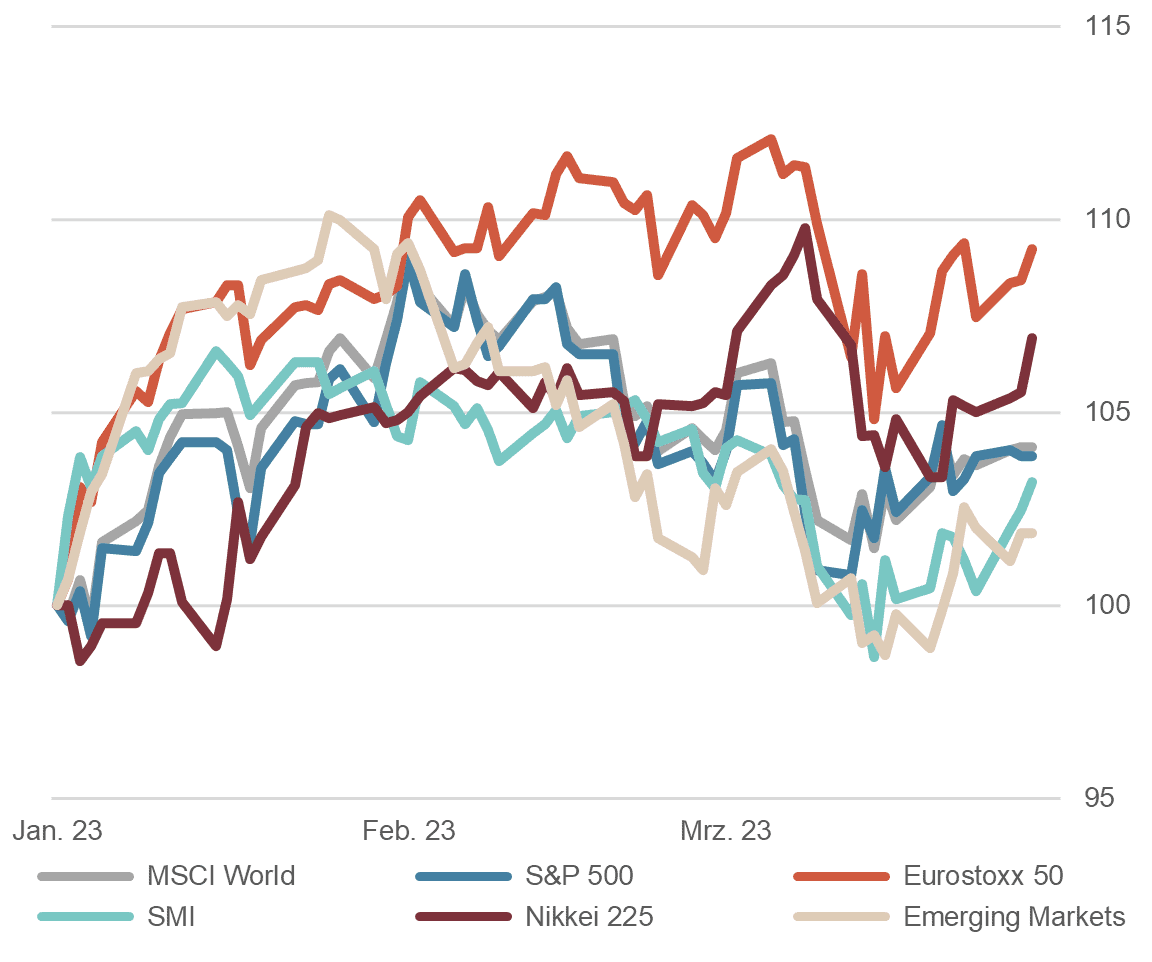

- Despite the many uncertainties, the stock markets are showing amazing resilience, especially the cyclical, technology-heavy Nasdaq in the US.

- In contrast, the defensive Swiss market in Europe is lagging behind.

- Although more defensive "value" stocks are currently less sought after, balance sheet quality is a valuable selection criterion. This is impressively demonstrated by the large, cash-rich U.S. technology companies.

- The upcoming corporate reporting season for the first quarter of 2023 will be another litmus test for the markets.

- Although expected earnings have declined slightly, some experts still consider them too high.

- Despite the increasingly worrying situation in the financial system and the geopolitical situation, we remain cautious in our assessment and neutral in our equity allocation.

Equity markets, performance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

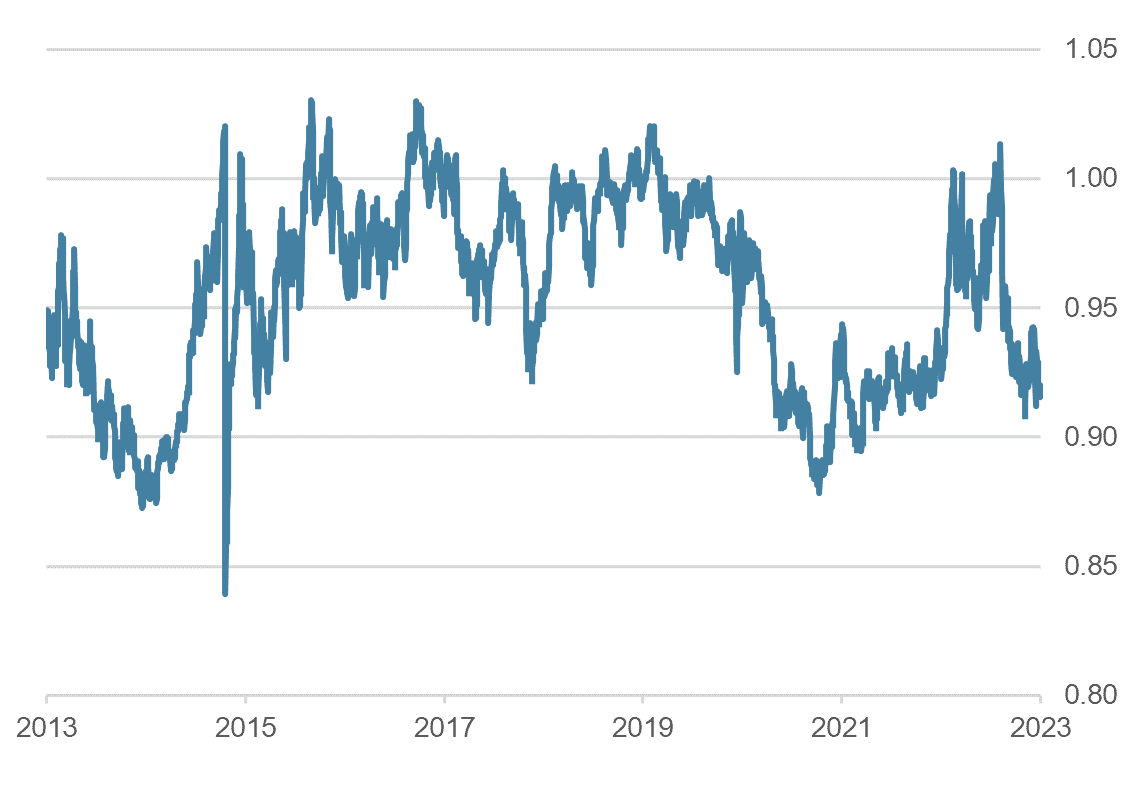

- Stress in the global financial system has led to increased volatility in foreign currency markets and increased demand for liquidity.

- The Fed has responded by activating USD swap lines on a daily basis with all major central banks. This normally leads to an appreciation of the U.S. dollar, but this is not currently being observed. Instead, the Swiss franc and the Japanese yen have appreciated slightly as "safe havens".

- The euro is again slightly below parity against the Swiss franc, which the Swiss National Bank has used to reduce its balance sheet somewhat.

- The rescue of CS has tended to weaken the status of the Swiss franc.

Dollar vs Franc, 10 years

Source: Bloomberg Finance L.P.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.