The World economy is clearly slowing. At the start of 2019 a defensive strategy is appropriate.

The world economy has lost momentum. More restrictive policies from the Fed and many emerging market central banks, the fading impact of the Trump Administration’s fiscal package as well as the trade war between China and the US are all slowing economic growth. For 2019 we forecast world economic growth at around 3.1%. The major components of this forecast are as follows – US: 2.2%, Euroland: 1.8%, China: 6%, Japan: 1%. Stocks are highly valued, especially in the US. Given this and the weakening trend in corporate earnings, the risks are high that world stock markets will fall in 2019. For investors, capital preservation should be the number 1 objective. Defensive strategies are preferred.

The US economy will grow around 2.2% in 2019

We expect the US economy will slow significantly in 2019. The impact of the 2017 fiscal stimulus is fading, and the more restrictive policy stance of the Fed is also working to cool the economy.

The recent G20 summit produced a truce of sorts in America’s trade war with China. The US agreed not to introduce new tariffs on Chinese goods or to implement planned increases to existing ones for a period of 90 days. In return, China promised progress in the fight against intellectual property theft and in combatting non-tariff protectionism. China also promised to work to reduce its huge bilateral trade surplus with the US and as a first step will raise its imports of US farm products. The agreement should serve to dampen tensions at least in the short term. But we fear hostilities will resume once the 90 days are up. The underlying conflict between China and the US has not been resolved. The US as the world’s current superpower is determined to see off a challenge from China which is well-placed to supplant it over time. China has a population of 1.386bn. as against the US’ 326million. The present US lead over China will only continue if China continues to nearly be 80% less productive, something the Americans should not count on. The peace brokered in Buenos Aires will not do away with the obvious rivalry nor with the overwhelming impact of the law of large numbers over time.

Public sector borrowing in the US is out of control

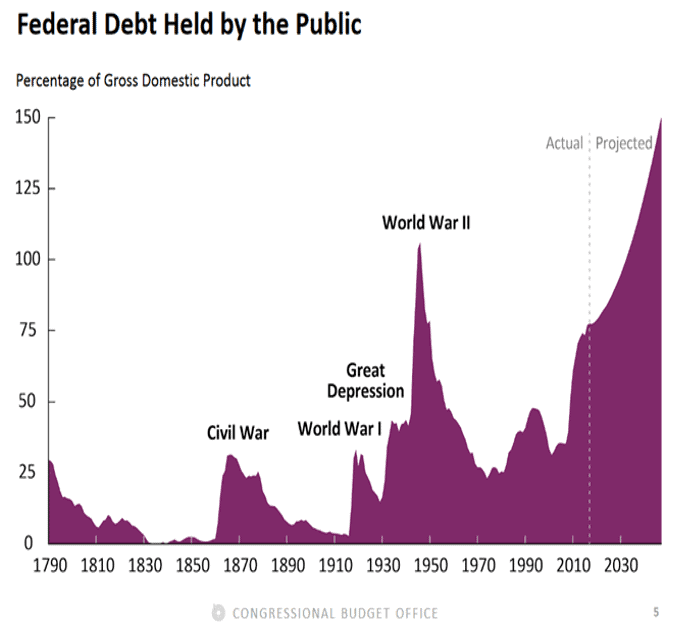

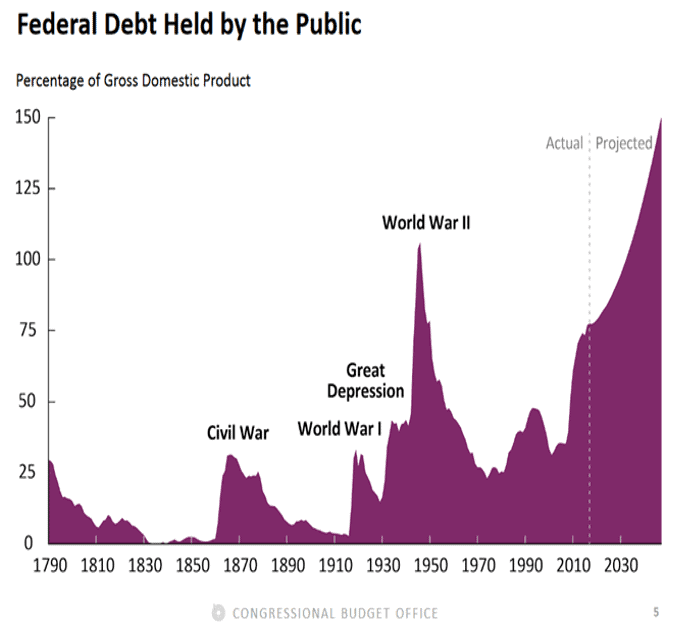

US public sector borrowing and the Federal debt service burden are both set to rise strongly. The Federal deficit was 3.9% of GDP in FY2018 (the highest in any peacetime expansion) and is forecast to rise by the Congressional Budget Office (CBO) to 4.7% of GDP for FY2019.

Clearly, the US is running its most pro-cyclical fiscal policy ever.

Often the year prior to a Presidential election year is good for stock markets as the economy is primed for the following year’s election. But this time the outlook is different. Mr. Trump has already used up much of his scope for fiscal stimulus. Also, Democrat control of the House of Representatives makes a pre-election fiscal boost more problematic.

CBO projections show the growth in Federal tax revenues will not keep pace with the growth of Federal health and pensions spending programs.

This unwelcome conclusion is based on the following premises which are far from pessimistic.

- No recession prior to 2027

- Real economic growth of 1.9% from 2021

- 10-year Treasury bond yields remain within the 3-4% range. After briefly running above capacity the economy slips back to full employment.

Despite these very favourable assumptions the CBO says Federal indebtedness relative to GDP is set to exceed substantially previous records set during WW2 and immediately after. And the CBO assumes peacetime. It can hardly base its projections on a major war.

Presently, the Federal government deficit is expanding at a time when the Federal Reserve is working to reduce its enormous balance sheet, a process known as “quantitative tightening”. This means additional supply of government bonds from two sources – the Treasury and the central bank. This extra supply will need to be priced for take-up by America’s private and overseas sectors.

We believe that US public sector borrowing levels will probably need to be reduced sharply at some stage, possibly in circumstances of recession. Indeed, recent tax cuts might well then be reversed. Also, the risks are high that US rates will rise further, bringing a decisive end to the long-running bull market in bonds.

Graph 1: US Federal debt as a % of GDP

Source: Congressional Budget Office

The Eurozone should grow around 1.8%

We forecast Eurozone growth at 1.8% in 2019. The slower growth outlook does not just reflect a generally weaker trend for the global economy. Europe’s well-understood structural shortcomings and specific problems are further sources of weakness. Issues include Brexit, Italy, the Ukraine, as well as the general unwillingness to undertake liberalizing reforms in Eurozone countries,

including France. The Purchasing Managers’ index for Italy recently fell from 49.2 to a disturbingly low 48.6. And within the Eurozone “Target 2” balances (balances within the Eurozone’s clearing system) are widening again. This is a sign of capital flight from Italy and Spain and towards “core” Europe. Our 2019 Eurozone growth forecast represents a significant slowing in European economic activity. Indeed, another Eurozone crisis cannot be ruled out.

The UK should grow around 1.3% in 2019

We estimate the likelihood at 40% that the UK will consummate a deal with the EU, albeit at the very last minute. We put a 25% chance on a no-deal “Hard Brexit”, and give a 35% weight to other outcomes – a fresh referendum, an agreed period of stand-still etc.etc.

Huge uncertainties are causing investment in the UK to be cut back. The strong undervaluation of the British pound is likely to prevent a seriously bad growth outcome as with a lower pound UK price competitiveness is high. This is reflected in the recent rise of the UK Purchasing Managers’ index from 51.1 to 53.1. We expect real growth for the UK economy of around 1.3% in 2019.

According to a Bank of England study a “Hard Brexit” could cause a 25% decline in the pound and in British property prices.

For Japan we estimate real growth at 1%

We expect 1% real growth for Japan in 2019. The positive impact of the increase in the labor market female participation rate is gradually wearing off.

For Switzerland we expect 1.9% growth in 2019

Switzerland is currently experiencing very strong growth. But the remarkable 2.8% now expected for 2018 has been boosted by some special factors such as football’s World Cup. Many multinational organizations have headquarters in Switzerland, so Swiss GDP tends to benefit from large events, even if these take place outside the country, as part of the value added by these events can be attributed to Switzerland.

There will be less such favourable one-offs in 2019. And the Eurozone economy is clearly weakening. As a result, we expect Switzerland’s growth to slow significantly – to 1.9% in 2019.

China should grow around 6%

The price to be paid for China’s policy of moderating the trend decline in its long-term growth rate is a further rise in national indebtedness. The Bank of International Settlements estimates that the indebtedness of China’s non-bank sector is now 165% of GDP, an increase of 12 percentage points since 2015. Put another way, China’s slowdown is being delayed by the fact that indebtedness continues to grow faster than the economy.

The gearing inherent in China’s growth process will bring big problems over the medium-term. Moreover, with the trend to higher US interest rates now quite advanced, the general threat to emerging markets has intensified – in terms of both their currencies and their securities markets. Hence, we still advocate caution in emerging markets, even though their correction now looks quite advanced, in particular relative to US assets.

Central banks will become more restrictive

The US unemployment rate remains at 3.7% and we believe the American economy has moved beyond “full employment” and is now operating “above capacity”. Wage inflation looks set to increase in coming quarters. But recent comments from Fed Chairman Jerome Powell as well as FOMC member interest rate forecasts suggest that future interest rate rises may be fewer than previously expected. Yet again, Mr Powell indicated that monetary policy developments would be data-dependent. (“We’re going to be letting incoming data inform our thinking about the appropriate path” of future rate increases.) Following the December 2018 hike, we now expect at most one or two further interest rate rises over the course of 2019. In this context, we note that the US yield curve is now not only very flat but also partially inverted. This is a fairly reliable indicator of future economic weakness.

The ECB terminated net purchases under its Asset Purchase Program in December 2018, though the proceeds of maturing securities will presumably be reinvested in longer-dated paper. But we don’t expect the first cyclical increase in Eurozone interest rates before autumn 2019. This will restrict options for the Swiss National Bank which will only be able to raise Swiss interest rates once the ECB has made its interest rate move. The Bank of England is likely to raise UK interest rates next year, assuming that an orderly Brexit process is in train.

In general, we believe that central banks will have some success in normalizing monetary policies next year, despite clear signs of a less strong economy. The Fed withdrew some $330bn of liquidity from the markets in 2018, but this was more than offset by net liquidity injections from the ECB ($360bn) and the Bank of Japan ($430bn.) For 2019, we expect that the major central banks will be net withdrawers of liquidity from the markets.

This is likely to impact all major asset markets negatively – equities, bonds, property and commodities. Moreover, the extraordinarily stimulative policies central banks have felt obliged to pursue over the last several years mean that they are now poorly placed to provide further stimulus in the event of any future recession in 2020. All this argues for investment caution.

Outlook for equities

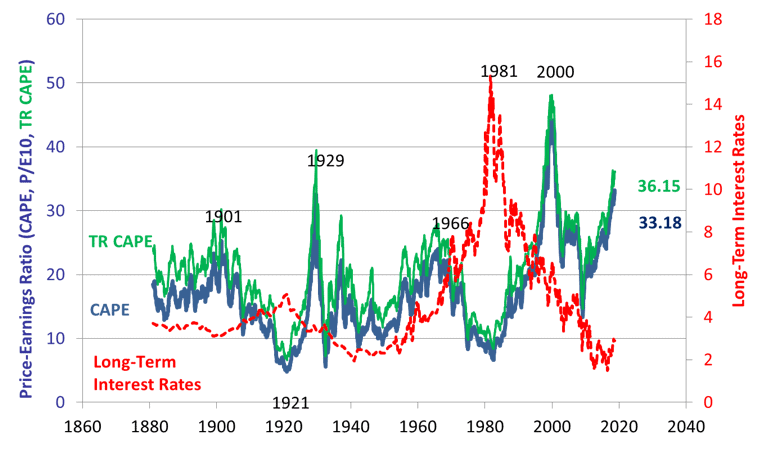

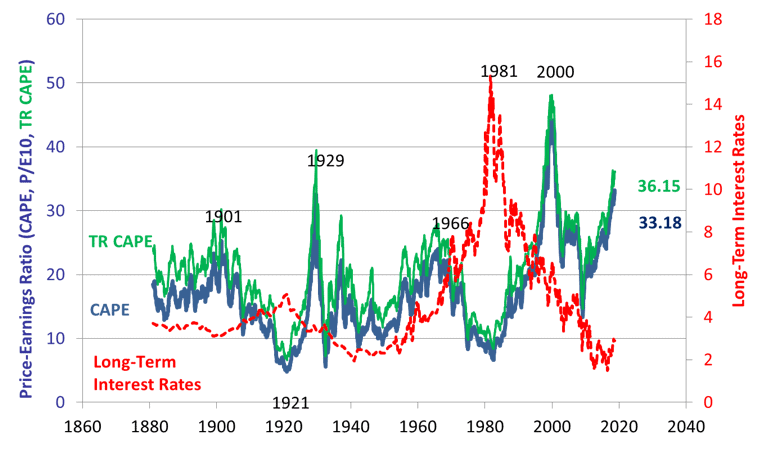

Unfortunately, we don’t see any factors to drive the equity markets higher. The current bull market is very old, and certain areas of the US market, especially technology stocks, are still trading at nosebleed valuations. Based on cyclically-adjusted corporate earnings the US market as a whole is expensively valued.

Graph 2: Professor Shiller’s cyclically-adjusted PE ratio for the S&P500

Source: Homepage Prof. Shiller

Not all stock markets are expensive, however. “Emerging Europe” has an overall Shiller PE of “just” 8.6. Among relatively inexpensive markets on the Shiller metric are South Korea (12.4), Spain (12.5) and Singapore (12.6).

But the problem with non-US markets is the influence of the much larger US market on them. While non-US markets don’t have much impact on Wall Street, major falls in New York tend to cause sympathetic declines in markets across the world.

We don’t look for buying opportunities in 2019 until a substantial correction has occurred

Forex

The flat US yield curve is a sign the US dollar’s multi-year period of strength is coming to an end. We believe the current US business cycle will soon pass its peak in terms of growth.

With increased uncertainty emanating from the US and elsewhere, the Swiss franc is set to perform its “safe haven” function in 2019.

In terms of purchasing power parity, the pound is the cheapest of all the major currencies. Should the UK manage to achieve an orderly Brexit process, or decide to hold a fresh referendum, we would expect the pound to appreciate significantly.

Swiss property

The Swiss construction industry has been enjoying extraordinarily favorable conditions. The average yield on a fixed Swiss franc 10-year mortgage is now only around 1.75% according to the Swiss National Bank.

The residential vacancy rate is only 1.6%, though this is slowly rising. Property markets are giving ever stronger signals that too much has been built and that too much still continues to be built. That said, we note “applications to build” fell 6.1% from January to August 2018.

In the area of Swiss property investment we believe a conservative approach will be increasingly appropriate as we move through 2019.

Our key message:- As we start 2019 a conservative investment strategy, with an emphasis on capital preservation, is called for. We prefer large caps to small caps and established companies to growth situations. But 2019 could eventually provide good entry opportunities in certain markets.

We thank you for your confidence in us and wish you “all the best” for 2019!

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.