Many economies are now weakening in tandem. Gold could be interesting in this environment.

Unfortunately, many of the world’s economies are now losing momentum in a synchronized way. Given its strong starting position, the US economy is still a long way off recession. But it’s a different picture elsewhere. Italy’s manufacturing sector, for example, is already contracting. Once again, the financial markets have reason to fear a sharp slowdown in China. The Fed has reacted to investor nervousness by indicating its prospective policy stance is now much less restrictive. In this environment gold could be an interesting investment.

A broad-based slowdown in the world economy

Economic data show a general picture of significantly weaker growth.

We are still a long way from recession in the US…

The US economy remains pretty robust and recent data show such momentum that a sharp turn in the direction of much lower growth is unlikely in the near-future. Thus, the US is a long way from recession, an assessment confirmed by the leading economic indicators.

…. but the picture in Europe is different

Europe on the other hand now shows significant weakness. The Euroland figure for new orders fell the most in six years this January. And the overall index for manufacturing in Euroland also fell to just 50.5, its sixth consecutive monthly decline. It is thus very likely that Eurozone manufacturing is either in recession or soon will be. Italy’s manufacturing sector is already in recession and the Italian Purchasing Managers’ index reported just 47.8 for January, compared to an expected 48.8.

European inflation data also shows a slight declining tendency. Euroland’s Harmonized Index of Consumer Prices showed a rise of just 1.4% in January compared with 1.6% in December.

Concerns about economic growth in China are hurting financial markets

China’s Purchasing Managers’ index for manufacturing has now fallen to 49.4 – i.e. below the 50 barrier which separates contraction from expansion. The comparable index for small and medium-sized enterprises was an even lower 48.6. Thus, it is increasingly likely that China’s industrial sector will be shrinking before long. No surprise then that in just one day no less than 440 Chinese firms gave out a profits warning!.

It is also worrying that 373 out of 2400 firms in China’s mainland have indicated that they will be reporting losses. In 2017, over 80% of these firms were profitable. But China’s bad news seems concentrated among small and medium-sized firms. Hence the weaker Purchasing Managers’ reading, compared to that for larger companies, reported above. Smaller companies don’t have access to finance via the securities markets in the way that larger companies do and are dependent on bank credit. We believe it is only a matter of time before China’s government steps in to support the sector.

Small and medium-sized companies particularly affected

However, the bad news seems to be concentrated on small and medium-sized companies. The poor situation in this segment is also reflected in the purchasing managers' index for small and medium-sized enterprises, which fell to 48.6. Since these companies are denied access to bond financing due to their size, they are dependent on bank loans. We therefore expect further support measures from the Chinese government in the near future.

Globally, equities are expensive, but bonds are even more expensive

With a Shiller (“cyclically-adjusted”) PE reading of 21.1, global stock markets are rather expensive, but as an asset class bonds seem even more expensively rated. Indeed, several government bond markets have for some time had yields that are either around zero or in negative territory.

A trade agreement between China and the US is possible but may not prove long-lasting

China has said that it will buy more American products to reduce its huge bilateral trade surplus with the US.

The most difficult issue is probably the American demand that China respects its patents and its intellectual property. Moreover, it is one thing to have an agreement on paper but quite another to ensure it is observed. Americans will not be satisfied with Chinese promises and letters of intent. Our assessment is that a China-America trade agreement may well materialize but then turn out to be unsustainable given the difficulty of enforcing intellectual property rights. Any agreement may also be undermined by President Trump’s tactical need to identify enemies in advance of the next election should the US economy turn out weaker than hoped. While the Fed is a domestic candidate for scapegoat, Trump attacks on the Fed may resonate less with the US electorate than attacks on an external enemy such as China. Should there be no trade agreement soon between the US and China, US tariffs on $200bn. worth of Chinese goods are scheduled to come into effect on March 1.

The Fed makes a U-turn

Fed Chairman Jerome Powell has recently said that US interest rates will only be raised further if inflation continues to accelerate. He has even hinted that the Fed’s next rate move could be a cut. The reestablishment of the Fed’s monetary policy arsenal – through interest rate rises and $50bn. of bond sales per month – is now substantially complete. We are somewhat surprised by the Fed’s about-turn given the underlying buoyancy of financial markets as indicated by their recent strong recovery from last December’s swoon. Indeed, we had thought that it would take a major crisis in the markets for the Fed to row back on its planned moves of further tightening. Thus, we view the Fed’s recent shift as an almost unconditional, even submissive, surrender to the whims of moderately nervous investors. We hope it is not a surrender to President Trump, who has shared his joy at the Fed’s policy shift with the millions who get his Twitter feed. But we fear the Fed’s rapid and abrupt change of course will cost its Chairman credibility with investors.

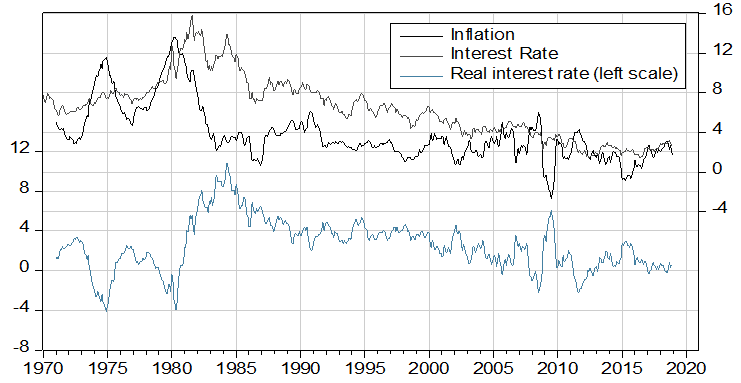

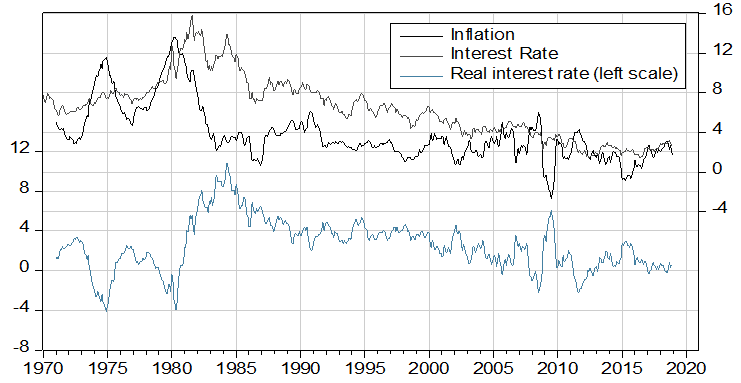

The graph in the next column shows the yield on US Treasury 10-year bonds, the US inflation rate and (on the left-hand scale) the implied real yield on 10-year Treasuries. One can observe that US real bonds yields have been on a declining trend since the mid-1980s.

Businesses, consumers, governments and state enterprises as well as shareholders and borrowers have all gotten used to very low and declining real interest rates. A return to a “normal” world, in which real interest rates are positive and bond owners can achieve an acceptable return, seems out of reach. We expect that the next recession will produce real interest rates even lower than those which developed in the Financial Crisis.

US inflation and US nominal and real interest rates

Source: Thomson Reuters, Datastream

The US labor market is still hot

The US labor market has remained very strong in recent weeks. Notwithstanding the government shutdown, nonfarm payrolls rose by 304´000 in January. This is the largest reported increase in new jobs for around a year. Another milestone is that US employment has now risen continuously for 100 months. While clearly good news, one should remember that rising employment can be a leading indicator of rising inflation and that with respect to the general business cycle it is rather a coincident or even a lagging indicator.

Gold will benefit from the Fed’s change of course

Faced with problematic markets, the Fed has decided not to pursue its planned tightening course. In this, it has given a powerful boost to gold. Despite a rising gold price, the volume of gold in ETF instruments rose 3% in January alone to 2281 tonnes. With real interest rates effectively zero, as shown in the graph, the real opportunity costs of holding gold (i.e. the income foregone by owning a non-interest-bearing asset) are also negligible. We recommend clients to consider an investment in gold.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.