Independent asset managers pursue these risks

2023 will be a decisive year for independent asset managers in Switzerland. On the one hand, they will need a license from Finma to continue doing business, and on the other, another bad year on the stock market is likely to take its toll on some companies. But how do the players themselves assess their situation?

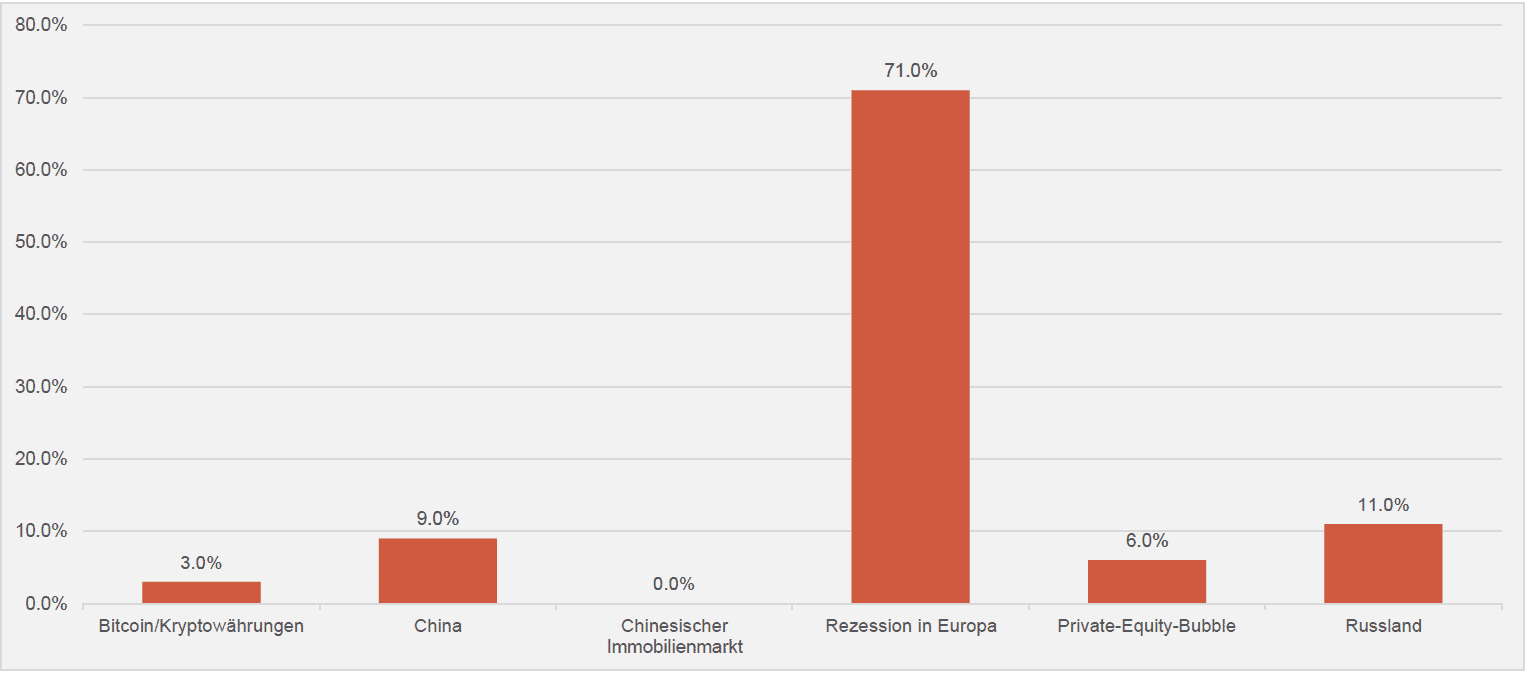

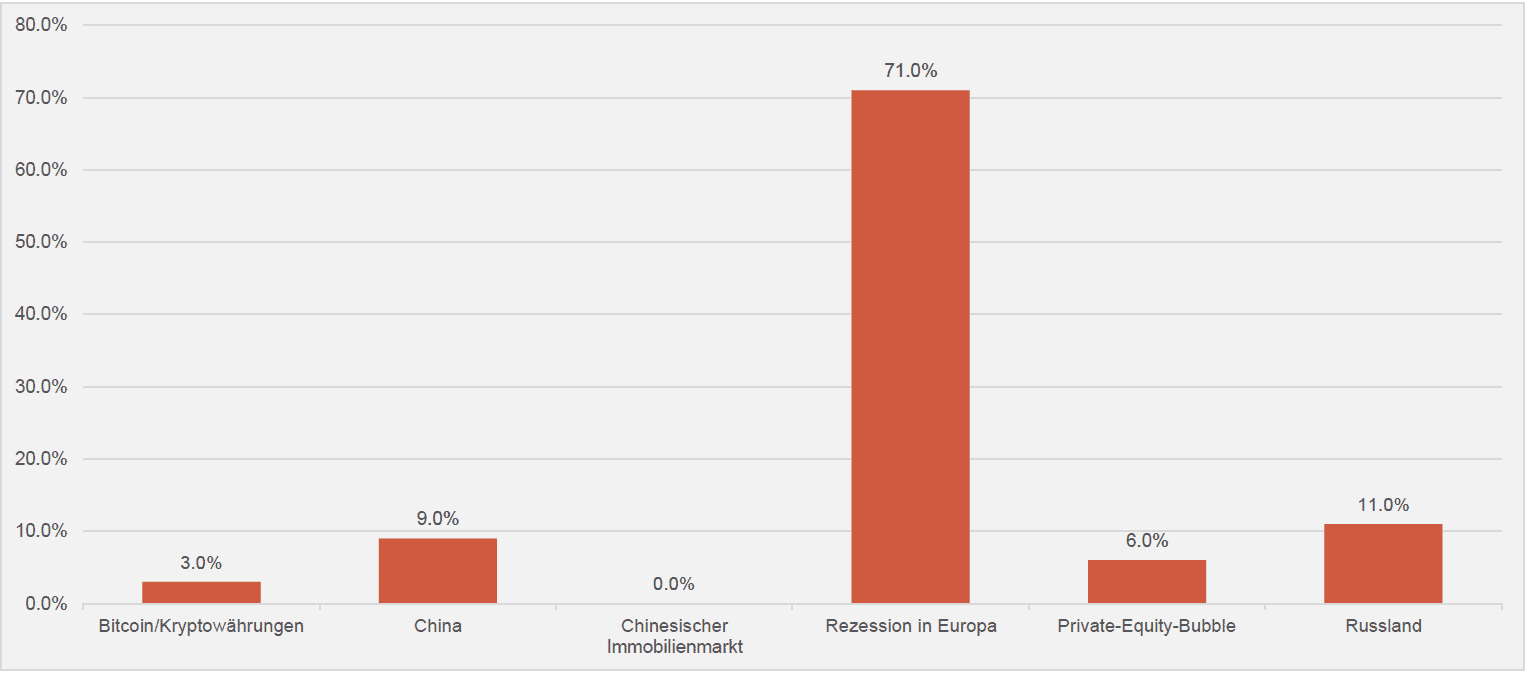

Independent asset managers in Switzerland consider a recession in Europe to be the greatest risk in the new year. More than 70 percent of respondents are of this opinion. The second biggest risk is the ongoing war in Ukraine, followed by uncertainty in China (see chart below).

For independent asset managers, 2023 will be a decisive year in several respects. Because from now on, companies will need a license from the Swiss Financial Market Supervisory Authority (Finma) to continue their business activities. However, many firms have so far failed to comply with this requirement, as finews.ch has also reported on several occasions.

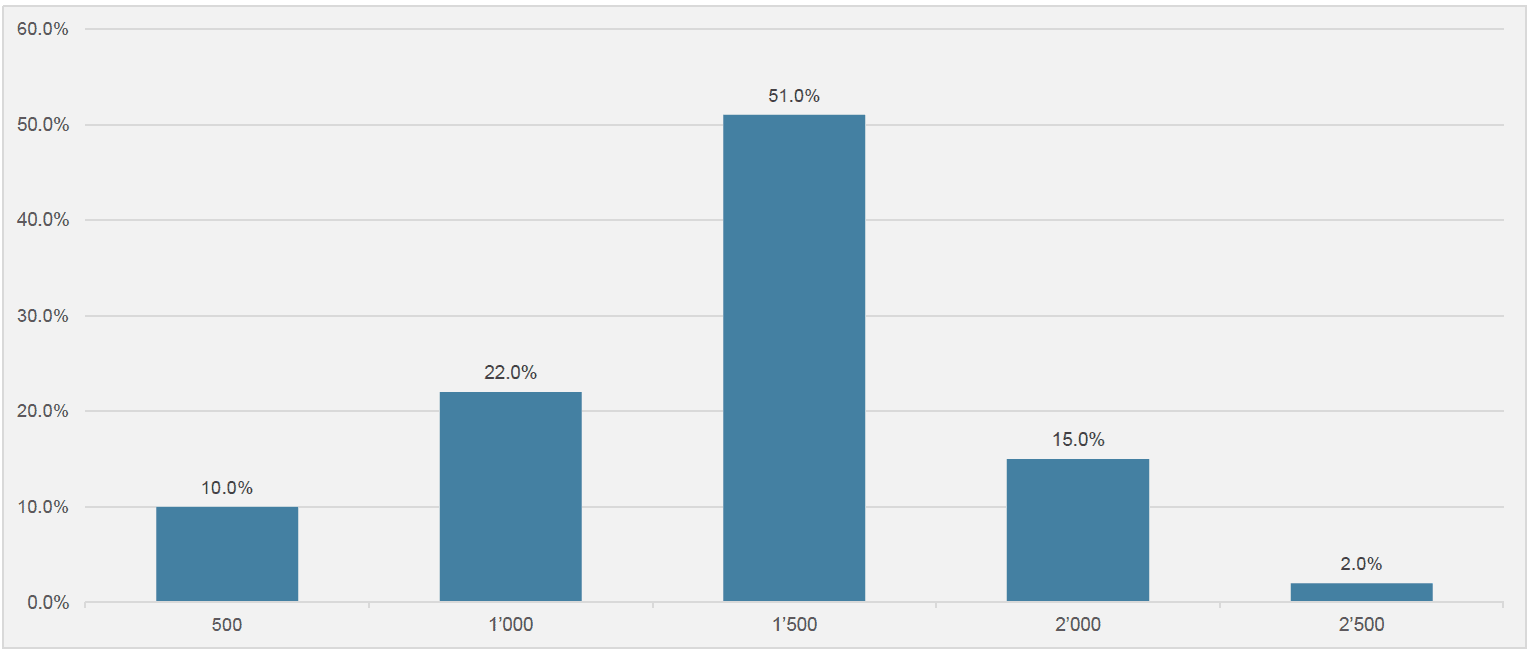

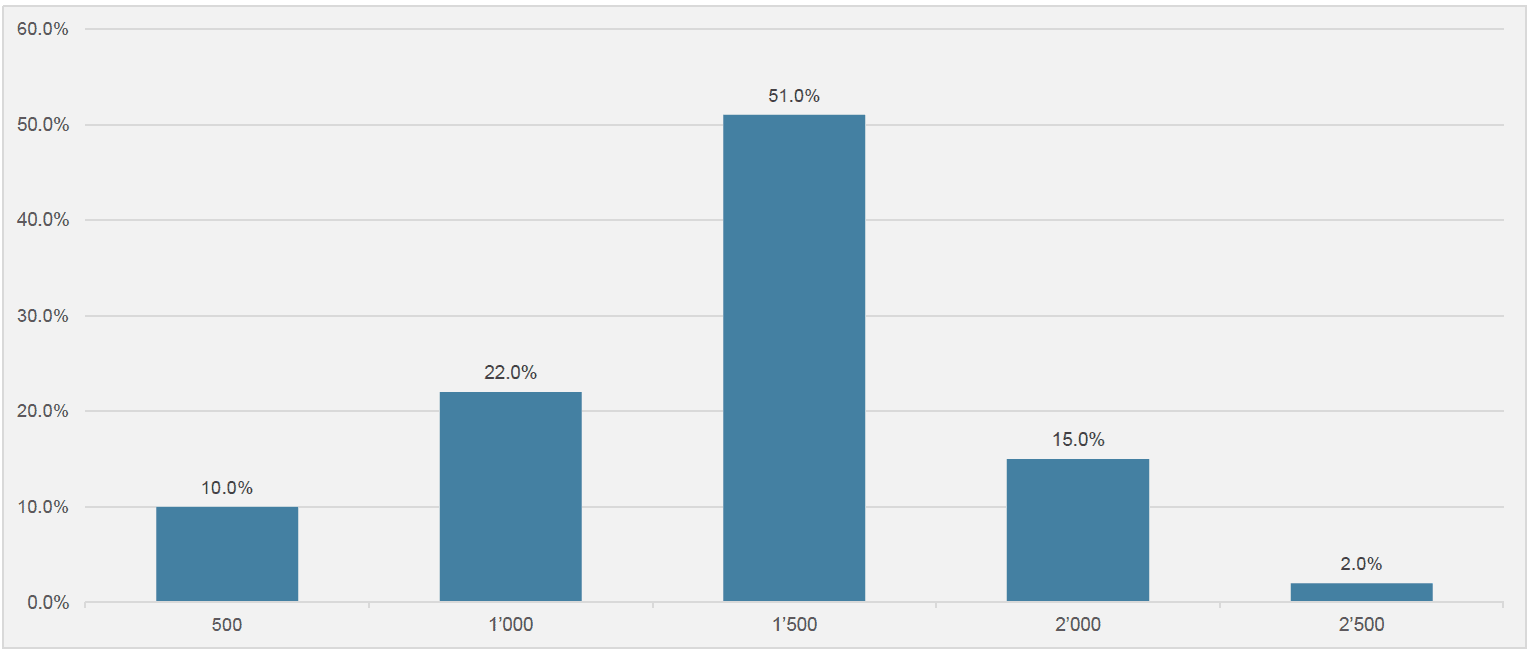

Against this background, many companies, especially smaller ones, are likely to exit the market. This is also the opinion of the players themselves. The majority of them expect around 1,500 independent asset managers to remain in Switzerland in the medium term. Currently, there are still around 2,200 (see chart below).

Higher share prices in the next three months

This information is derived from the Aquila Asset Manager Index (AVI) which is published every three months by the Swiss Aquila Group in cooperation with finews.ch. The index summarizes various forecasts and assessments of independent asset managers in Switzerland. 150 firms participated in the latest survey.

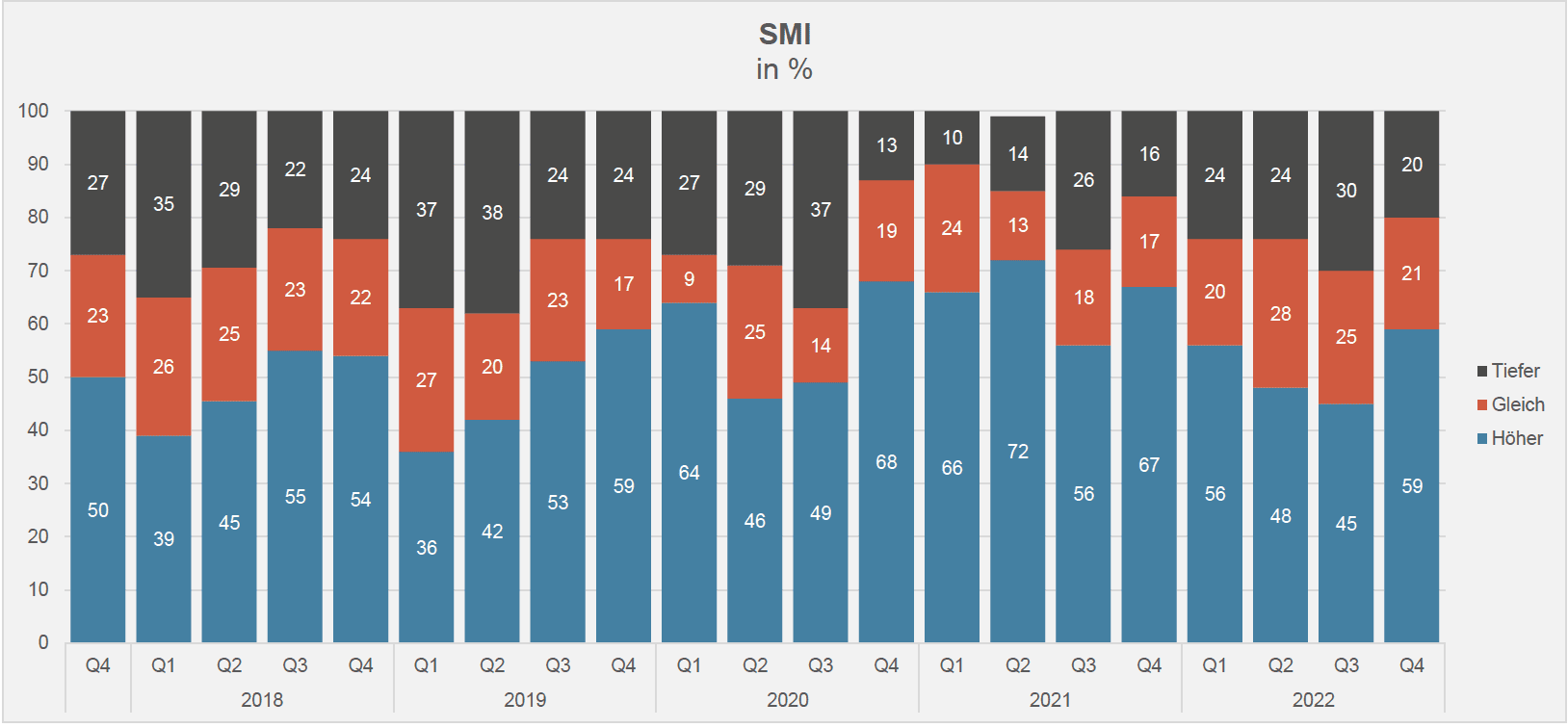

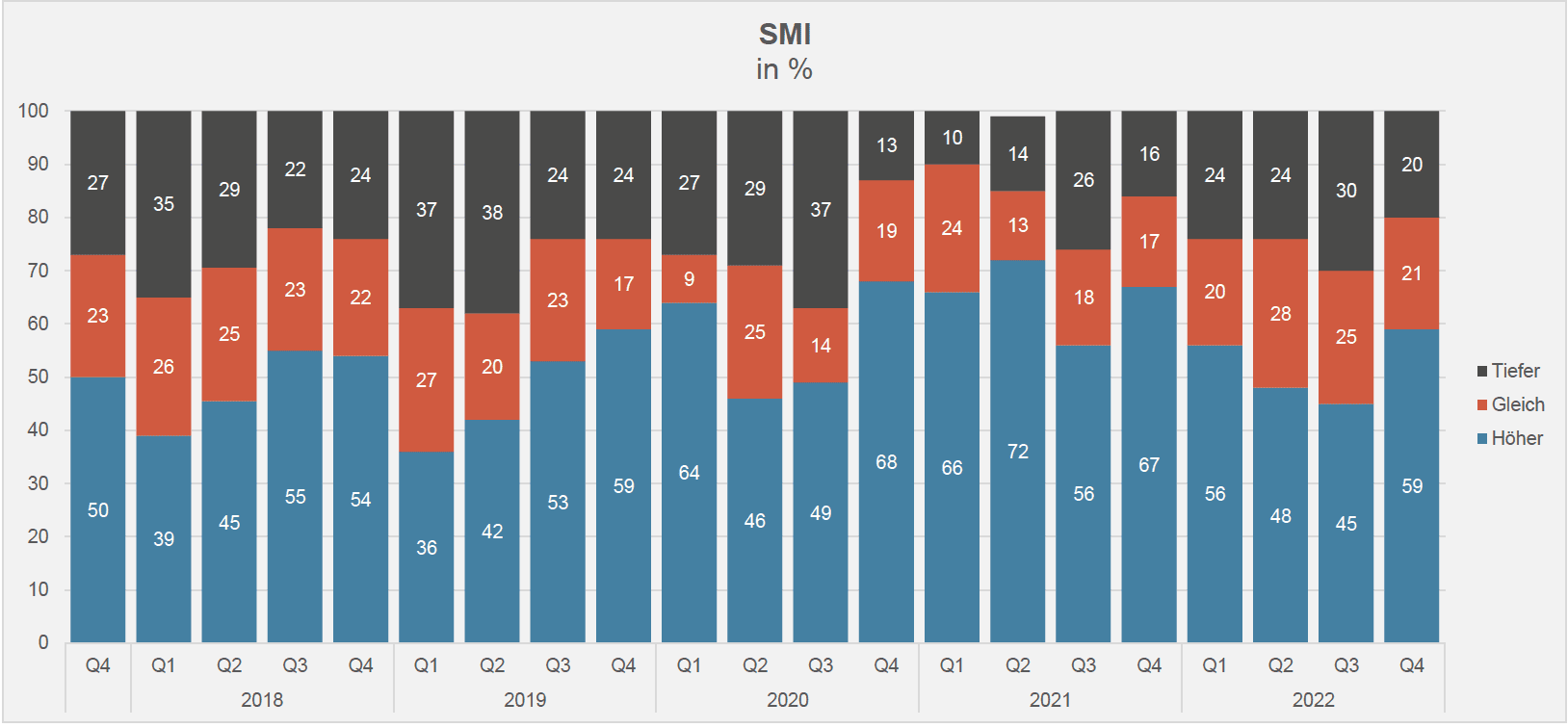

Despite the many uncertainties and risks in the new year, independent asset managers expect higher share prices in the next three months. A remarkable 59 percent are of this opinion, compared with only 45 percent three months ago. Only 20 percent expect lower share prices, compared with 30 percent at the end of September 2022 (see chart below).

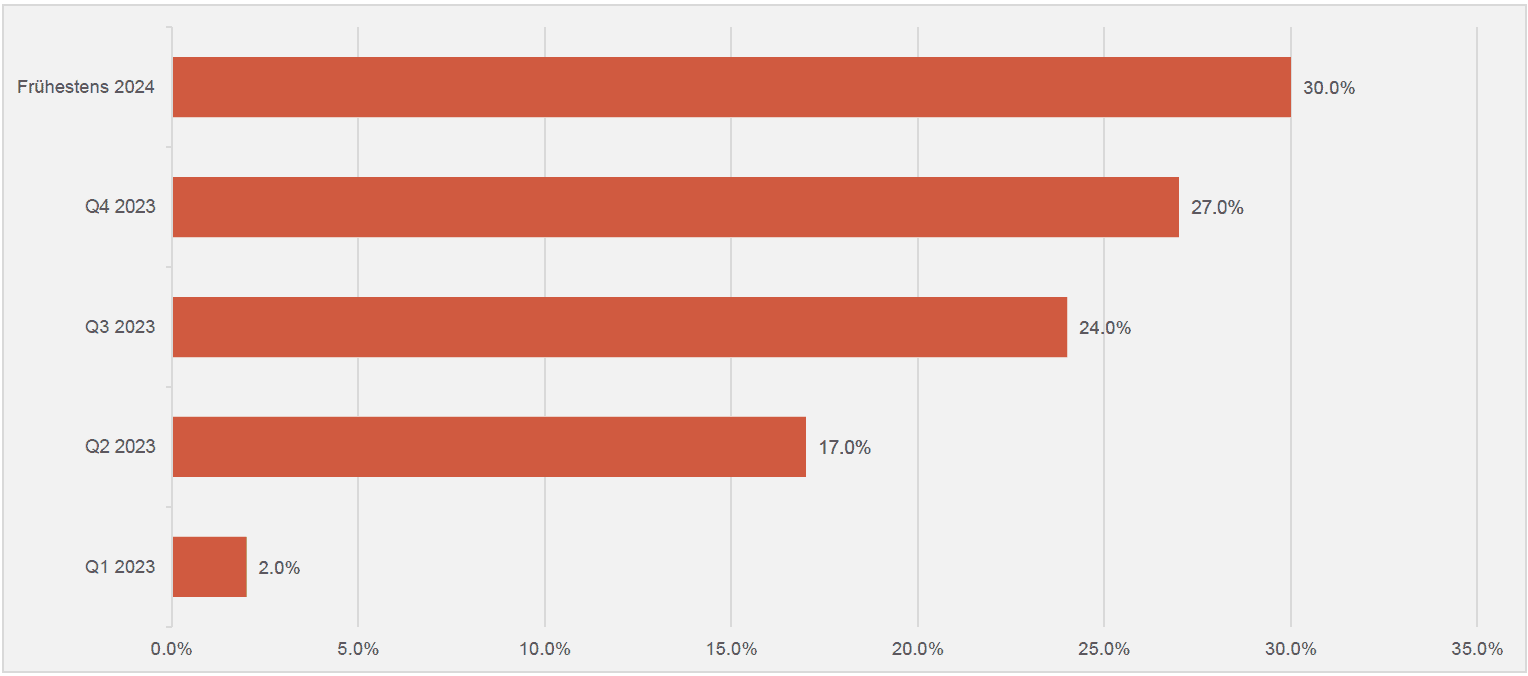

Disagreement on interest rate policy

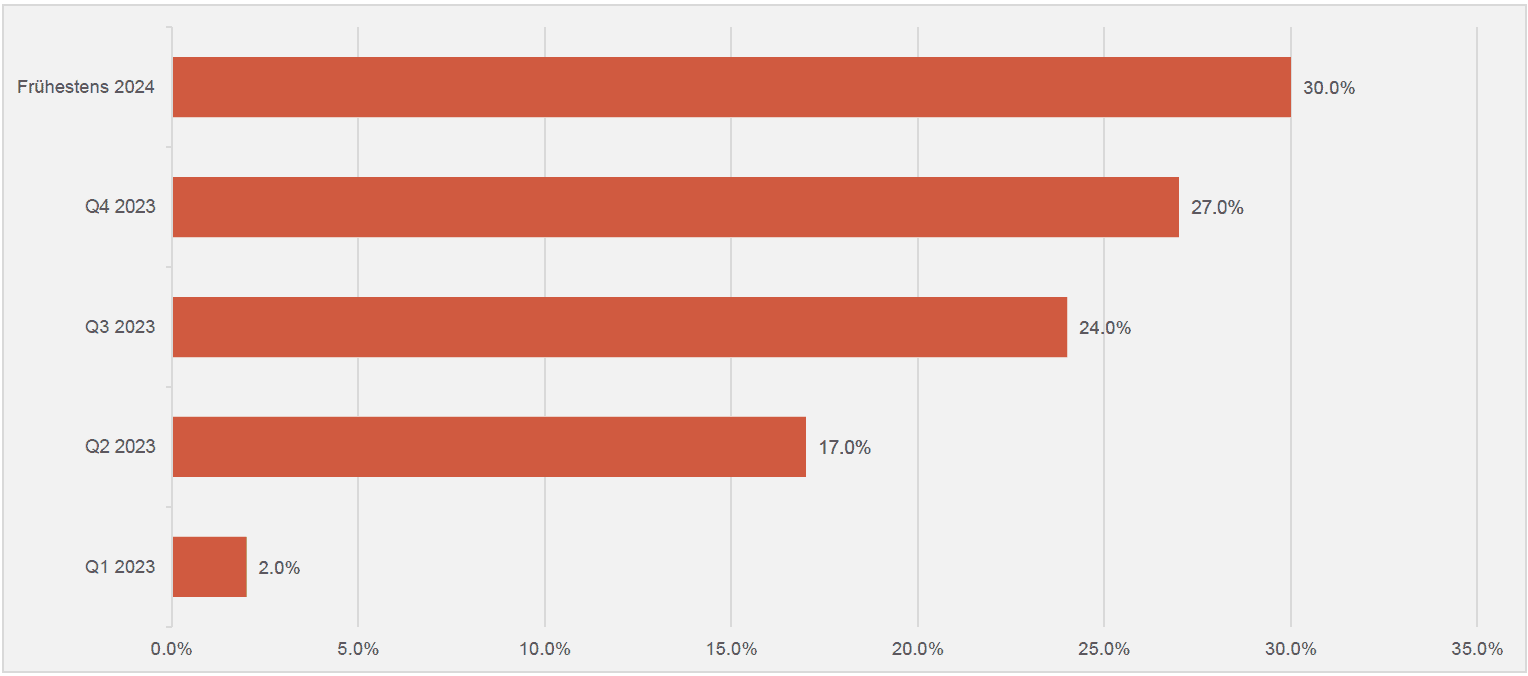

With a view to the central banks' interest rate policy, independent asset managers disagree on when exactly the US Federal Reserve will cut interest rates again for the first time. Just under a quarter expect such a move as early as the third quarter of 2023, while slightly more than a quarter do not expect a cut until the fourth quarter of 2023.

Around 30 percent of respondents believe that the U.S. Federal Reserve will not react accordingly until 2024 at the earliest (see chart below).

Behavior optimistic

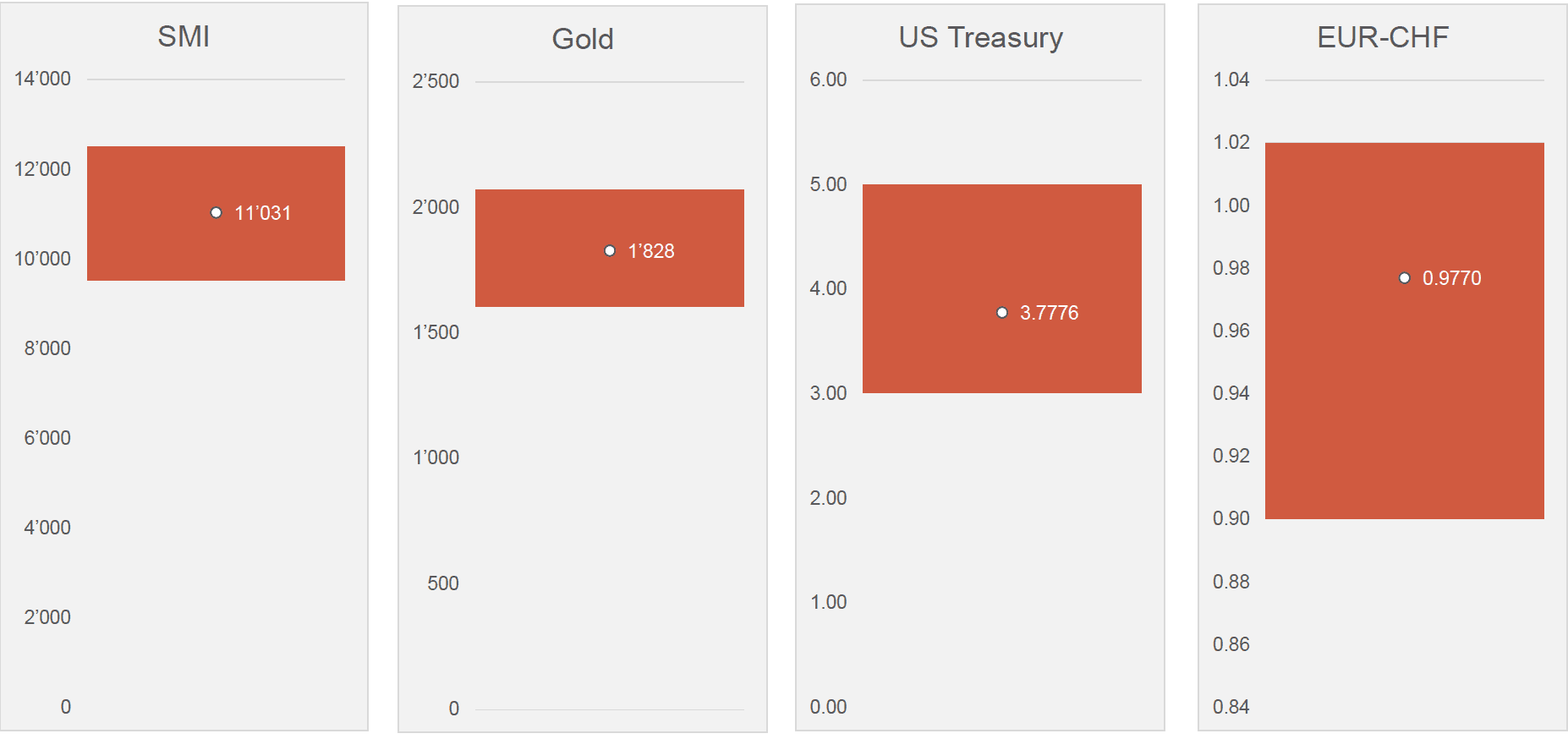

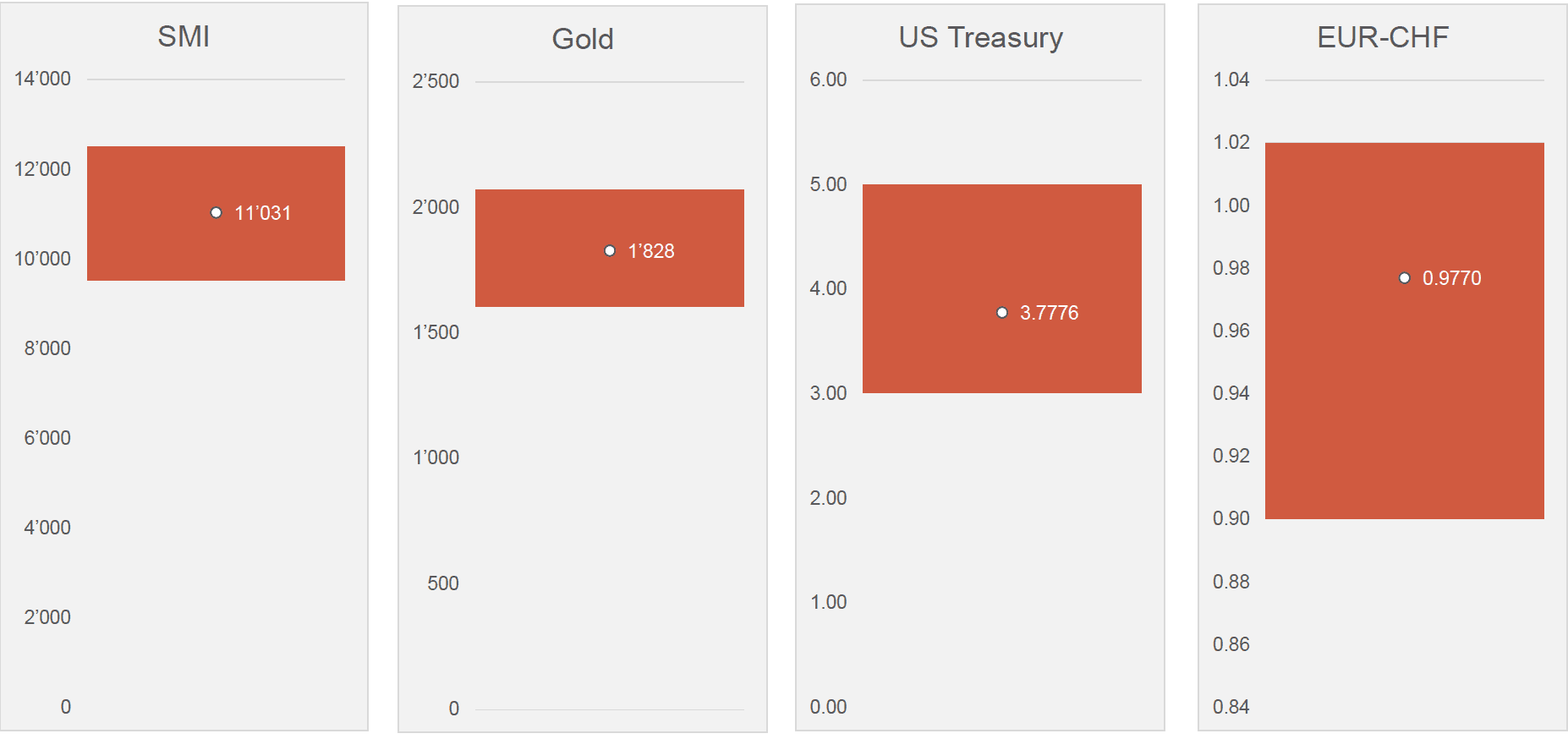

Three months from now (see chart below), the independent asset managers see the Swiss Market Index (SMI) at a level of 10,964 (currently: 11,241).

Independent asset managers are skeptical about gold; the various interest rate hikes by central banks have clouded the view of the yellow precious metal.

Gold well below 2,000 dollars

By the end of March 2023, the respondents expect a price of only 1,828 dollars per ounce (currently: 1,841 dollars) - well below the 2,000 dollar mark.

They estimate the yield on the 10-year U.S. Treasury at 3.78 percent in three months (currently: 3.87) and the euro-franc exchange rate at 0.9770 (currently: 0.9858)

The next AVI index will be published in April 2023.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.