Majority of asset managers are crypto skeptics

Two-thirds of independent asset managers in Switzerland believe that cryptocurrencies do not belong in a client portfolio. Instead, they focus on equities and were able to significantly increase their assets under management in the first three months of the current year.

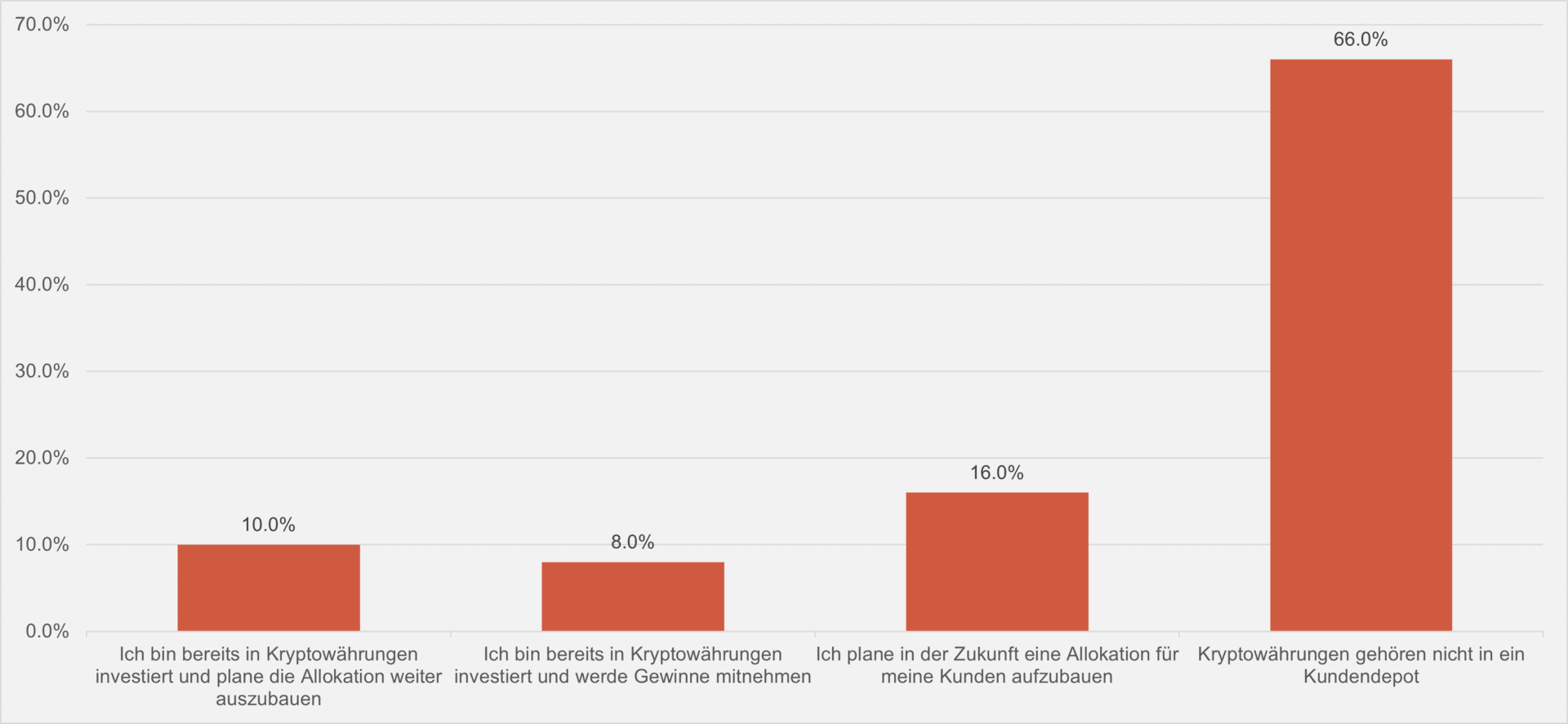

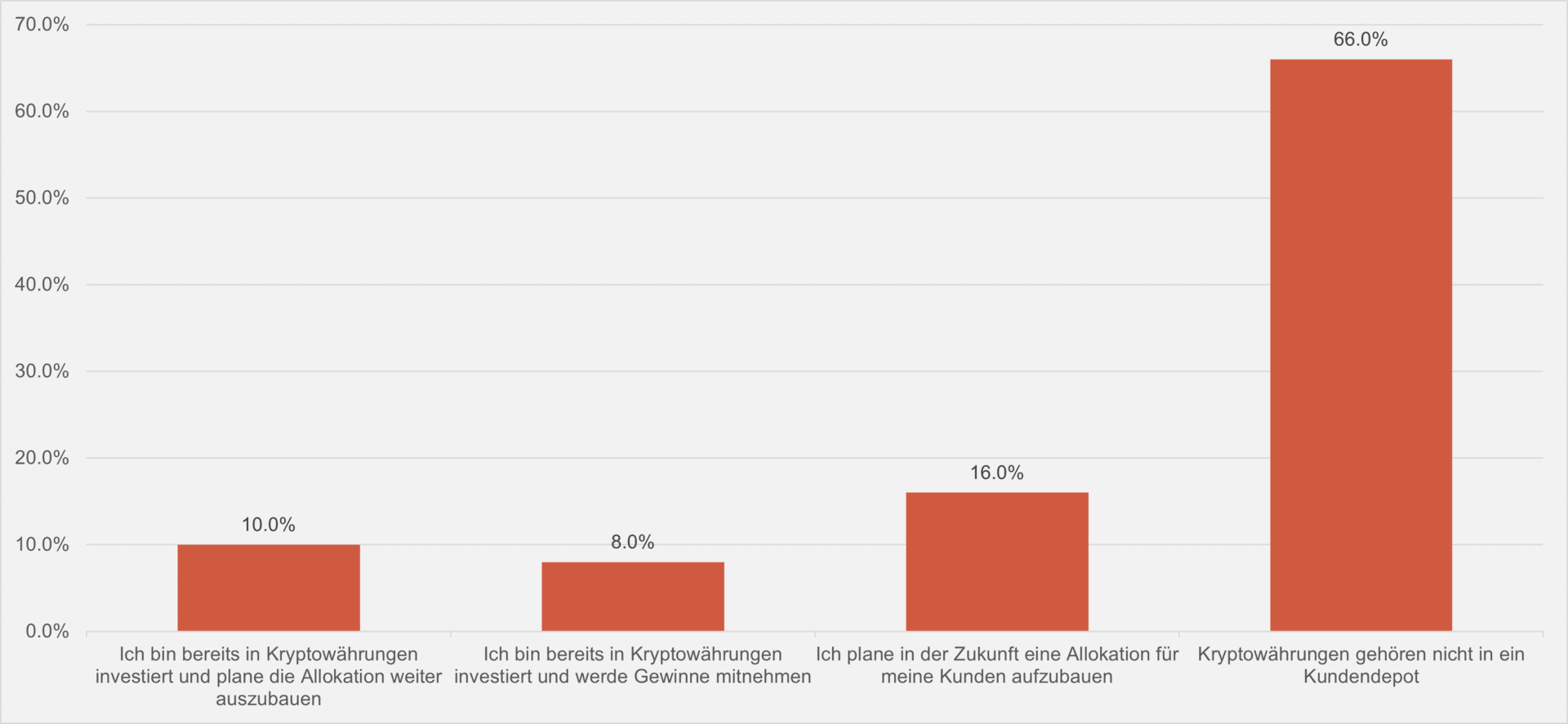

Although demand for Bitcoin is rising inexorably, independent asset managers in Switzerland have a clear opinion on cryptocurrencies. Two-thirds of them are of the opinion that these assets do not belong in a client portfolio. In contrast, only 16 percent of respondents plan to make an allocation for their clients (see chart below).

After all, 18 percent are already invested in cryptocurrencies. This is according to the latest Aquila Asset Manager Index which is published every three months by the Swiss Aquila Group in cooperation with finews.ch. The index summarizes various forecasts and assessments of independent asset managers in Switzerland. 150 firms participated in the latest survey.

A challenge for every asset manager

"It is now important for asset managers to reassess the risk profile of their clients from the perspective of cryptocurrencies," says Gerd Lehner, Managing Director of Delta Coaching, "is this digital currency more of a risk that is difficult to calculate, or is this asset class becoming a stability factor in the portfolio given the uncertainty of currencies?"

That's a challenge that every asset manager has to clarify individually with his client. And all this in addition to Corona and the regulatory requirements," Lehner notes.

Substantial inflows of new money

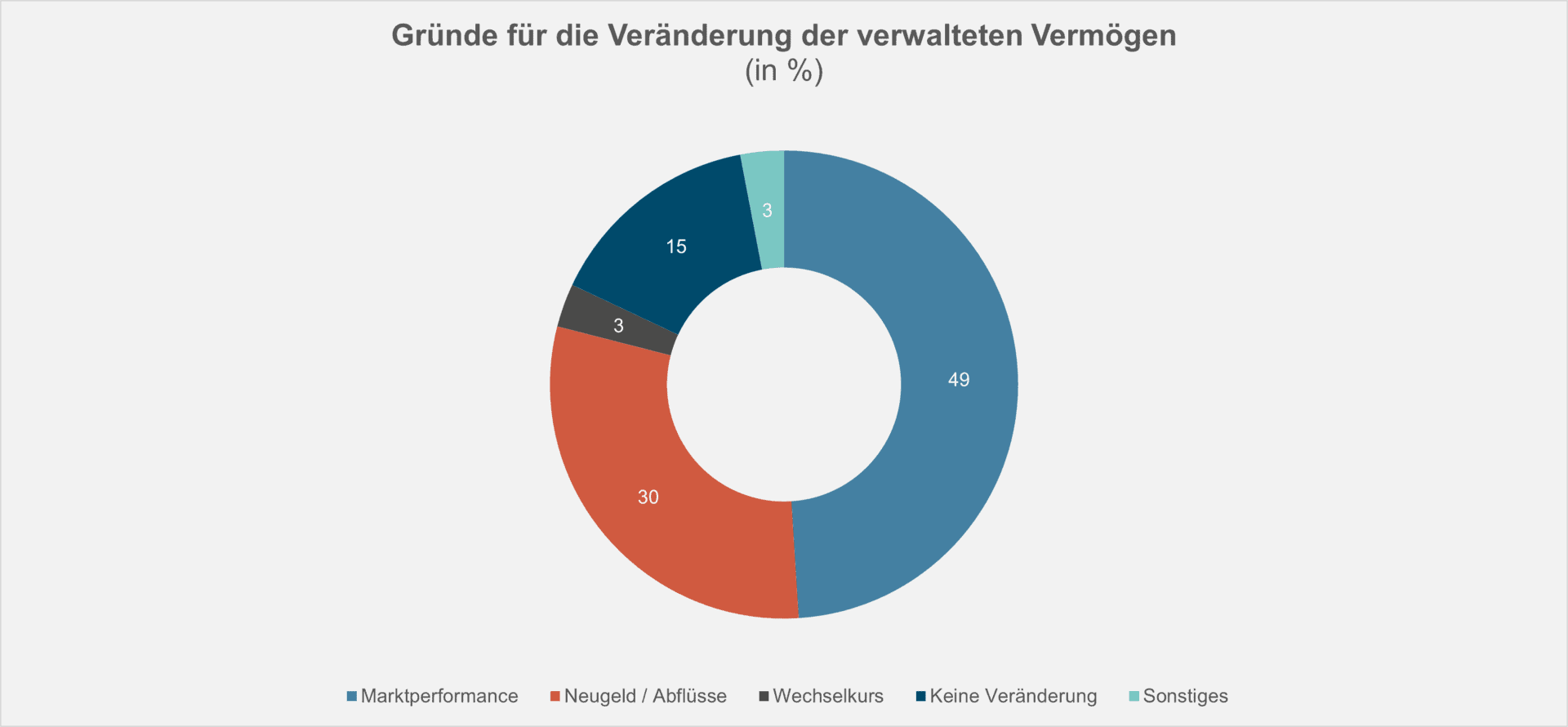

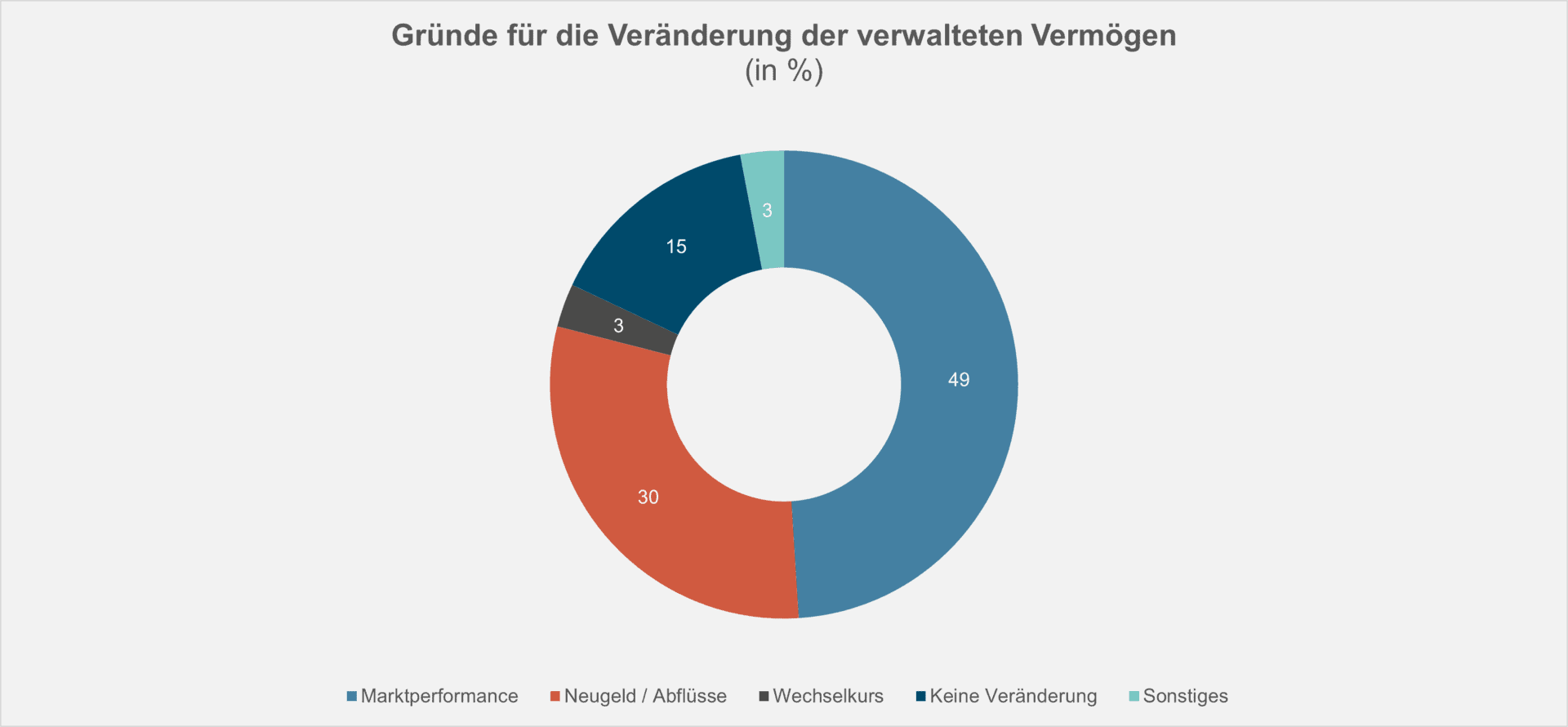

The question of the right asset allocation is important, especially since 63 percent of independent asset managers were able to increase their assets under management in the past six months. Only just 7 percent recorded a decline, while the portfolios of the remaining 30 percent remained stable. The main reason for the increase in value was the continuing good stock markets and, for 30 percent of those surveyed, also substantial inflows of new money (see chart).

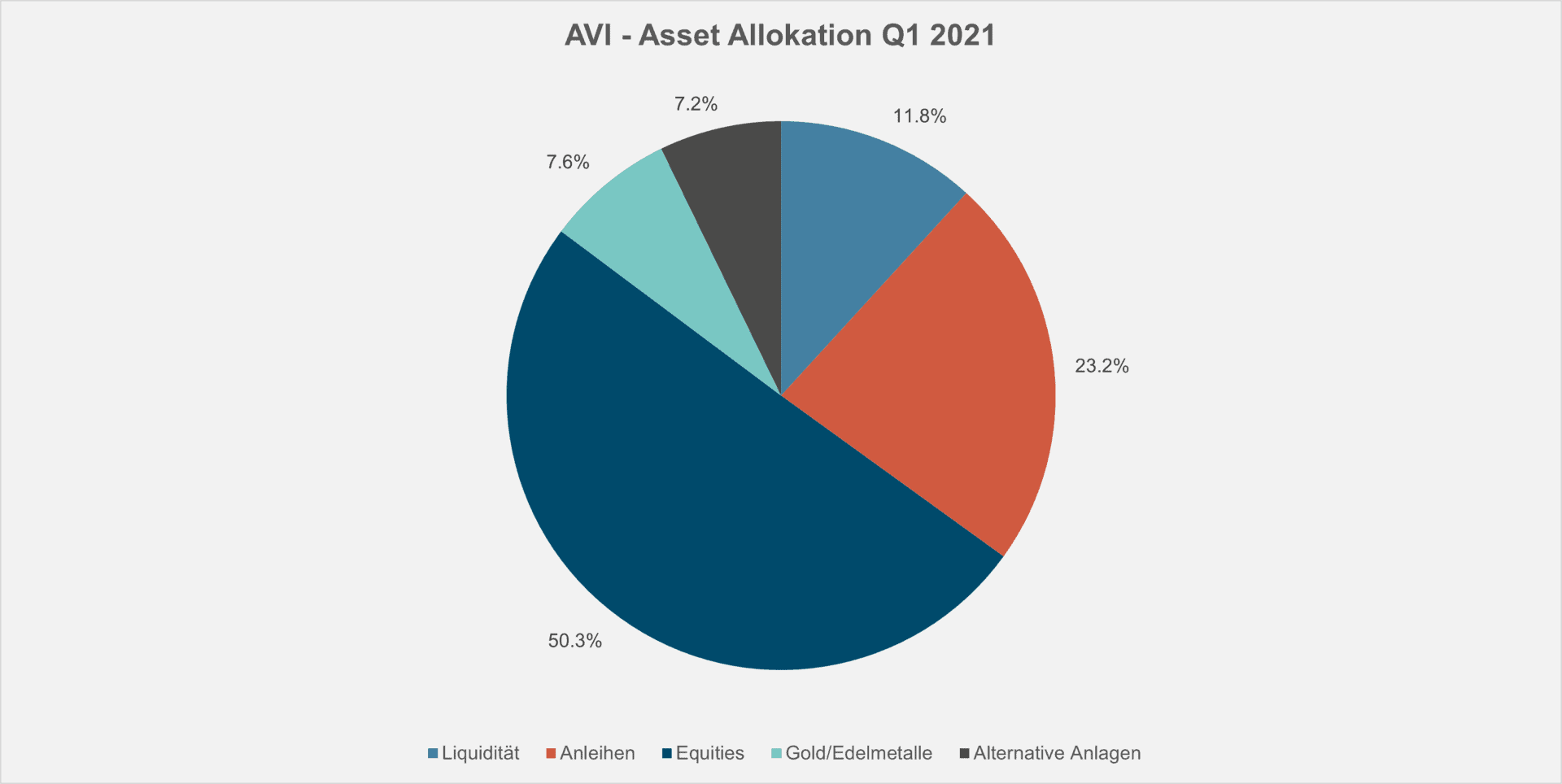

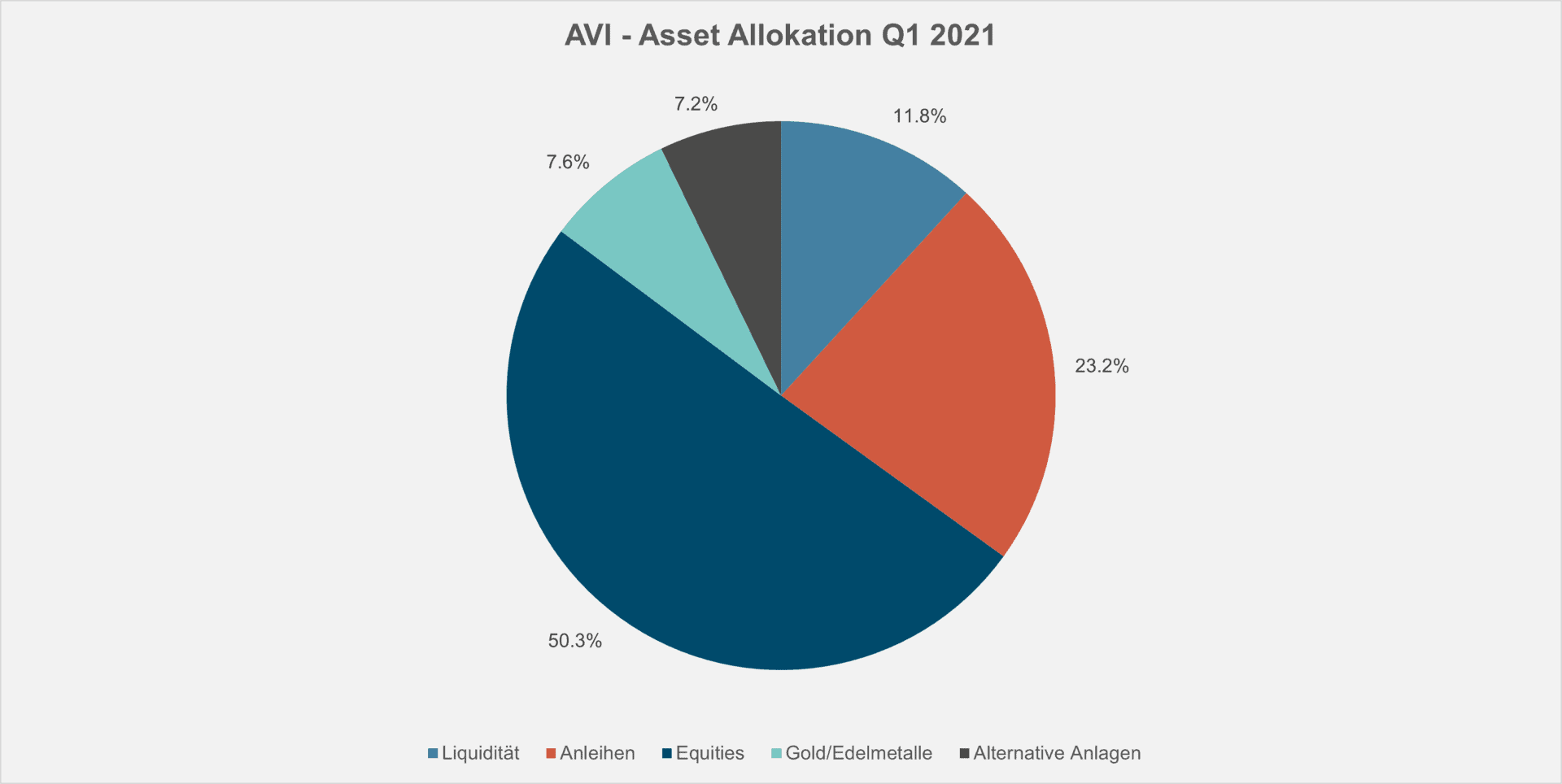

Asset managers are confident that the stock markets will continue to rise over the next twelve months. And under these premises, they are focusing even more on equities. They have now increased this share to 50.3 percent (previous quarter: 45.6 percent). This was at the expense of alternative investments, which now account for 11.8 percent (previous quarter: 14 percent), and bonds, which now account for 23.2 percent (previous quarter: 24.0 percent).

In this context, it is interesting to note that 80 percent of independent asset managers expect value stocks to outperform in the coming months. The big question for the outlook going forward is: Does the recent rise in inflation signify a turnaround in interest rates?

Financial repression scenario expected

"The Federal Reserve (Fed) made a very astonishing remark last year. They would want to accompany rising inflation with zero interest rates for a long time to come. Therefore, we assume that we can expect a scenario of financial repression in the coming years: rising inflation while maintaining the low interest rate policy," says Peter Lippross, Portfolio Manager at Geneve Invest.

"Similar to what you saw in the 1950s after World War II, when the Fed locked in interest rates at 2.5 percent for several years, despite much higher inflation. Back then, too, the U.S. was heavily indebted due to the costs of war," Lippross said.

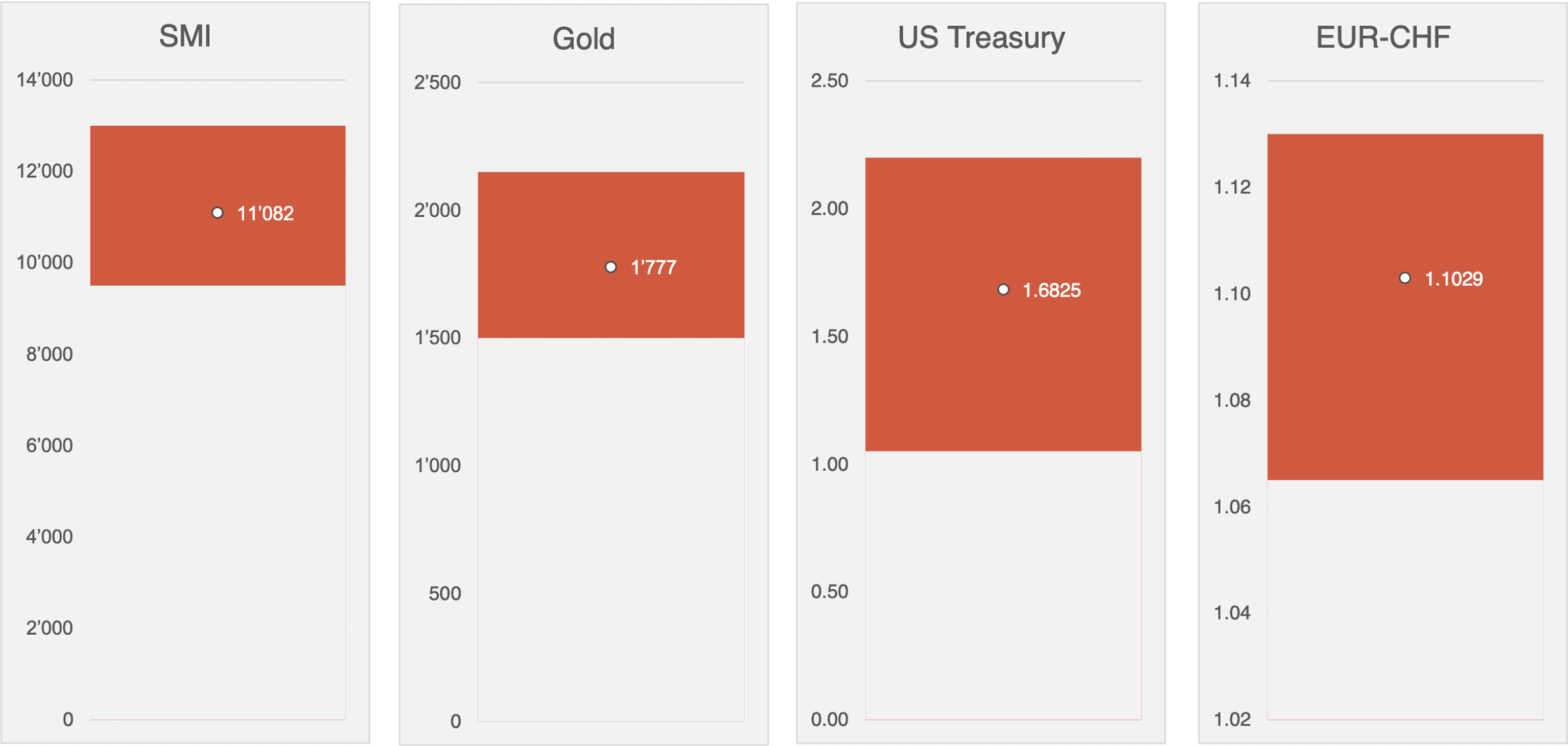

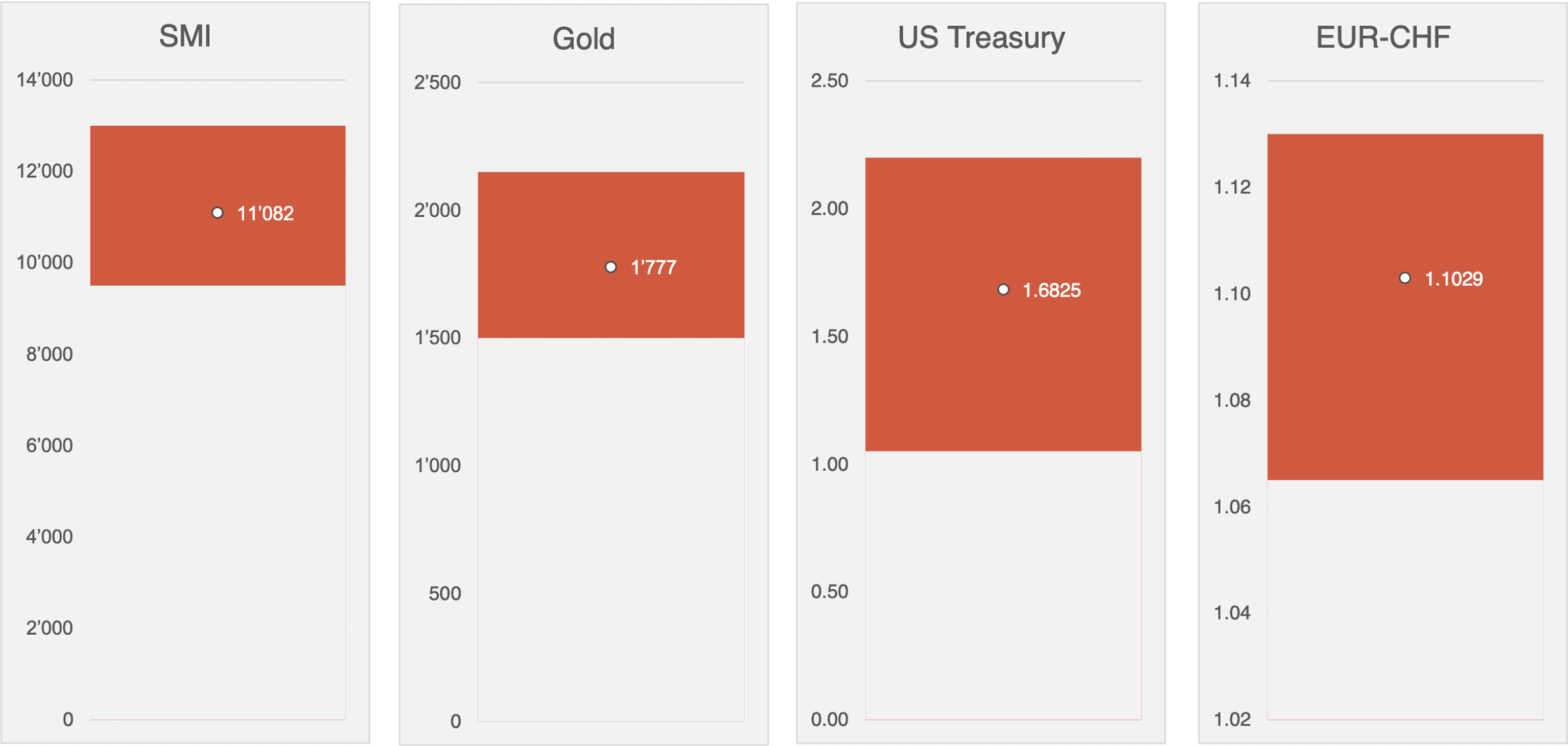

Looking ahead to the middle of the year, survey participants expect the Swiss Market Index to reach a value of 11,082; the price of an ounce of gold to reach 1,777 dollars; the yield on 10-year U.S. government bonds to reach 1.6825 percent; and the euro-franc exchange rate to reach 1.1029.

The next AVI Index will be published in July 2021.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.