A difficult first half-year is over. Practically all asset classes show a negative performance in the sixmonths to end-June. Central banks face tough policy decisions, the effects of which could be troublesome for capital markets.

Review of a challenging first half-year

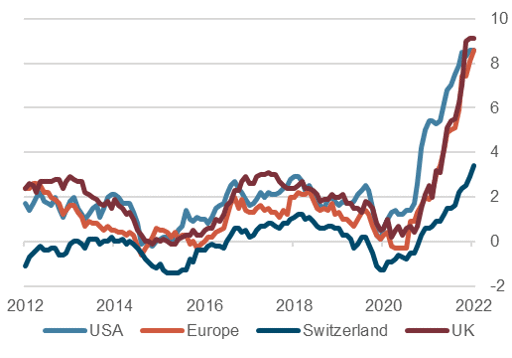

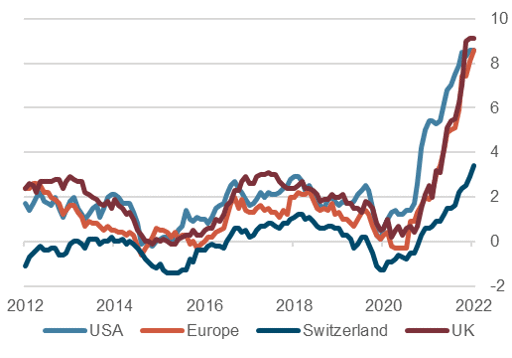

The strong rise in inflation rates and the shift to more restrictive monetary policies have resulted in higher interest rates and falling bond prices. Stock markets also came under pressure, as higher interest rates triggered a downward move in valuation metrics. The broad-based American S&P 500 stock index saw its worst half-year since 1970.

First half performance of financial markets (in %)

Source: Bloomberg Finance L.P.

The war in Ukraine as well as China’s zero-tolerance policy on covid (which has led to large-scale lockdowns and renewed delays in global supply chains) have contributed significantly to the sharp rise in inflation.

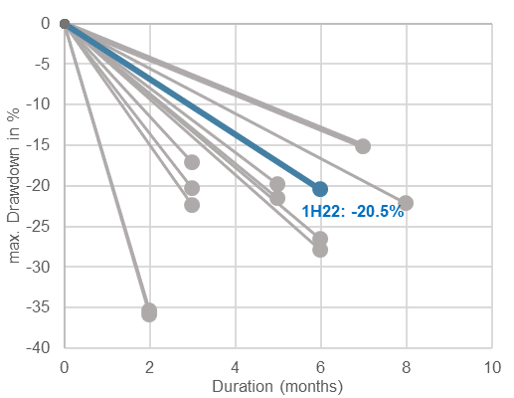

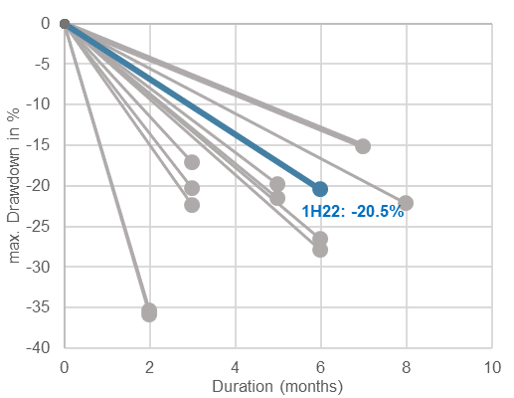

However, it is worth recalling that in the last 80 years we have had eleven stock market corrections in the S&P 500 comparable to that seen in the first half of 2022. What is unique about the current correction is that the turn of the year and the peak in stock markets practically coincided.

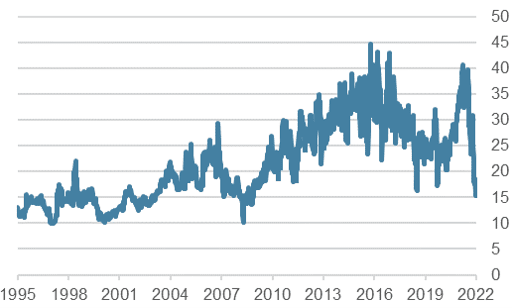

S&P 500: Bear markets since 1940

Source: Bloomberg Finance L.P.

Inflation push

More than two years of pandemic-related closures in important economic areas (for example, the zero covid tolerance policy in China) coupled with other events (such as the blockade of the Suez Canal by the stranded freighter “Ever Given” have led to a sustained shortage of important production inputs and to persistent supply bottlenecks. Limited availability has resulted in rising prices, especially for construction materials.

While Russia’s war against Ukraine is primarily a human tragedy, its impact on the world economy has been a further worsening of supply bottlenecks and an additional surge in inflation. Key products affected are basic foodstuffs (such as grains) and fertilizers as well as fuels, especially natural gas, on which Western Europe is heavily dependent.

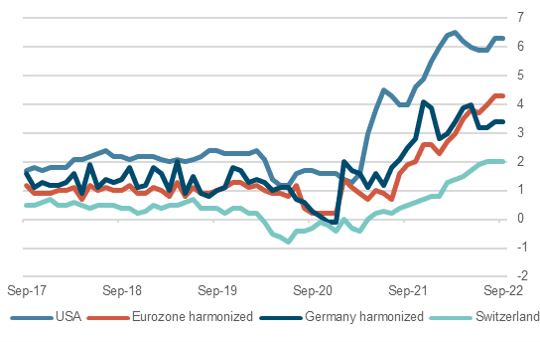

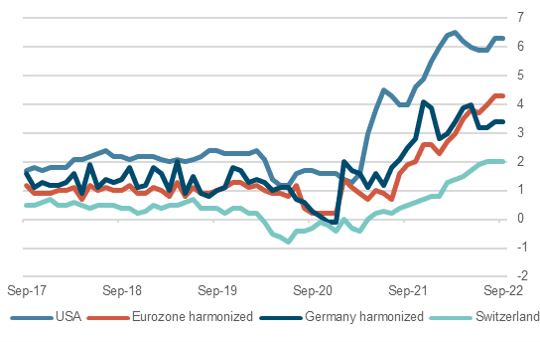

Consumer price inflation, % year on year

Source: Bloomberg Finance L.P.

As a result, inflation rates in many Western industrialized countries have risen to 40-year highs, forcing central banks to take decisive action. And, given still robust levels of economic activity, there is plenty of scope for further interest rate increases, especially in the US. In addition to hiking rates, the Fed is now reducing its balance sheet, which had been massively inflated following the global financial crisis.

Rising interest rates depress bond markets. Meanwhile, growth concerns lead to higher interest rate spreads for bonds with “credit risk”. And in the equity markets, rising interest rates depress valuation multiples. Among so-called alternative investments, interest-sensitives such as real estate, have experienced a significant price correction. Precious metals, calculated in US dollars, recorded slight losses while industrial metals, which are more economically sensitive, came under pressure, in some cases significantly.

Only energy commodities have posted significant price gains in the first half due to the production quotas of “OPEC+” and the Western sanctions on Russia triggered by the attack on Ukraine.

Macro and geopolitical factors are challenging

“The main problem with the future is working out what it will be”. Today, this facetious statement seems even more true than in the past. Not only is the sheer number of economic variables greater, their potential impacts could not be more diverse.

Economy: The economic situation remains robust (i.e. labor market and Purchasing Manager Indices), but the effects of monetary tightening are starting to show up in some softening of demand. Hopes for a gentle economic slowdown (the “soft landing”) can still be justified and the Fed still seems confident it is able to achieve this. That said, there is increasing comment on the possibility of recession, and we think the chances of one are rising. For inflation to be cut significantly, demand must be calmed, and it is difficult to see how this can happen without a recession. Whether or not the economy goes into recession will depend crucially on how aggressive in their monetary tightening central banks turn out to be.

But we don’t expect even a mild recession before 2023. The leading indicators and the (only marginally) inverted US yield curve point to this. Typically, such economic indicators have a lead time of several months. Moreover, currently-full company order books, and the scope central banks have to revert back to easing if needed, suggest any upcoming recession would be slight and short.

Monetary policy: Central banks are increasingly focused on bearing down on high inflation, which is at a 40-year high. Fed Chair, Jerome Powell has stated he will do everything possible to fight inflation. At least one more substantial rate hike (75 basis points or even more) is expected.

While the ECB promised its first interest rate step for mid-July, the SNB forged ahead with an unexpected and bold rate hike of 50 basis points. ECB caution reflected the “fragmentation” between core and peripheral countries within the Eurozone which it hopes to counter with a new facility to buy the bonds of peripheral regions.

Inflation above target levels of 2% is likely to continue for longer, keeping central banks on alert. A favorable base effect for year-on-year comparisons and (from a dollar and franc perspective) a strong currency are helping to depress inflation. Nevertheless, without a noticeable cooling of the economy and a decline in demand, inflation rates around 2% will not be achieved in the foreseeable future. The situation could also be solved by relaxing the supply side.

Since the global financial crisis of 2008/9, central bank balance sheets have grown massively, causing a bubble in almost all asset markets, including for equities. So far, the goal of balance sheet reduction has only been taken up seriously by the Fed and the absorption of Fed bond sales has impacted liquidity, leading to additional selling pressure on equities.

The big unknown is: how much stock market correction will central banks tolerate before switching monetary policy back in the direction of easing?

The Fed’s clear statements as to its intended measures and its ability follow up with action is highly welcome and confidence-building, especially in this phase. Based on these Fed announcements, an increase in key interest rates of 75 basis points is expected in July, followed by fine-tuning with smaller interest rate steps of 25-50 basis points over following months. Regarding the Fed’s balance sheet reduction, it can also be assumed that the roadmap will be followed for the foreseeable future.

Whether other central banks will follow suit and to what extent is uncertain – especially since other central banks cannot, or do not wish to, communicate as clearly as the Fed.

Euro crisis 2.0: The ECB’s timid attitude to rate hikes, despite inflation rates in the Eurozone which are in many countries well above 8%, is directly related to high rates of government indebtedness in the Eurozone periphery and other fundamental problems that have stayed unresolved for a very long time. From this perspective, the ECB’s hesitation is even understandable. Meanwhile, the SNB’s rush to tighten reference interest rates by 50 basis points not only caused uncertainty, it also aggravated the situation for the ECB. As a result, the franc is now trading below parity to the euro for the first time since 2015. On a trade-weighted basis, the euro is battered and near its five-year low.

“Fragmentation” is the basic problem. This cannot be countered with a new financial facility. A currency area with a single monetary policy but different interest rates in member states can hardly be effective. The solution could be uniform euro bonds, against which, however, there is massive resistance, especially from Germany. After all, the credit ratings of Eurozone countries range from BB (Greece) to AAA (Germany).

The collapse of the euro in recent days raises the question of a new euro crisis. It is too early to assume such an outcome. Nevertheless, the problems of the Eurozone’s periphery may indeed develop in this direction. Attempting a solution via a new ECB purchasing facility to combat fragmentation will not fix the problem but may provide time to address it more fundamentally.

The devaluation of the euro does, however, have a positive side effect. A weak currency means that domestic producers become more competitive against those in countries with expensive currencies such as the dollar and the franc. In terms of imported inflation, on the other hand, the effects are clearly negative.

An earnings recession: The reporting season for second quarter corporate results is just getting underway. There are fears that increased labor, energy and other raw material costs will weigh on margins. But the oil and gas sector is expected to show significantly increased margins and thus influence positively the development of broad stock indices. In the other sectors, especially at the level of individual stocks, the outlook is most uncertain.

We assume that not all the second quarter’s “earnings recession” has yet been priced in. The potential for surprises – in both directions – is high, implying that volatility will remain elevated.

The war in Ukraine: On 24 February 2022, Russia launched its offensive against Ukraine. Russia’s hoped-for rapid success in conquering the “separatist areas” of Donetsk and Luhansk failed to materialize. The widespread destruction of Mariupol, for example, demonstrates Ukrainians’ will to fight. Nevertheless, only constant support with armaments from the West has enabled Ukraine to restrain the Russian attack and even to partially reverse it.

While Ukraine wants to reclaim the territories recently conquered by Russia in the east and the Crimea, which was lost in 2014, Russia’s intentions are unclear. The fear is that Russia’s territorial claims will expand.

Geopolitics: In the context of the war against Ukraine and the resulting global shortage in basic foodstuffs, the affordability and supply of such foodstuffs for emerging countries threatens to deteriorate significantly. For millions living in emerging countries, the situation is existential involving the threats of famine and unrest. For developed regions, the problem is limited to a manageable loss of purchasing power due to the inflationary effects of higher food prices on living standards.

Other trouble spots include China/Taiwan, North Korea, the Middle East, Brexit and its impact on political stability in Northern Ireland.

Energy gap: Russia severely curtailed gas deliveries via Nord Stream I in mid-June, exacerbating an already tense supply situation in Germany. A complete, seasonal supply stop is expected for mid-July. Typically, this is related to maintenance work and lasts about two weeks. The resumption of gas deliveries to Europe at the end of July is eagerly awaited but is conditional on the delivery of a turbine covered by the sanctions.

Regardless of what Russia decides over the summer, the energy situation in Europe is set to become critical during the winter months from October when the heating season starts. An “energy gap” cannot be ruled out. Politicians have unequivocally stated they will prioritize households in the event of energy shortages. Thus, industry, which is given a lower priority, is threatened with a substantial “gas gap”. The basic chemicals sector is likely to be most affected and a shortage of basic chemicals can have a sharp impact on the overall economy. A severe shortage would make a recession inevitable.

Corona: The pandemic has now faded into the background in most countries. People are again enjoying freedom of movement and thus supporting consumption. The experience of the last few years suggests that forecasting Corona is impossible. The hope remains that vaccinations and infections could lead to herd immunity. Drastic lockdowns other than in China could then be avoided.

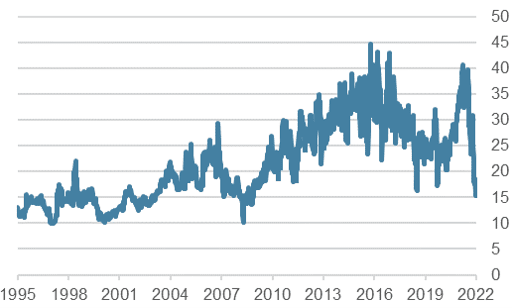

Sentiment indicators: Sentiment on the capital markets is negative as is reflected by “Fear&Greed indicators” which are in the lowest quintile.

But strong, short-term recoveries in stock markets could happen any time.

Credit Suisse Fear Barometer

Source: Bloomberg Finance L.P.

Conclusions: For the second half of the year, only one statement can be made with certainty. Price fluctuations will remain substantial.

The greatest influences on stock markets are likely to be 1. central bank decisions, 2. the course of the war and 3. what happens to profits.

We will gradually reduce our underweight in the bond quota due to the rise in interest rates. The preference within the equity quota continues to be for high-dividend, defensive, large-capitalization companies. Accordingly, we are slightly adjusting the allocation in the respective home market and keeping the overall equity quota neutral. We remain broadly diversified across the various asset classes.

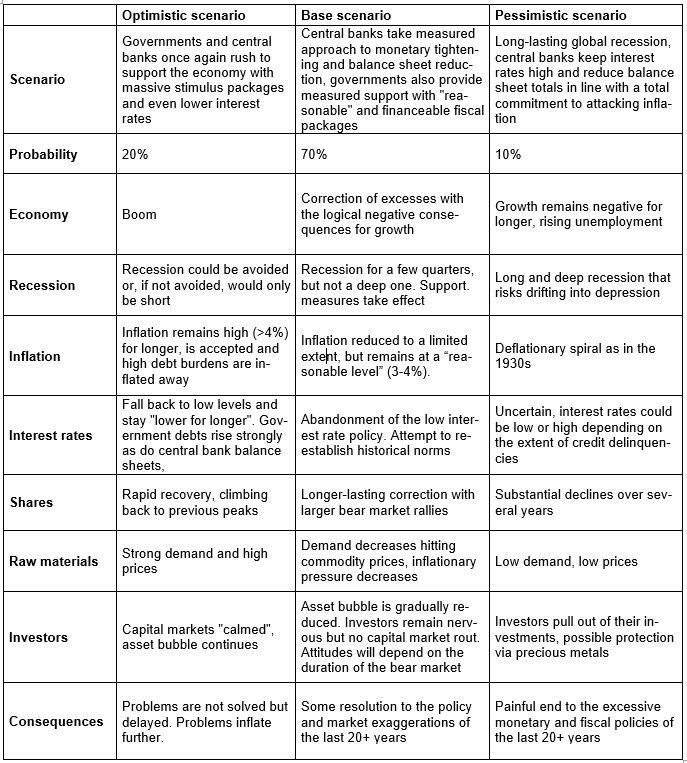

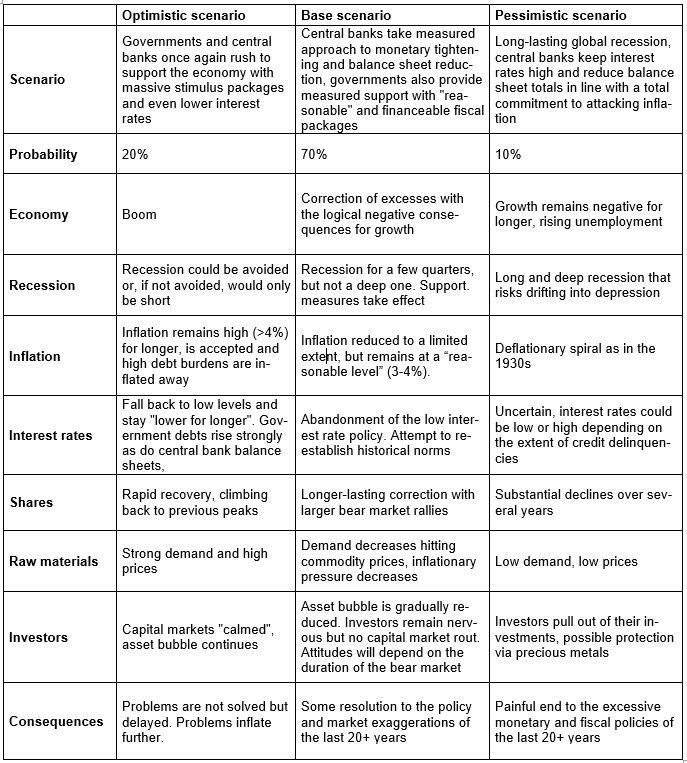

Please see the following scenario overview for our detailed market assessment.

Our scenarios

Contact: Christoph Sieger, Portfolio Manager

Telephone: +41 58 680 60 56

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.