Executive Summary

- We expect the world economy to grow by 2.9% in 2019.

- Our key regional and country growth forecasts are as follows: US: 2.1%, Euroland: 0.8%, Switzerland: 0.9%, China: 5.8%, Japan: 1.0%, UK: 0.9%.

- The economic cycle continues to lose momentum with service sectors now starting to show signs of weakness.

- As had been expected, the Fed and the ECB shifted their monetary policies in the direction of stimulus in September.

- The Fed‘s FOMC is split on whether to cut interest rates further and stresses the role of data dependence in policy-setting. At most, we expect one further rate cut out of the Fed this year.

- Bonds with a face value of some $15 trillion are posting negative yields.

- We remain slightly underweight in equities and expect stock markets to remain volatile.

- Gold tends to rise as real interest rates fall. We remain committed to our gold investments.

Our macroeconomic assessment

Business cycle

- The OECD has joined the ranks of those reducing their growth forecasts. OECD forecasts now put world economic growth at 2.9% for 2019, as against 3.2% at the start of the year. For the coming year, world GDP is expected to grow 3%.

- The European economy has been particularly disappointing. The Eurozone Purchasing Managers’ index for manufacturing fell in September from 47 to 45.6, compared to a predicted rise to 47.3. Meanwhile Germany’s Purchasing Managers’ index for the manufacturing sector, reported at 43.5 in August, fell to the shockingly low level of 41.4 in September when a slight rise to 44 had been predicted. It seems Europe’s services sector is now also on a weakening trend.

- The index for US consumer confidence reported a sharp fall in September, from 135.1 to 125.1. America’s trade conflicts (especially with China) as well as the more uncertain political situation have depressed confidence.

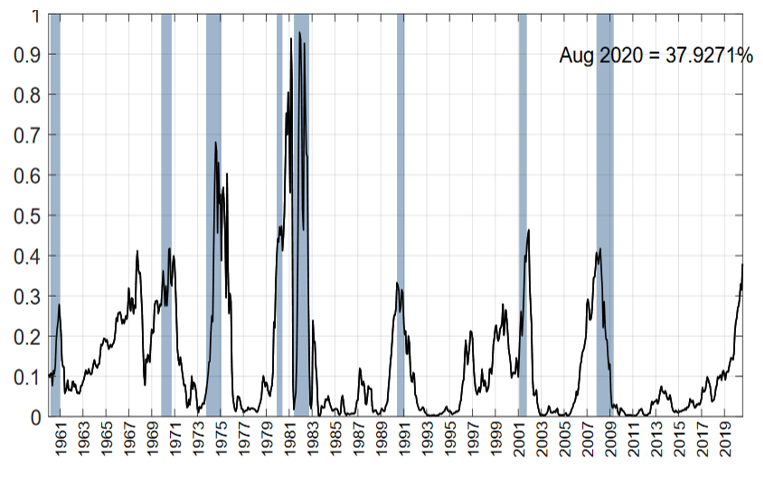

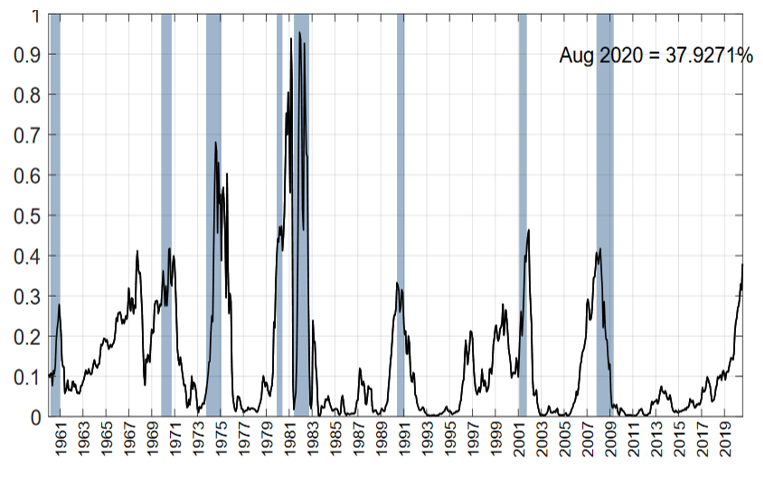

New York FED recession model: likelihood of recession

Source: New York Fed

Monetary policy

- In September, the ECB reduced its key policy rate from -0.4% to -0.5%. Also the ECB‘s bond-buying program will be restarted. As from November, the ECB will be buying bonds at the rate of Euro 20bn. a month.

- At the same time “forward guidance” has become more aggressive. And it is hoped that, with better access to long-term credit, Europe‘s banking system will become more robust.

Today’s very low interest rate policies are resulting in a very unequal distribution of wealth. With very high prices for equities, bonds and property, those who already own these assets, often financed by credit, are doing very well. Meanwhile savers and the poor are disadvantaged.

- Thus, in September the ECB delivered what the markets had been expecting. According to Reuters, economists surveyed prior to the ECB‘s September policy meeting had been expecting an interest rate cut of 10 basis points, renewed bond-buying of the order of Euro 30bn. a month, easier credit facilities for Europe‘s banks and the promise that European interest rates would be kept very low “for longer“.

- As expected, the Fed cut its key policy rate for a second time by 25 basis points at its September meeting. However, the Fed also stated that the hurdles for further interest rate reductions are “high” given the very strong US labor market and that a severe economic downturn is not currently in Fed forecasts.

Our investment policy conclusions

Bonds

- After the sharp decline in bond yields towards the end of the summer, there has been some consolidation in yields at slightly higher levels. It looks as though recession fears – which in August led to such panic-buying of “safety” investments that the yield on the 10-year Treasury fell to 1.5%, with the yield curve partially inverting – have dissipated to some extent.

- With a large portion of Europe’s bond markets now trading on negative yields, there is the obvious question as to who will now buy these bonds given the certainty of loss if they are held to maturity. Are Europe’s bond investors succumbing to hopes that the future will provide “even dumber” investors to whom positions can be sold on at even higher prices? We have a highly unstable situation in Europe’s bond markets.

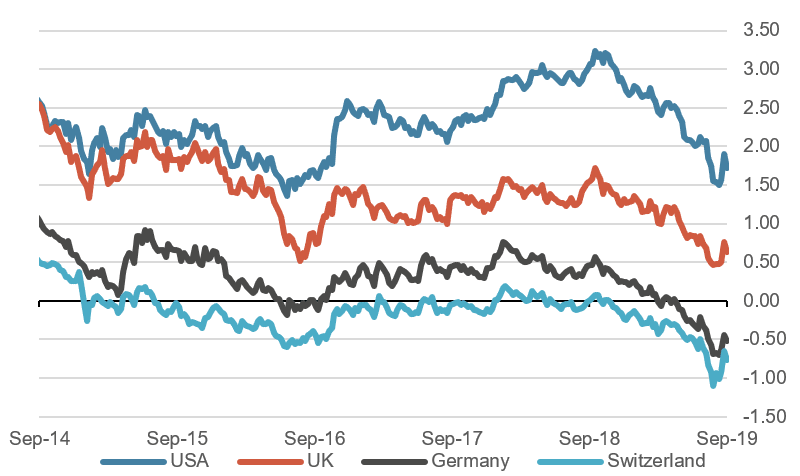

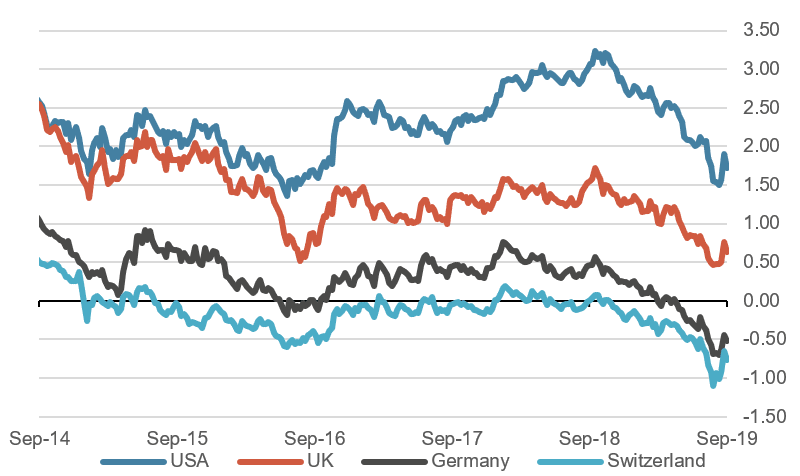

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

- This year’s motto for equity investors seems to be: “ignore the macro data and trust in the central banks”. Thus some major markets have recently been able to drift back up towards all-time highs.

- On an index unit basis, analyst expectations for 2019 earnings for S&P 500 companies are now around $165. If the US economy does not succumb to recession, it is likely that US corporate earnings will accelerate somewhat next year. From a valuation perspective, today’s interest rates might imply a P/E ratio for the S&P 500 between 17 and 19. In turn, this suggests a level for the index between 2800 and 3100.

- Overall, we remain underweight in equities as an asset class. But we will be inclined to view any substantial setback in the markets as a buying opportunity, with a focus on quality companies.

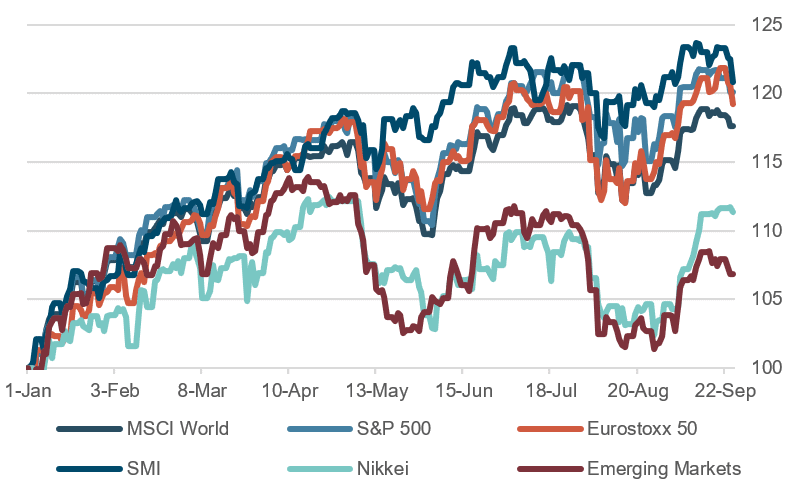

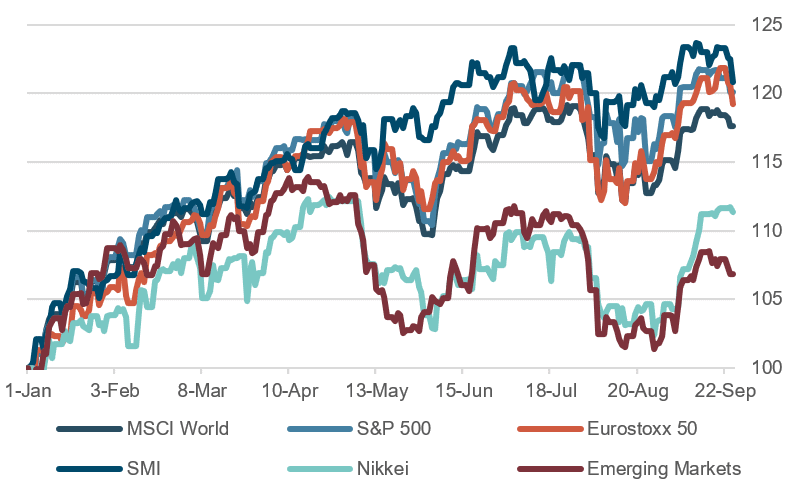

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

- This year’s motto for equity investors seems to be: “ignore the macro data and trust in the central banks”. Thus some major markets have recently been able to drift back up towards all-time highs.

- On an index unit basis, analyst expectations for 2019 earnings for S&P 500 companies are now around $165. If the US economy does not succumb to recession, it is likely that US corporate earnings will accelerate somewhat next year. From a valuation perspective, today’s interest rates might imply a P/E ratio for the S&P 500 between 17 and 19. In turn, this suggests a level for the index between 2800 and 3100.

- Overall, we remain underweight in equities as an asset class. But we will be inclined to view any substantial setback in the markets as a buying opportunity, with a focus on quality companies.

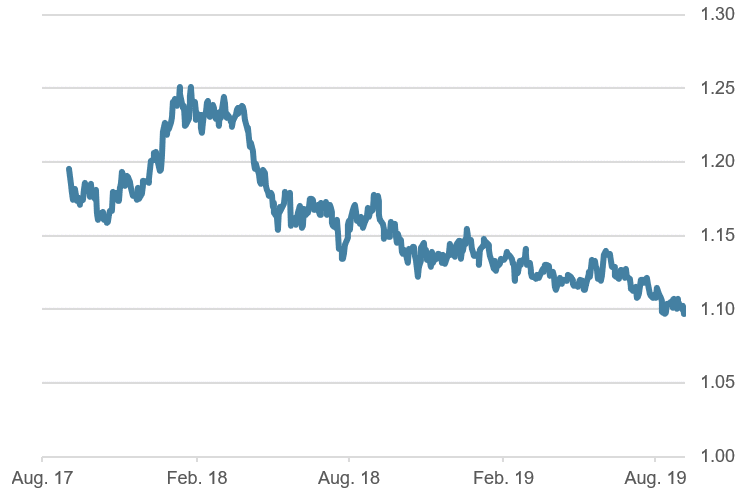

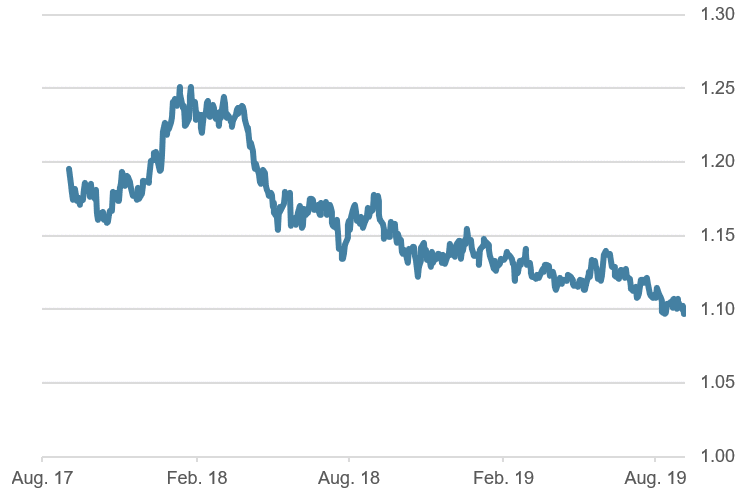

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.