Executive Summary

- We still expect the world economy to grow by 3.5% in 2018. But second quarter US growth may turn out to have been surprisingly strong.

- The Eurozone economy has lost some momentum of late. Europe’s exporting countries have been hurt by recent US skirmishing on trade policy.

- But the near term risk of recession is low.

- Over the medium term the Trump Administration’s pro-cyclical fiscal policy will seriously degrade US government finances.

- We expect two more rate hikes out of the Fed this year

- Equity markets have not moved much in recent weeks. Swiss equities have been clear underperformers.

- For the time being we retain a slight underweight position in equities, awaiting better opportunities to rebuild positions.

- The US dollar has been strengthening, supported by interest rate differentials and capital inflows.

Our macroeconomic assessment

Business cycle

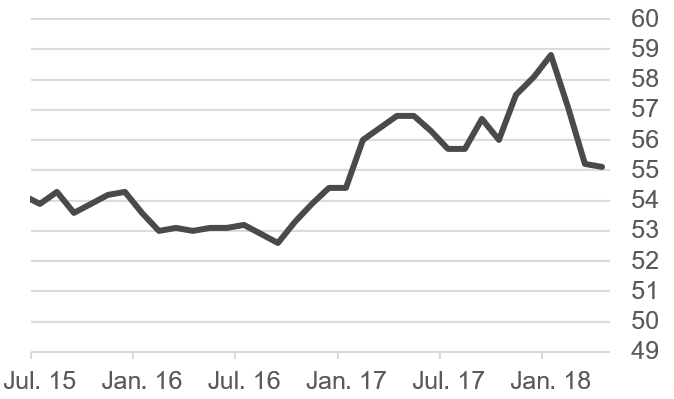

- The world economy has lost some momentum of late but we are broadly retaining our 2018 forecasts as follows – World (3.5%), US (2.3%), Euroland (2.0%, previously 2.1%), Switzerland (2.0%), China (6.5%) and Japan (1.2%).

- Slightly lower growth implies a somewhat weaker performance for corporate earnings. The big exporting countries – Japan, China and Germany – are particularly vulnerable to Trump Administration aggression on trade policy.

- Over the next one to two years we expect economic growth to slow, but the risks of recession a little further out (within the next few years) have risen markedly.

- Should, against expectations, the Trump Administration initiate a serious trade war, growth rates are likely to fall sharply

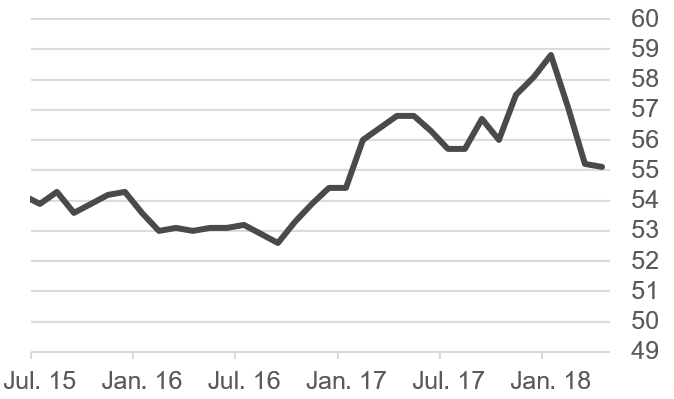

Euroland Purchasing Managers index since 2015

Source: Bloomberg

Monetary policy

- The Fed says that its previously formulated target for inflation has now been reached. But it insists that, following years of very low inflation, it might allow US inflation to remain above target for some time. This symmetry – implying that the Fed’s inflation target is an average covering quite long periods – has implications for Fed policy making in the future.

- We now expect two further rate rises from the Fed this year.

- For the foreseeable future the BoJ will remain the most “dovish” of the G5 central banks.

- The ECB has now stated that the first cyclical rise in Eurozone interest rates will not happen before the summer of 2019. The ECB’s monthly bond purchase program will be reduced to EUR15bn. from October and the program will be concluded at the end of this year.

- The SNB will only raise Swiss interest rates once the ECB has started to move Eurozone rates. The risks now associated with Italy are once again revealing the Swiss franc’s “safe haven” status.

- The BoE should raise interest rates again within the next three months.

Our investment policy conclusions

Bonds

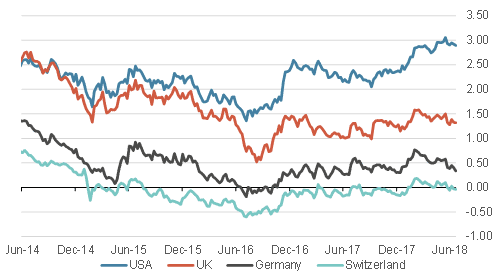

- Yields on 10 year US Treasuries are hovering around the 3% mark.

- Investor anxieties concerning Italy have caused yields to fall once more in the US and in core European bond markets. This is the “safe haven” trade.

- With longer-dated bond yields falling in the US, the US yield curve has become flatter. But we don’t believe this yield curve flattening is signaling a recession in the near future. The current strength of the US economy indicates continuing growth near term.

- The yield on 10 year German Bunds is currently 0.4%, having fallen 25 basis points since the middle of May. This level is consistent with the views that (i) the ECB is unlikely to change policy in the near-term given events in Italy and (ii) the ECB will not make its first interest rate move until next year.

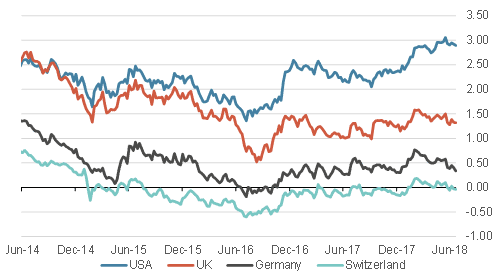

10 year government bond yields since 2014, %

Source: Bloomberg

Equities

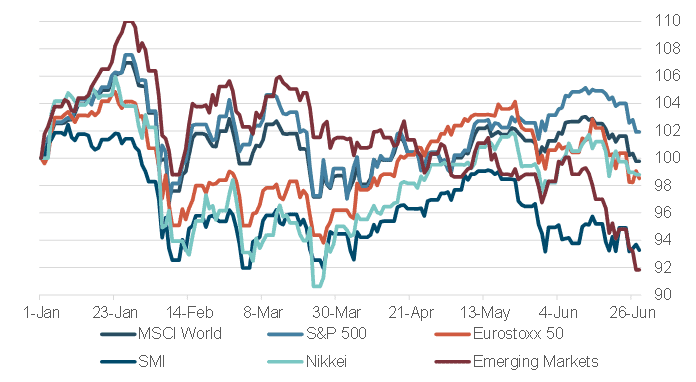

- US equities, especially small caps, have fared best during the recent correction triggered by events in Italy. For the time being, Wall Street seems to ignore Trumpian trade protectionism. Europe, on the other hand, has seen its auto company equities come under significant pressure.

- The SMI has underperformed substantially of late, a reflection in particular of the stock market performance of the three index heavyweights. Roche, Novartis and Nestle have all fallen between 7% and 10% year to date.

- It is the performance of the US IT sector that sticks out. Large IT firms are using their huge cash piles to buy back stock. They are thus boosting the Nasdaq index, where most of them are represented. We note that 40% of the broader S&P 500 index now consists of IT and financial companies. Many now see parallels between today‘s situation and the Tech bubble in 1999/2000. They fear the stock market, and tech stocks in particular, will soon collapse.

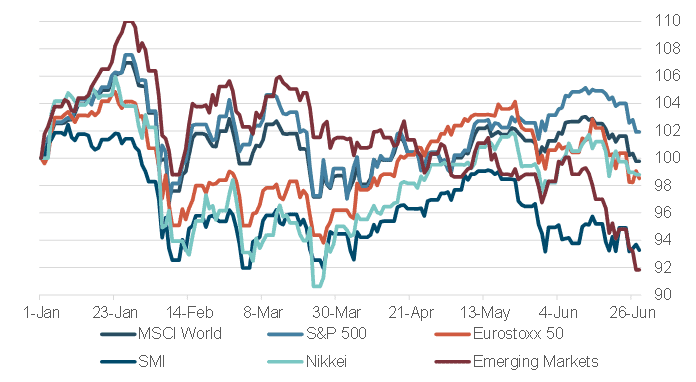

Equitiy markets, perfomance year do date

Source: Bloomberg

Forex

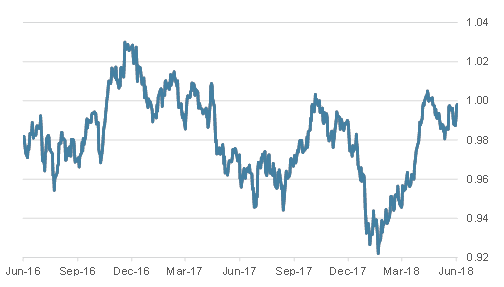

- Since the start of President Trump’s announcements on tariffs aimed at China the yuan has weakened about 3% against the US dollar. It’s not far-fetched to suggest that Beijing has chosen to retaliate against the US in this unobtrusive way. After all, a stronger dollar is not in the interest of the US.

- With a depreciating yuan in the background the dollar has moved well off the floor against most currencies and is once more trading around parity against the Swiss franc. Furthermore, rising US interest rates, combined with somewhat weaker economic data out of Europe, have boosted capital inflows into the US currency. But over the medium to long term America’s twin deficits and its increasing indebtedness will probably weigh negatively on the dollar.

- The political crisis in Italy has provided a classic example as to how quickly a “shine” can come off the euro. Within just a few days the euro fell from 1.20 against the Swiss franc to 1.14. Currently this currency pair trades around 1.16.

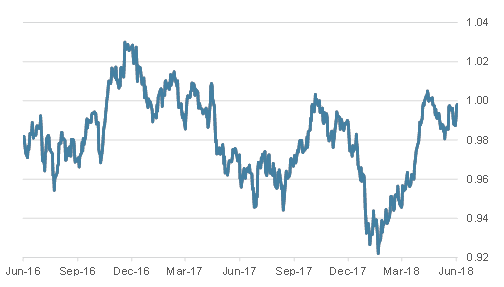

EUR/USD, last two years

Source: Bloomberg

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.