Cautious signs of economic improvement. Brexit is further delayed.

In the US and China there are signs that the slowdown in growth may be over. But economic data out of Europe remain disappointing. The Brexit process has been further delayed.

Equities markets soar in early 2019

For investors the first quarter of this year has been stellar. The MSCI World equity index rose nearly 12%. In Europe, the Swiss SMI (+12.4%) could almost keep pace with US stocks (+13.5%), but other European markets did less well. Chinese A shares rose a remarkable 24%. The general rebound reflected a change in sentiment and hopes of an end to US-China trade hostilities rather than better trends in the fundamental data. Critically, the Fed announced a remarkable change of course which has produced a reduction in risk premiums.

Interest rates fall worldwide

Yields on 10-year US government and German Federal bonds fell during the quarter by 27 and 31 basis points respectively. Meanwhile, yields on Swiss 10-year Confederate bonds fell almost 50 basis points. Thus, fixed income also posted strong gains during the first quarter.

The bull market in bonds was driven by the shift in central bank policies as well as rather weak economic trends. In this context, we note that inflation expectations have been rather stable so the fall in nominal bond yields was reflected almost one-to-one in real bond yields.

Signs of some economic stabilization

The equity markets seem to have already priced in an economic recovery, whereas the performance of bond markets arguably implies further economic weakness.

Better numbers out of the US…

In the US, the Purchasing Managers’ index (PMI) for the manufacturing sector rose from 54.2 to 55.3 in March (compared to an expected 54.5). The new orders component was particularly strong at 57.4. Although neighboring Canada’s Manufacturing PMI disappointed at 50.5, compared with 52.6 in February, we nevertheless believe the US growth pause is over, at least for the near-term.

… and China

As with the US, the March reading for China’s Manufacturing PMI was stronger than forecast – 50.8 compared with the expected 49.9, which was also the reported figure for February.

Europe continues to disappoint

Economic data for Europe have been rather disappointing. The Eurozone Manufacturing PMI fell to 47.5 in March, a sharp drop on February’s 49.3. This was the eight consecutive monthly decline and the lowest reading since April 2013.

Although the latest IFO reading – a rise to 99.6 from 98.7 – does suggest some improvement, we believe Europe’s manufacturing sector will continue to face a difficult environment.

Switzerland – not immune from global trends

The Swiss economy cannot escape global economic weakness. And the latest PMI reading, at just 50.3, was the weakest since December 2015 and compares with forecasts ranging from 53 to 54.2. Indeed, the March decline was the steepest since November 2008 and it brings the Swiss PMI back almost to the 50 threshold which separates expansion from contraction. Swiss industry’s mini-boom seems to be over.

Mrs. May’s Brexit deal fails for a third time

Mrs. May’s EU deal failed for the third time in the House of Commons and the margin of failure – 344 to 286 – was still large. Thus far, Britain’s MPs have not managed to secure a majority for any alternative EU arrangement.

Brexit – like the Hornberger Cannonade?

The story of the Hornberger Cannonade (Das Hornberger Schießen) relates to a botched welcome for Duke Christoph von Württemberg made by the town of Hornberg in 1564.

The burghers, mindful of the honor conferred by such a visit, decided on an impressive cannon salute. On the day itself, watchmen in the castle tower saw a great cloud of smoke in the distance and the order was given for a massive discharge of powder. But as the cloud drew nearer it became clear that what had been seen was nothing more than massive amounts of dust disturbed by a cowhand herding his animals. When the Duke finally arrived, all gun powder had been spent and Hornberg’s citizens, by way of improvising a welcoming noise, could do none other than repeatedly shout at him. At first, the Duke was offended but soon felt welcome once the situation had been explained to him. The Hornberger Schießen, as referenced by among others Friedrich Schiller and Thomas Mann, is thus a metaphor for something heralded with great fanfare but which fails to produce anything of substance.

(Source: Wikipedia https://de.wikipedia.org/wiki/Hornberger_Schie%C3%9Fen)

So far, this seems to be the story of Brexit. Today, Hornberg re-enacts a version of the Hornberger Schießen on its open-air stage during summertime. Right now, some believe that Brexit might in the end provide no more than the story line for British theatrical comedies in the future.

A hard Brexit still seems rather unlikely

We stick with our view that a soft Brexit, no Brexit or a new Peoples’ Vote are all more likely than a hard Brexit accompanied by much aggressive posturing. The longer Brexit is delayed the less damaging even a hard version of it is likely to be because the delay itself will have already caused much of the eventual damage – in terms of investment being curtailed, staff being relocated away from London to other European cities etc. The continued stability of the pound despite the at-times farcical turn of events in Westminster suggests to us that markets see a parallel between the Brexit process and the Hornberger Schießen.

We see a good chance that markets continue to push higher but current high share prices point to greater-than-normal risk.

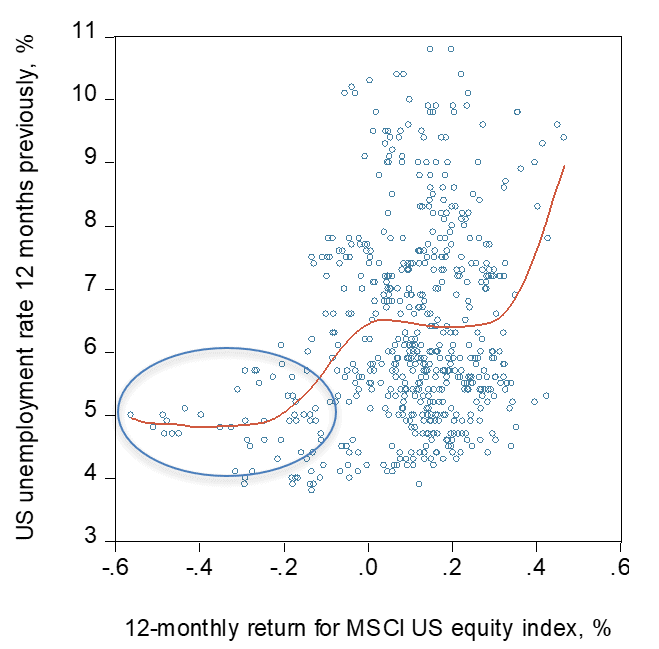

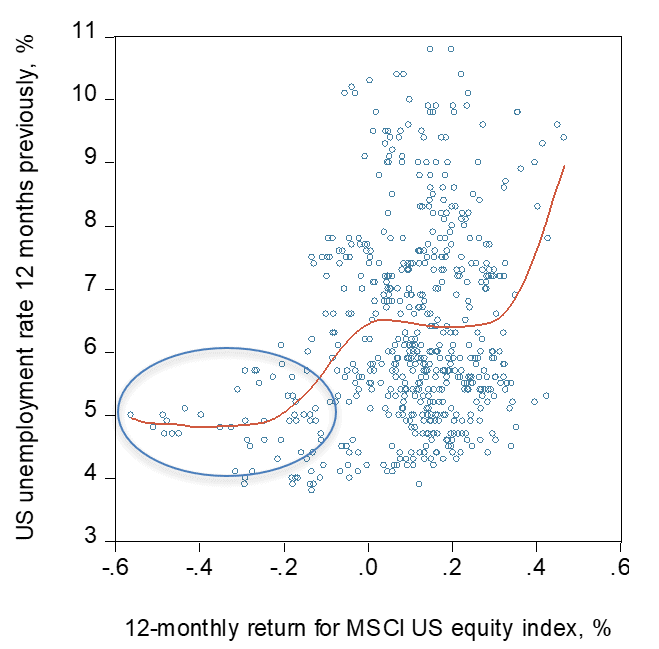

Many equity indices are either close to historic highs or are setting new records. We view further equity gains as quite likely, especially if the upcoming earnings season surprises positively. On the other hand, downside risk is well above average. The current economic upswing is now in its late stages and bond and currency markets are a good deal less euphoric than the equity markets. The above-average risk in today’s equity markets is well illustrated by the graph below where data points plot the 12-monthly return for the MSCI US equity index (X axis) against the unemployment rate 12 months previously (Y axis). With US unemployment just 3.8%, the risks of a major correction are high.

Record unemployment lows have heralded all major declines in US stocks since 1970

Source: Thomson Reuters / Datastream

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.