Executive Summary

- We expect the world economy to grow around 4.5% in 2021.

- But the second wave of the pandemic and associated lockdown measures will slow down economic growth in the northern hemisphere in coming months.

- The distribution of numerous vaccines has begun. The pandemic should be over by mid-2021. Until then, we expect discussions of further fiscal rescue packages in most regions.

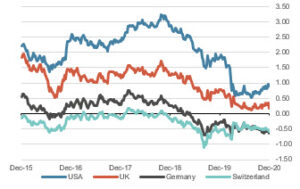

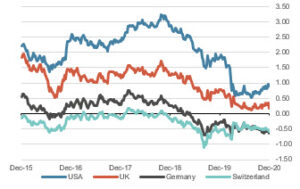

- Yields on many government bonds have continued to show little movement. Meanwhile, some $18 trillion worth of bonds are now trading on a negative yield.

- We expect a significant recovery in corporate earnings in 2021. But share prices already seem to anticipate a lot of positive news.

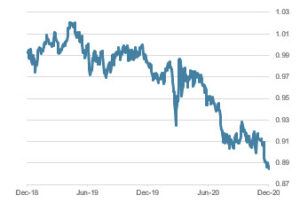

- The US dollar is likely to remain under pressure. The Fed will maintain its loose monetary policy.

Our macroeconomic assessment

Business cycle

- We expect global economic growth of +4.5% in 2021. Other growth forecasts for 2021 are as follows – USA: +4%, EU: +5.0%, Japan: +2.5%, China: 8%, UK: +5.5%, Switzerland +3%.

- In the US, the process of formal handover to the Biden Administration has begun. Meanwhile, further progress has been made on the vaccine front. The first regular vaccinations, not related to testing, have already taken place.

- In contrast to Europe and the US, the pandemic in China and Asia has been largely under control for months. As a result, the gap in economic growth rates between emerging market and western industrial countries has widened.

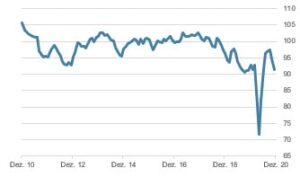

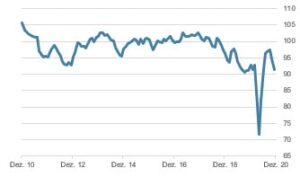

- The Ifo business climate index indicates the upswing in Germany has stalled. But in recent months purchasing managers’ indices for the US have managed to stay at high levels.

Germany: Ifo Business Climate Index, last 10 years

Source: Bloomberg Finance L.P.

Monetary policy

- In 2020, the monetary floodgates have been opened more quickly and more aggressively than ever before. Practically all central banks have clearly exceeded their policy mandates, implementing easing measures that regulatory considerations made unthinkable just a few years ago. For example, the Fed has acted like a normal commercial bank in providing companies with short term financing.

- In order to forestall an impending wave of insolvencies, all major central banks have started to buy the bonds of companies with poor credit ratings. Since most major central banks now have interest rates at or below zero, traditional easing through further interest rate cuts is no longer possible (unless cash is abolished). Central banks will therefore have to maintain their unconventional ways of delivering ultra-loose monetary policy in 2021.

- The European Central Bank (ECB) announced in December that it would increase its balance sheet expansion program by 500 billion euros (or by about 35%). Originally, some within the ECB were even calling for a 750 billion-euro expansion. The ECB has also increased its “Targeted Longer-Term Refinancing Operations” program. Commercial banks can now borrow up to 55% of their outstanding loans from the ECB under special conditions.

Our investment policy conclusions

Bonds

- Yields on government bonds in the most important markets are under control from the central banks’ point of view. The market’s pricing mechanism has been eliminated and thus there is no risk that reckless borrowers will get “punished” via rising yields. Worldwide, bonds with a total nominal value around 18 trillion US dollars are now trading on negative yields.

- The dimensions of the various central bank purchase programs, and of state refinancing needs that result from massive fiscal stimulus, make this essential.

- This trend is leading to “creeping death” for the bond markets: central banks under the clear leadership of Japan now hold between 35% and 90% of outstanding government bonds. And the first tendencies towards market domination by the state can also be seen in the area of corporate bonds.

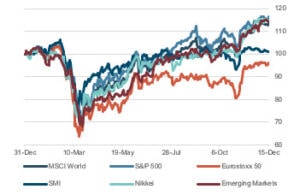

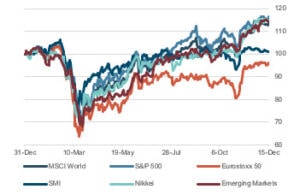

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Equities

- Positive developments regarding Corona vaccines have triggered a very buoyant mood in stock markets over the last few weeks. Widespread optimism is expressed in sentiment indicators, some of which are close to extreme readings. For example, bull-bear indicators, call-put ratios and the CNN Fear & Greed index are back at February levels.

- A whole series of IPOs (e.g., AirBnB, Doordash, etc.) from companies that are far from generating profits have found their way to the market in its present euphoric state. In some cases, these new stock offerings have initially traded at over 100% above the issue price. This phenomenon brings back memories of the winter of 1999/2000 – shortly before the bursting of the “tech bubble”.

- We view short-term setbacks in the stock markets as an opportunity for additional purchases. In the medium term, the attractiveness of equities as real assets remains a significant support.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

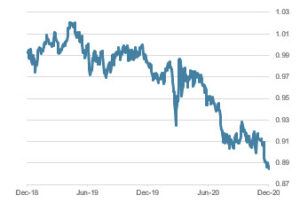

- The US dollar has come under increasing pressure in recent days and is trading at multi-year lows. Expectations not only of a US aid package in the near term but also of subsequent packages to support the economy are the reason for this. In this respect, the US dollar – much like the US bond market – is not giving the same optimistic message as the US stock market.

- This starting position is again putting pressure on the other central banks to try to weaken their appreciating currencies. Paradoxically, last week’s ECB meeting and the gigantic measures announced (the increase in QE, the expansion of TLTRO) were interpreted by the foreign exchange market as indicating ECB weakness, in the sense that “the ECB is at the end of its tether”.

- The Chinese central bank is, behind the scenes, effectively and calmly counteracting the appreciation of the yuan through

EUR/USD, last 2 years

Source: Bloomberg Finance L.P.

Disclaimer: Imprint: Investment Center Aquila AG. The information and opinions contained in this document are based on sources that we believe to be reliable. However, we cannot guarantee the reliability, completeness or accuracy of these sources. These information and views do not constitute a solicitation or offer, or recommendation, to buy or sell any investment instruments or to engage in any other transactions. Interested investors are strongly advised to consult their personal investment advisor before making any decisions based on this document so that personal investment objectives, financial situation, individual needs and risk profile as well as other information can be duly taken into account as part of a comprehensive consultation.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.