Executive Summary

- We forecast the world economy will grow 2.9% this year and by slightly less – 2.8% – in 2020.

- Our regional and country growth forecasts for 2020 and (in brackets) 2019 are as follows: US: 2.2% (2.3%), Euroland: 1.2%, (1.3%), Switzerland: 1.7% (0.9%), China: 5.8% (5.9%), Japan: 1.0% (1.2%), UK: 1.0% (0.8%).

- Over the course of next year, we expect that world economic growth will gradually stabilize.

- The ECB and the Fed will continue their processes of balance sheet expansion. In case of weak growth we would expect the Fed to react with further rate cuts.

- We remain slightly underweight in equities. Various technical indicators suggest that markets are “overbought” on a short-term perspective.

- Gold tends to do well when perceptions of geo-political risk rise and when real interest rates fall.

- Gold tends to rise as real interest rates fall. We remain committed to our gold investments.

Our macroeconomic assessment

Business cycle

- We expect that the world economy will stabilize in 2020, not least on account of widespread monetary stimulus, but also the growing prospect for fiscal stimulus in Europe and in certain developing countries. Moreover, it seems the already announced Phase 1 agreement in trade negotiations between China and the US will be signed and partially implemented in January. This should support international trade and, therefore, the broader growth process.

- Phase 1 of a US-China trade agreement, designed to put the bilateral trading relation on a friendlier footing, has been negotiated and is ready for signature in January. The US will not introduce fresh tariffs and will remove some existing ones while China has committed itself to purchase $50bn worth of US agricultural products. While we expect this Phase 1 deal will get implemented, this is not yet a total certainty.

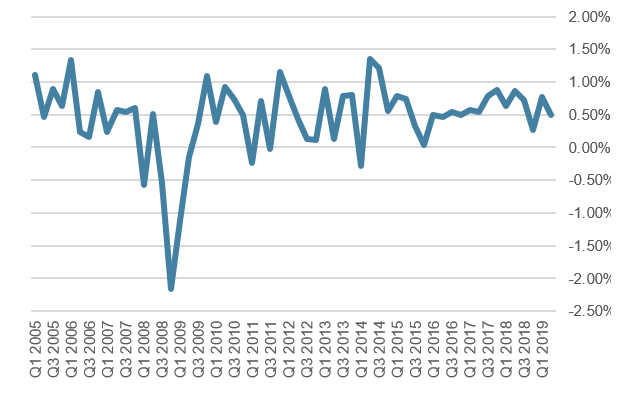

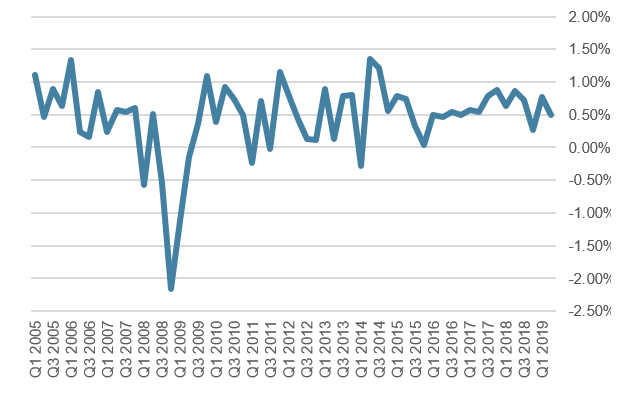

US real GDP, % growth, quarter on quarter

Source: Reuters / Datastream

Monetary policy

- FOMC member rate projections indicate no rise in rates in 2020 but one rise in both 2021 and 2022.

- The statement issued following December’s FOMC meeting removed the word “uncertainty” and indicated that (currently very limited) inflationary pressure is being closely monitored.

The Fed still views the long-term neutral interest rate as 2.5%. We are not as optimistic as the FOMC and see further rate cuts as a possibility.

- Given ongoing balance sheet expansion, at least in the early part of next year, the Fed policy stance can still be viewed as very expansionary.

- ECB President Mme. Lagarde has now had seven weeks in her new job but has not yet produced any surprise in her statements on monetary policy.

- There are tentative signs that the European economy is stabilizing and that investors view the still-high downside risks (geo-politics, protectionism) as having lessened somewhat. For now we share this view and as a result think further rate cuts from the ECB are unlikely in 2020. But we expect the ECB’s bond purchase program to continue at its current rate of 20bn. euros a month.

Our investment policy conclusions

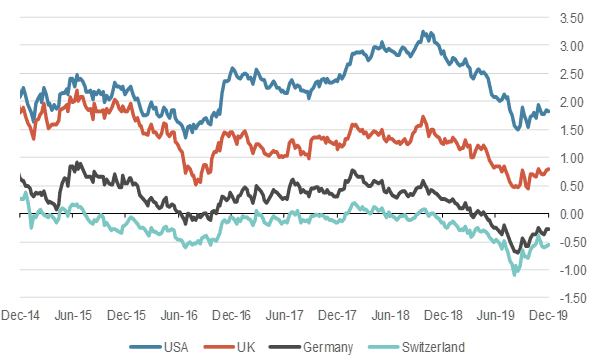

Bonds

- The now steeper yield curves are an expression that some optimism has returned regarding the outlook for the world economy. In particular, more investors seem to have come round to the view that this year’s slowdown in US growth was probably only temporary and that a reacceleration is in prospect. This view is supported by the recently announced agreement on a Phase 1 deal in US-China trade negotiations.

- But continued evidence of extreme liquidity shortfalls in America’s shadow banking system is concerning. This shows up in the strong commercial bank demand for borrowed funds from the Fed. Thus, by the end of the year the Fed will have had to provide an additional $500bn to America’s financial system, more than offsetting efforts to reduce the size of its balance sheet.

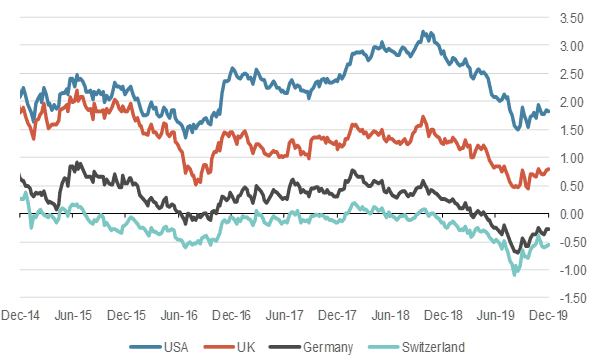

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

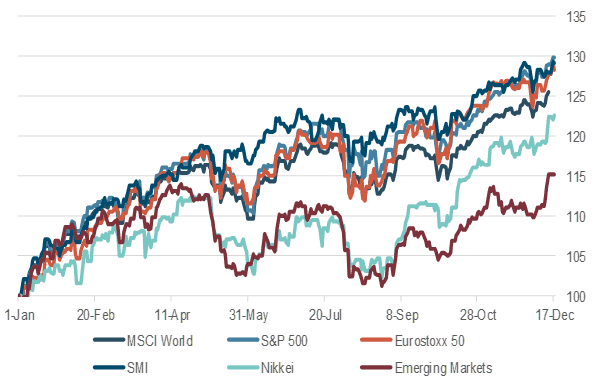

Equities

- All along, the equity markets have been fairly convinced that some sort of trade deal would be put together. So the announcement on a Phase 1 deal in US-China trade negotiations was broadly discounted by the markets. Even so, it is amazing how markets seem to dance to the tune set by the media, including the many digital, social platforms. It’s legitimate to consider who are the beneficiaries of this trend.

- We do not expect to change our strategic assessment of equities in the coming year, as the absence of attractive alternative asset classes looks set to continue. However, we are tactically cautious because valuations are high and sentiment and other technical metrics indicate elevated risk in stock markets. Markets are always vulnerable to setbacks and now, just after the announcement of a trade agreement between China and the US, could be a classic “sell the good news” opportunity.

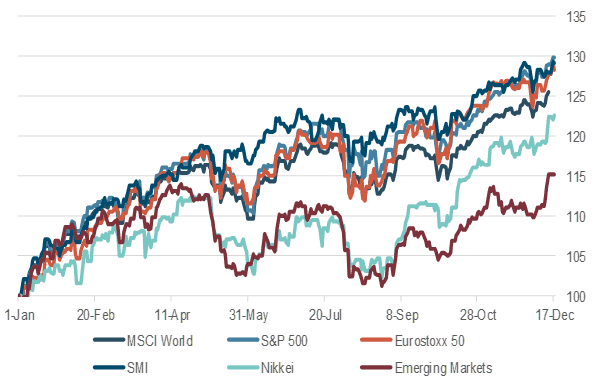

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

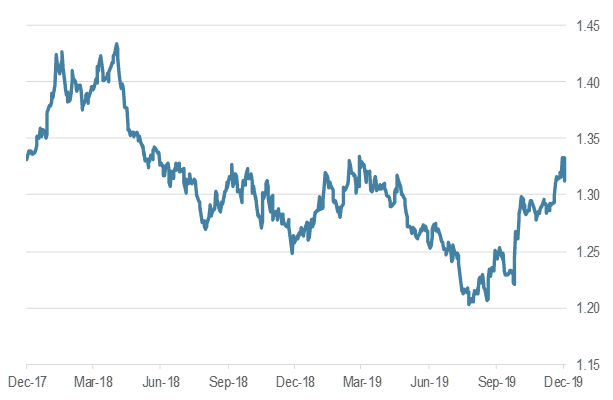

Forex

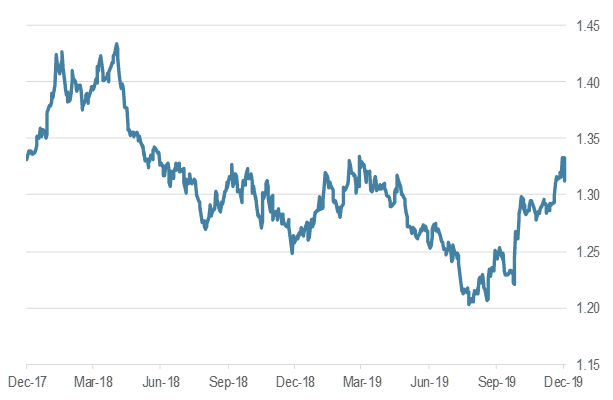

- Forex markets have been quiet of late, but the British pound is an exception. Following the decisive Tory victory in mid-December it has strengthened significantly. We note, however, that even here profit-taking has set in.

- The Chinese yuan has strengthened following the announcement of a Phase 1 trade deal between the US and China. One can assume that this deal has the approval of the Chinese government. For the time being, markets seem content to interpret the deal as clearing the way to a “blue sky” environment with no unsettling problems on the horizon.

- We continue to expect the dollar to move sideways, even though on a trade-weighted basis it is currently trading at almost a new high. The verbal interventions of the Trump Administration aimed at devaluing the dollar have declined significantly of late.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.