Executive Summary

- The global economy has lost momentum. We expect world economic growth will be between 3% and 3.5% in 2019.

- The major components of our 2019 world economic growth forecast are as follows – US: 2.3%, Euroland: 1.8%, China: 6.2% and Japan: 1.0%.

- We expect two further interest rate rises from the Fed in 2019.

- The first ECB rate hike will not happen before autumn 2019

- Following the December Fed policy meeting yields on 10 year Treasury bonds have fallen back – to around 2.75%.

- World stock markets fell substantially in 2019, undermined by a deteriorating outlook for growth and increasing political uncertainty. We advocate a defensive investment strategy for 2019.

- But deeply “oversold” markets conditions could well provide tactical buying opportunities in the year to come.

Our macroeconomic assessment

Business cycle

- We forecast world economic growth at between 3% and 3.5% in 2019. Slower growth next year reflects in part a forecast reduction in US growth, which we estimate at 2.3% for 2019. The impact of the Trump fiscal stimulus is fading, while there are first signs the more restrictive Fed policy is working to cool the economy.

- The recent G20 summit produced a sort of truce in America’s trade war with China. The US undertook not to introduce new tariffs or to raise existing ones for 90 days. The bargain could bring some short term improvement to business confidence and to financial markets. But we fear that trade hostilities will break out again once those 90 days have elapsed.

- We forecast Eurozone growth at 1.8% in 2019. Within the Eurozone, “Target 2” imbalances continue to widen. There are signs of capital flight from Italy.

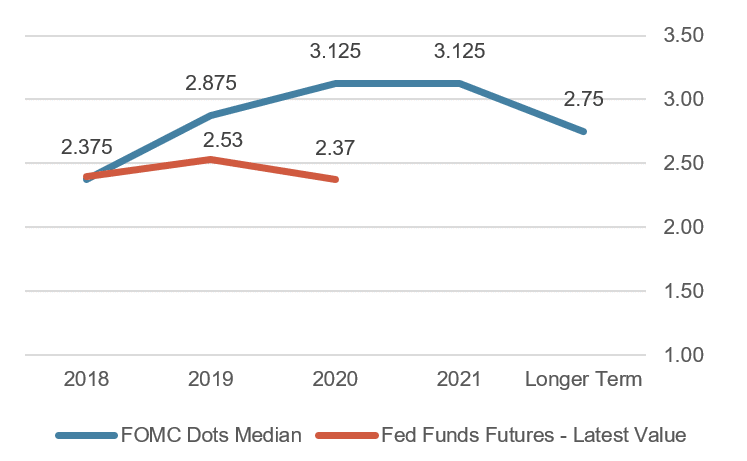

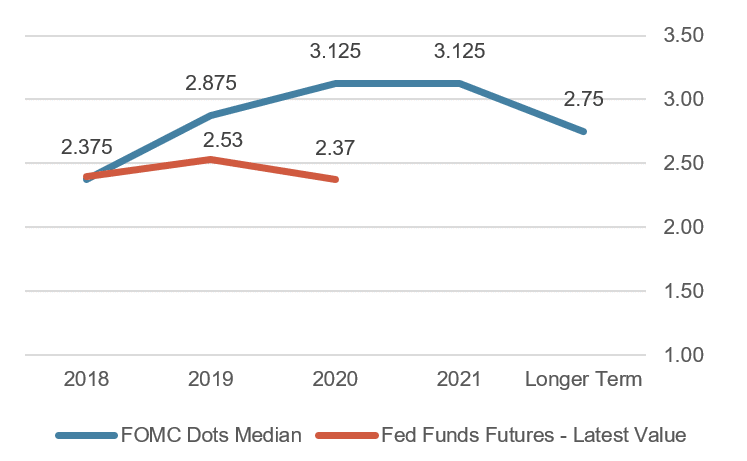

FOMC members «Dots»

Source: Bloomberg Finance L.P.

Monetary policy

- At its December FOMC meeting the Fed, as expected, raised its target range for the key Fed funds interest rate. From the “dot forecasts” of FOMC members (shown in the graph), it appears that a majority now expect only two further interest rate rises in 2019 and that the current phase of rising US interest rates will have run its course by 2020.

- In general, we believe that central banks will have some success in normalizing monetary policies next year, despite clear signs of a less strong economy. That said, the extraordinarily stimulative policies they have felt obliged to pursue over the last several years mean that they are now poorly placed to provide further stimulus in the event of a future recession.

- The Fed is not slackening the pace of its balance sheet contraction ($50bn. per month), arguing the present course is justified by the still relatively strong economy, labor market conditions and the generally moderate trend in price pressures. Future Fed actions will be driven chiefly by the business cycle.

- The ECB will terminate its bond purchase program at the end of 2018. But the first ECB interest rate hike should not be expected before the autumn of 2019. Maturing issues in the ECB’s massive bond portfolio will presumably be reinvested in longer-dated securities.

Our investment policy conclusions

Bonds

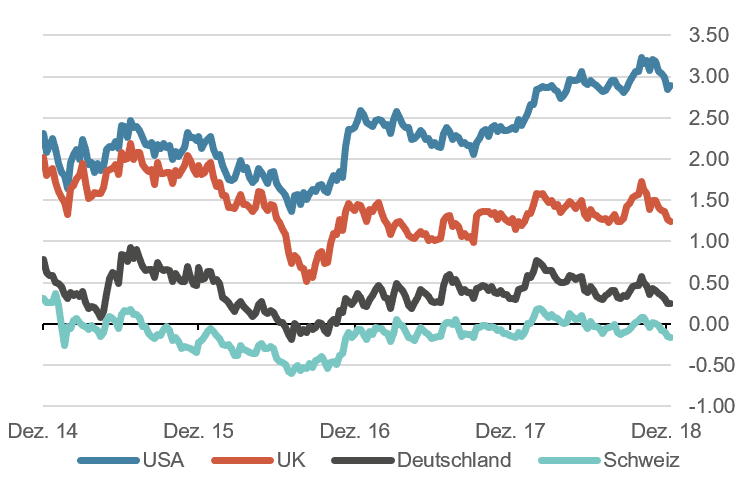

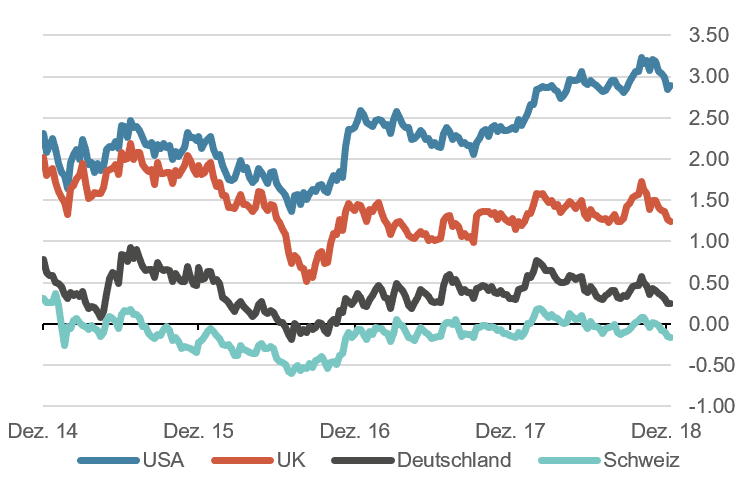

- Following the latest FOMC meeting, the yield on 10 year US Treasuries has fallen to around 2.75%. This sharp move probably reflects the deteriorating stock market environment which in turn has prompted investors to move to “risk off”. The “risk off” trade has also been encouraged by recent Fed comments on the inflation outlook.

- The very flat US yield curve which has emerged from recent trading could well be suggesting the following: (i) inflation is not going to “surprise” on the upside, (ii) the Fed will remain fairly cautious when it comes to further rate rises and (iii) this will lead to a “soft landing” for the US economy. That said, we also think the yield curve now implies an increased chance of a serious disruption to growth.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

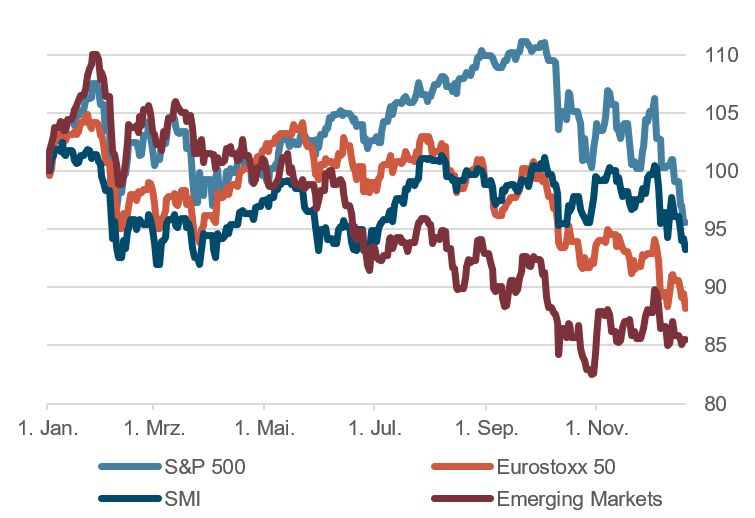

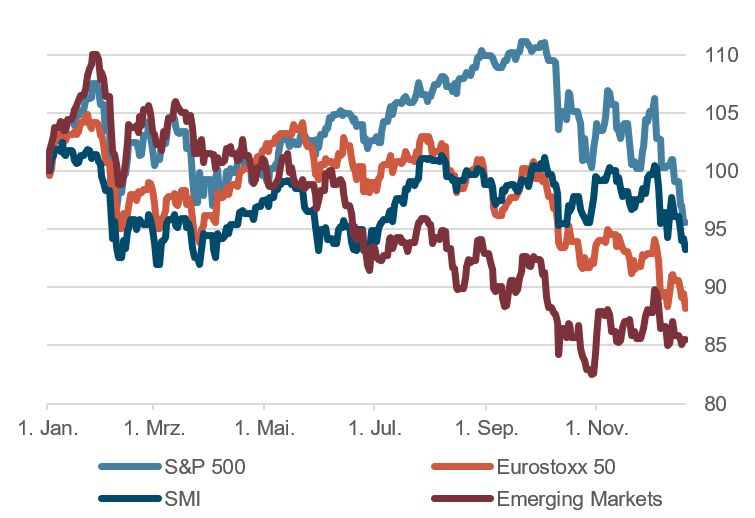

- For equity investors the fourth quarter of 2018 has led to a sobering reassessment. Now that the US market has followed the others in posting a negative return for the year as a whole, many are wondering “Why?”. We think a variety of political uncertainties and the deteriorating outlook for growth are chiefly to blame. They have unsettled investors and cost them performance.

- A further factor is the tighter liquidity environment consequent on the Fed’s balance sheet reduction program. Now that the Fed is no longer seen as friendly, markets seem to be looking for new leadership, something that for many will require portfolio adjustments.

- Emerging market indices are generally showing a significantly negative performance on a year to date basis. While many of these developing economies have strong growth prospects over the long term, their stock markets are being adversely affected by the currently strong US dollar and by rising US interest rates. Overall, the indebtedness of many emerging market economies is now at a record high.

Equitiy markets, perfomance year do date

Source: Bloomberg Finance L.P.

Forex

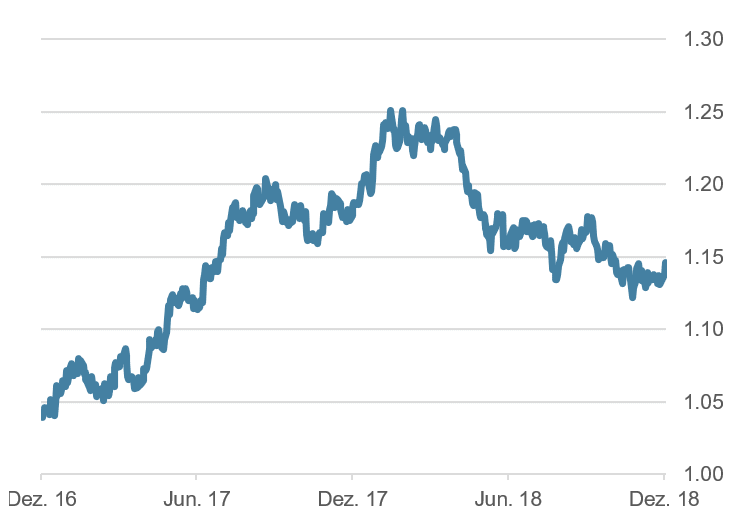

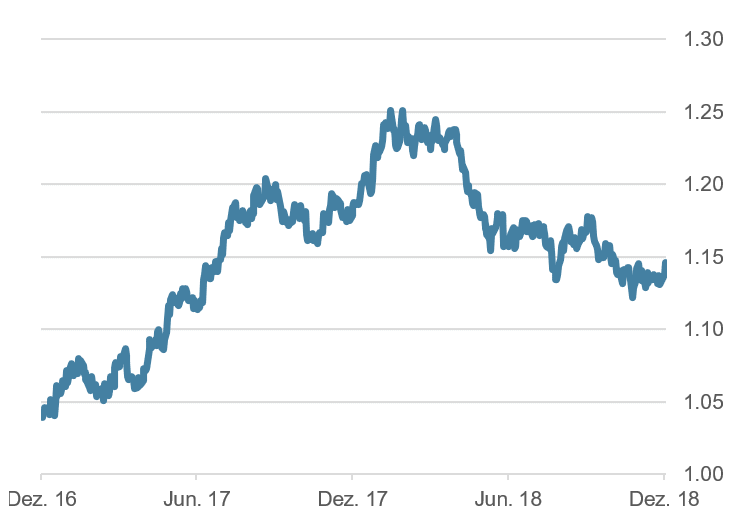

- The US dollar has moved sideways against most other currencies recently, most obviously against the Chinese yuan. The decisions of the December FOMC meeting were broadly expected by the markets, so did not have much impact on forex rates. Hedging US dollar positions is not appropriate at the moment given the large US dollar interest rate differential and low volatilities in dollar exchange rates.

- But the British pound is showing substantial volatility. The pound rose following the agreement on post-Brexit arrangements between Mrs. May and the EU. But, as it became clear that Mrs. May’s deal as outlined would not pass in the UK parliament, the pound lost value again and the “cable” (GBP/USD) falling to 1.25.

- The EUR/CHF has been relatively stable at around 1.13. The Swiss franc rose briefly at the start of December in the context of rumors that the Swiss National Bank was set to end its policy of negative interest rates, but has since fallen back.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.