Asset managers expect Donald Trump to be re-elected

Despite the risk of impeachment, the trade war and other disputes, 70 percent of Swiss asset managers expect U.S. President Donald Trump to be re-elected, and expectations for the stock market are correspondingly positive.

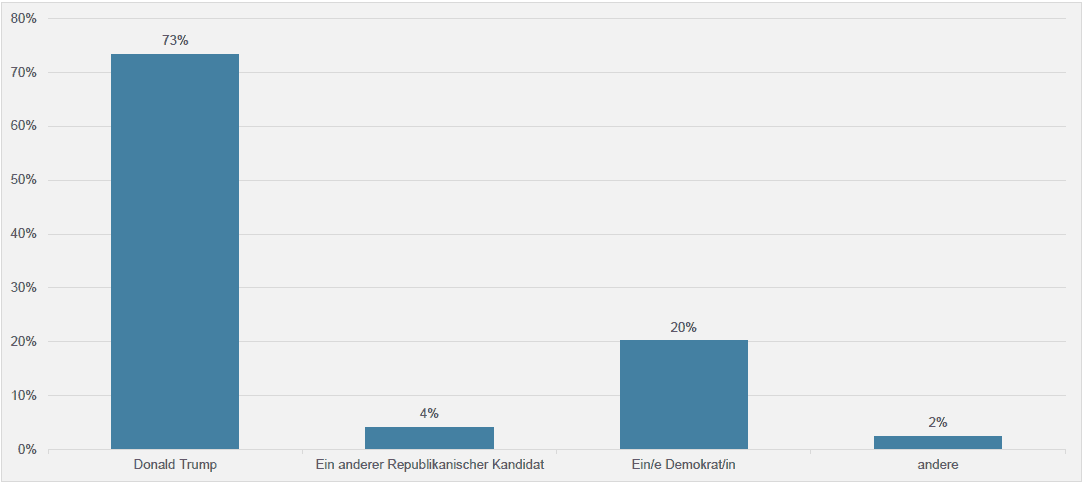

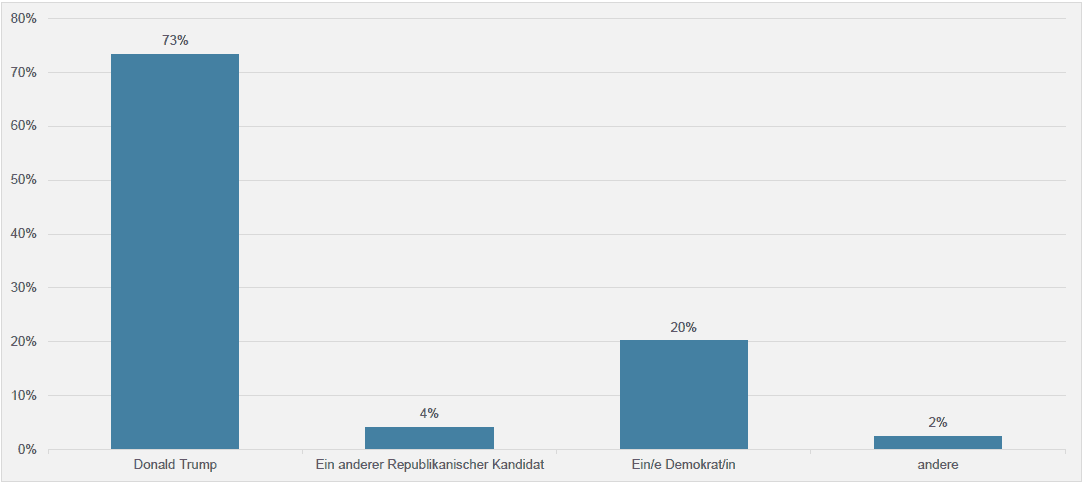

The opinions are obviously made: A good 70 percent of Swiss asset managers expect US President Donald Trump to be re-elected next year. In contrast, only 20 percent of respondents expect the Democratic Party to win (see chart).

This is according to the latest Aquila Asset Managers Index (AVI), published by the Swiss Aquila Group every three months in cooperation with finews.ch published. The index summarizes various forecasts from independent asset managers in Switzerland. Almost 160 firms took part in the latest survey.

Click here for the complete overview

Another four-year term for Donald Trump is likely to have a positive effect on the stock market. At least, that is the assumption of the survey participants. They expect interest rates in the USA to fall further, which in turn would have an impact on interest rates in the euro zone and Switzerland.

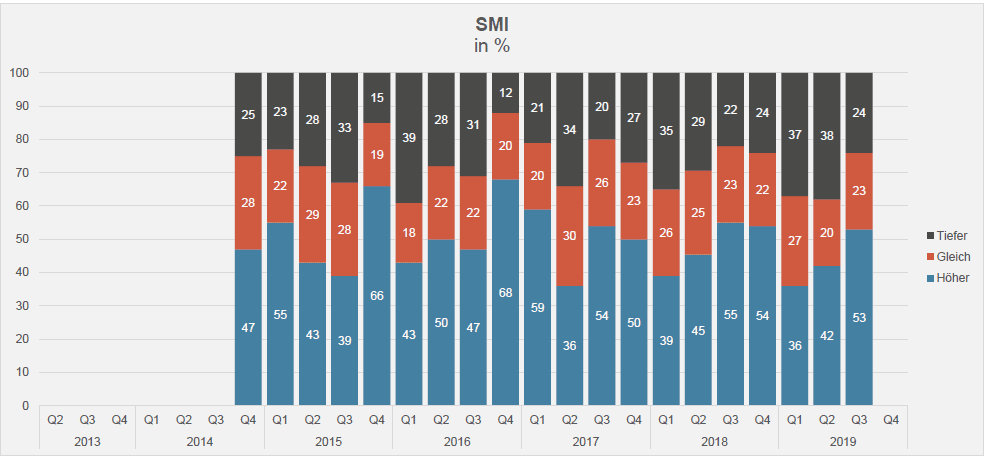

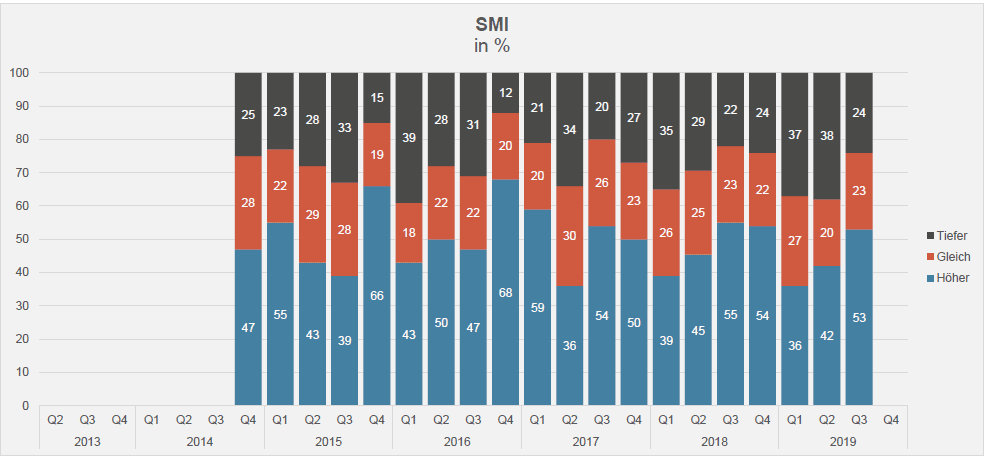

Against this backdrop, it comes as no surprise that Swiss asset managers expect stock market prices to rise significantly over the next three months (53 percent of respondents in the SMI, 43 percent in the EuroStoxx50 and 47 percent in the S&P500) (cf. graphic).

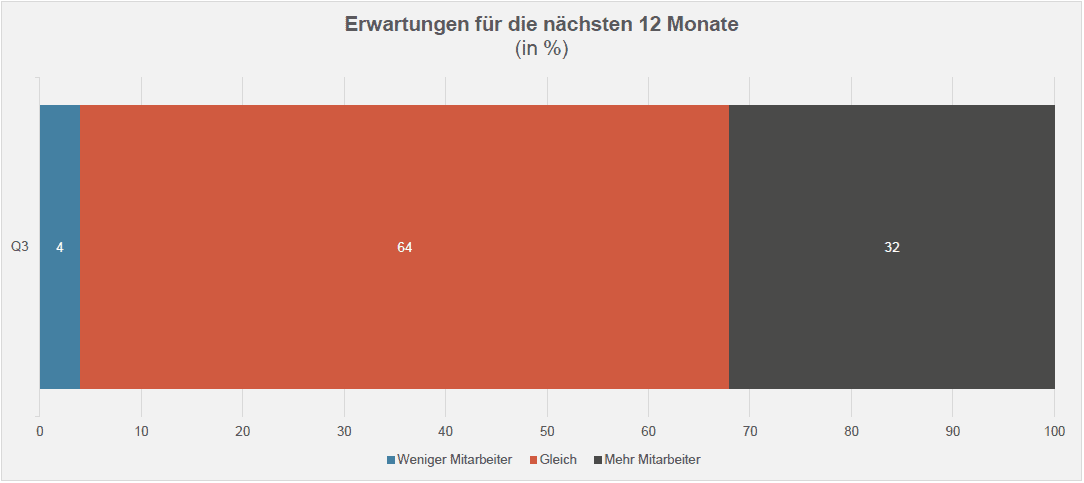

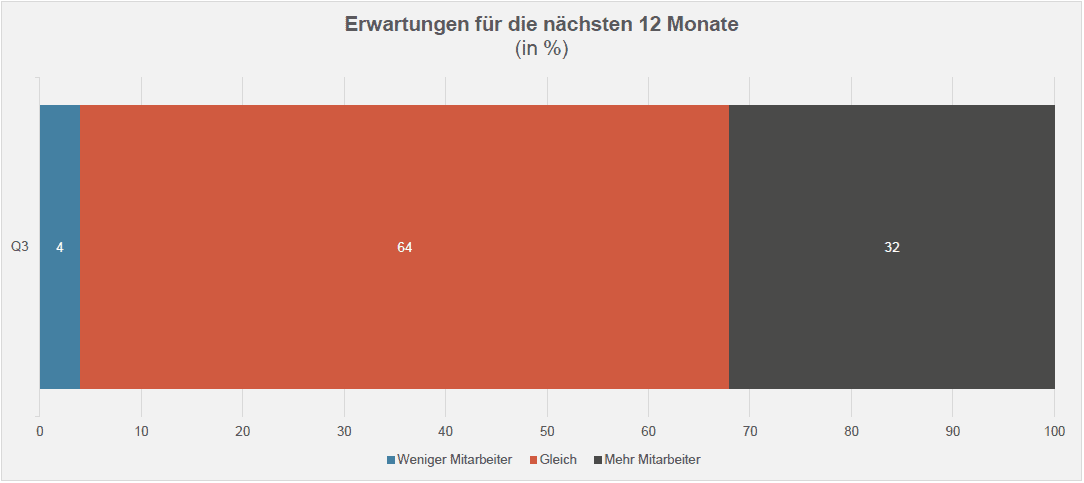

The positive expectations generally make asset managers optimistic. A total of 44 percent of survey participants expect business to develop positively or even very positively over the next twelve months; 43 percent anticipate stable development. And based on these premises, one third of the asset managers surveyed intend to hire additional staff, as the current survey further reveals (cf. graphic).

More new money

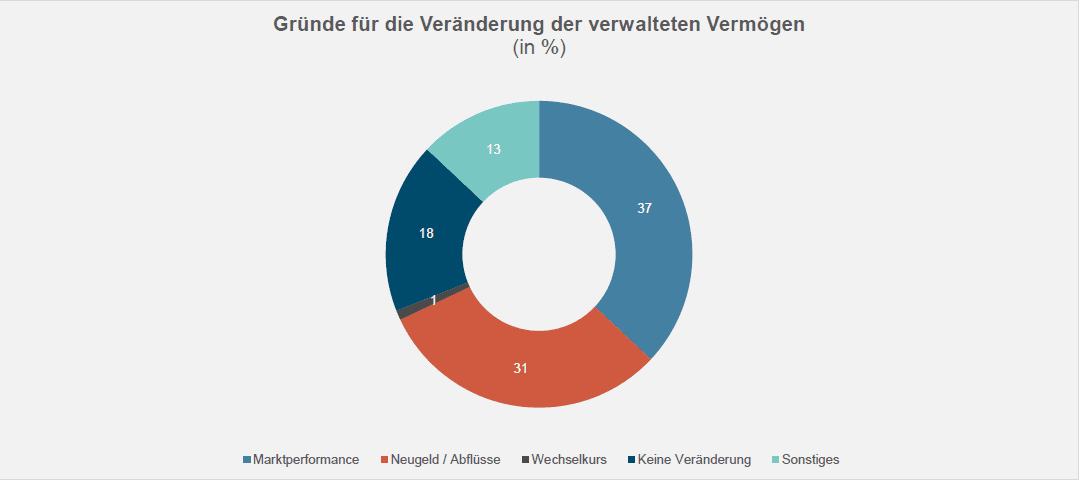

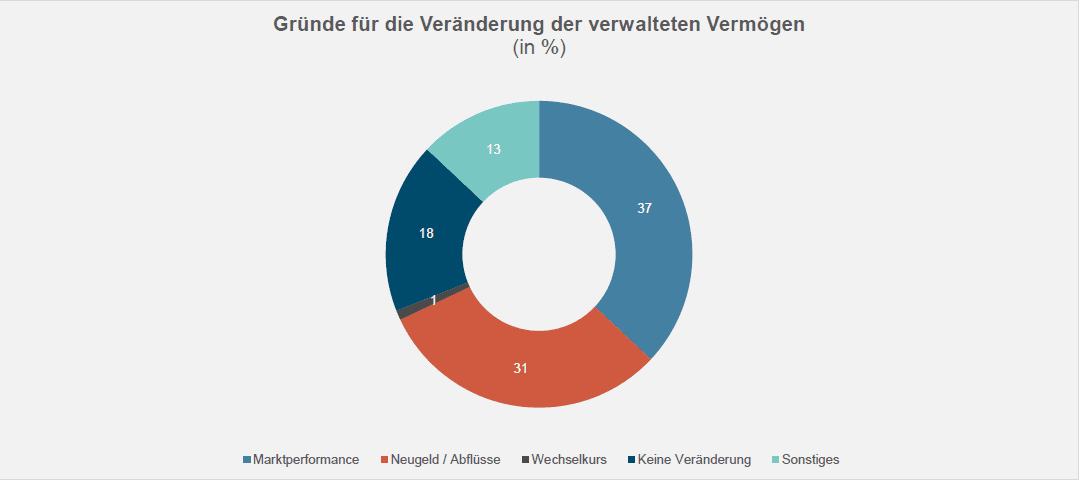

A look back also shows that the first nine months of 2019 have left a positive mark on the books of independent asset managers. Rising prices between January and the end of September not only led to an increase in assets under management for 57 percent of respondents, but also to a significant increase in new money for 31 percent of survey participants. Good market performance was also important to growth for 37 percent of asset managers (cf. graphic).

In three months, Swiss asset managers see the SMI at an average of 10,017 (in the previous quarter: 9,693), gold at a price of just over 1,538 (in the previous quarter: 1,392) dollars an ounce and the euro at 1.08 (in the previous quarter: 1.11) francs.

The next AVI Index will be published in January 2020

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.