Clear signs the US economy is slowing

The American economy cannot escape the global growth slowdown. The Fed is expected to cut interest rates yet again in October. There is no agreement in sight regarding the US trade dispute with China.

How far should we trust the US economy can continue to expand?

A major recession would probably spell the end for President Trump. The President certainly knows this; and many investors reckon that his Administration will do all it can to prevent one. “All it can” includes putting massive pressure on the Fed to cut interest rates repeatedly, further tax cuts, more government spending and (perhaps) even striking a trade deal with China. One reason why US stocks are so highly priced is that investors believe the Trump Administration will be successful in avoiding a recession.

But confidence that the longest US expansion since pre-industrial times can continue has received some setbacks in recent days.

- The US Purchasing Managers’ index (PMI) for ma-nufacturing sank in September to 47.8, the lowest level since June 2009. And the exports component – at 41 – hit its lowest level since March 2009. But the September PMI report revealed a small ray of light with a slight increase in the new orders component to 47.3. In the US, manufacturing makes up around 10% of the economy.

- The September PMI for non-manufacturing fell 3.8 points to 52.6, the lowest value since August 2016. Thus, the US services sector, while still expanding, has weakened substantially. The employment component fell to 50.4, the lowest reading since February 2014.

These data points suggest that the US has not been able to stand apart from the worldwide contraction in manufacturing and that signs of weakness are now starting to show up in America’s service sectors as well.

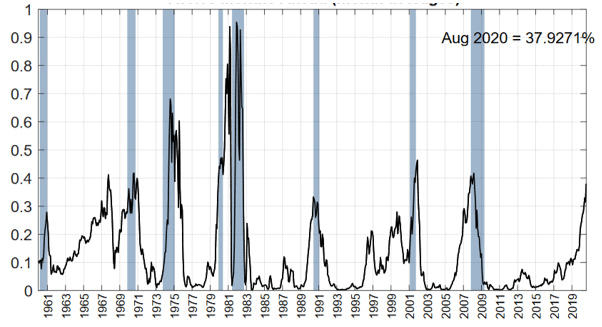

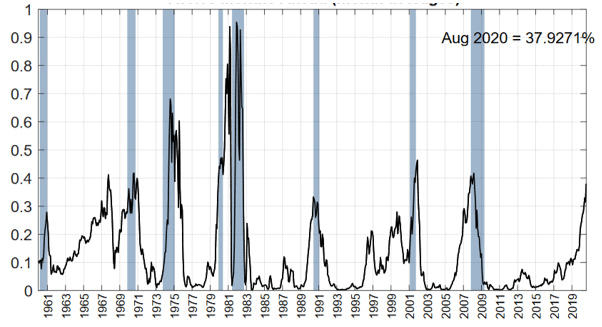

The graph shows the probability of a US recession according to a model of the New York Fed.

Recession probability model of the New York Fed

Source: New York Fed, Bloomberg

Investors should consider how far confidence is justified that the US economy can continue to expand, including that it can be manipulated into continuing expansion by the government. Right now, the market expects, in our view rightly, that the Fed will announce yet another rate cut as soon as this month.

Should there be a trade agreement, with a settling of differences between the US and China, the world economy would presumably recover rapidly. But prospects here are poor. The likelihood that an impeachment process will be formally initiated in Congress could reduce China’s willingness to compromise with the present Administration on grounds that an agreement might more easily be reached with the next President.

Hong Kong will be just another part of China in 2047

The special rights that were negotiated when the former British colony was handed over in 1997 – freedom of assembly, expression and religion – will not exist beyond 2047 and the clock is ticking inexorably. Today’s protests are about much more than a proposed new extradition law. They are about whether Hong Kong can avoid becoming just another ordinary part of China.

But what is an ordinary part of China?

China has always been a dictatorship. But artificial intelligence and an all-embracing communications network have enabled the most-perfect example so far of an Orwellian state able to monitor closely the activities of its citizens. “Big data” dictatorship is technically possible today and the Chinese have mobilized at full speed to establish one. Public places are now under almost permanent oversight. Indeed, the Communist Party has recently declared with pride that the national network of surveillance cameras means that within a second all China’s 1.4 billion inhabitants can be identified. Cameras with embedded facial recognition can pick up immedia-tely any “anti-social” behavior. Those who conform to the system get bonus points, access to credit and other benefits. Those who attract too many negative notices may find themselves unable to book a flight ticket, buy a car, or obtain a visa to travel abroad. Among other things, transgressors may also find their access to the internet is more restricted and that their children cannot attend the best schools.

We Chat

WeChat is a multi-function mobile phone application through which one can do almost anything (submitting divorce documents, managing loans, booking travel, making payments and directly accessing your bank account…). Those using this “one stop” software are constantly monitored. The State knows everything. The real-time recording of every person, including foreigners living in China, allows the automatic evaluation and control of an entire population so as to promote behaviors perfectly compliant with the objectives of the Politburo. China’s is a real-time experiment of historic proportions.

This Orwellian state is also the ultimate destination for Hong Kong and Taiwan. China’s long-term plan is to integrate these territories and to monitor their citizens as closely as those in other parts of the country.

It is clear that the basic conflict between China and the US is ideological and strategic. Today’s trade war is a symptom of the broader issue of competing systems.

Unless its protesting citizens can succeed in changing their destiny Hong Kong will no longer be a part of the West 28 years from now

Hong Kong’s freedom of expression, to the extent that it still exists, is scheduled for abolition 28 years from now. Her citizens know exactly what is at stake and this is why they are so determined to continue fighting. Ultimately, they are fighting for our values and for a liberal freedom-loving democracy. This is a fight they will probably lose. Realizing this, Hong Kong’s elite, so long it can, is transferring its assets abroad at an increasing rate, chiefly to Singapore. Capital flight is under way.

Hong Kong unrest could impact the US trade war with China

Should China intervene militarily in Hong Kong the chances of a breakthrough in China’s trade conflict with the US would vanish. Rather the clamor for further additional international sanctions against China would likely intensify.

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.