Greater clarity on Brexit, Phase 1 of a US-China trade deal ready for signature

British Conservatives under their newish leader, Boris Johnson, have won a decisive victory. As a result, there should now be an orderly Brexit by the end of January. Then negotiations about the future relationship between Britain and the EU will begin. It is clear that the UK wants as much access as it can get to the EU single market. But the EU will want a heavy price for this and years of negotiating probably lie ahead. The EU does not want to see Britain prosper as an outsider, able to compete on the basis of less stringent regulations. Phase 1 of a US-China trade deal has been agreed and is ready for signature.

The Tories have won the biggest majority since Mrs. Thatcher in 1987

The Conservatives gained 47 seats and, with 364 seats, now have a comfortable majority in the House of Commons. So, the UK will be able to press ahead with leaving the EU before the end of January. The Labour party lost 59 seats.

Finance markets react positively to the UK result

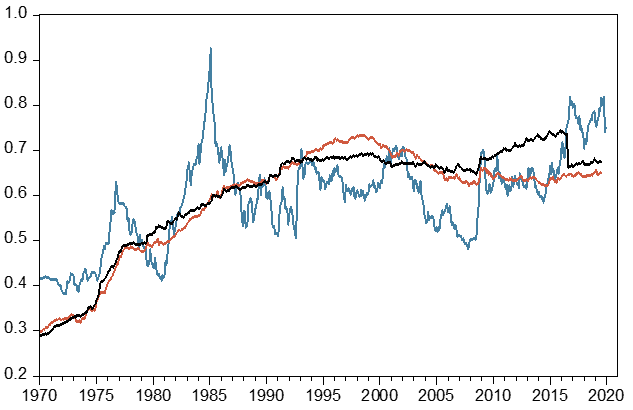

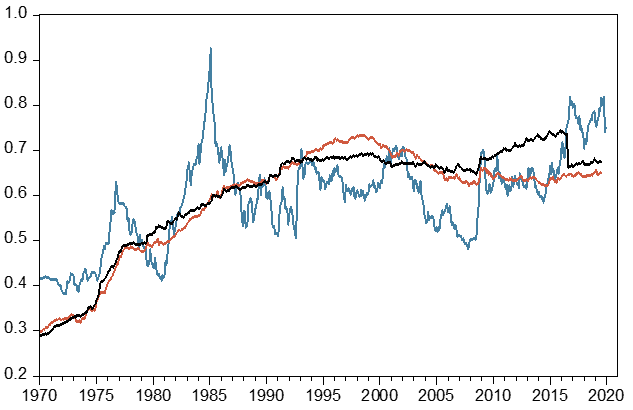

The election result is very positive for UK equities, bonds and the pound in that Brexit uncertainty has been put to one side. An orderly Brexit is now going to happen. Second, the UK now has a government which is likely to have a business-friendly program. A Corbyn-led Labour administration – which would have seriously undermined the UK business sector – is off the table. Graph 1 shows the pound/dollar exchange rate and our estimates of fair value based on relative prices. Despite its smallish post-election rally the pound is still undervalued. “Fair value” is estimated at 0.65 per dollar on the basis on producer prices and 0.68 on the basis of consumer prices. Thus, on our estimates the pound is still about 10% undervalued.

Long and difficult negotiations between the UK and the EU lie ahead

After an orderly Brexit, a new relationship between the UK and the EU now has to be negotiated. The UK wants as much access as it can get to the EU single market. Negotiations could take years and are likely to be very difficult. The difficulties are probably being underestimated by the markets.

Unfortunately, the EU has no interest in regulatory competition

The EU does not want to allow the UK access to the single market unless it adheres to (high) EU regulation standards. The new UK government, on the other hand is determined to pursue its own immigration policy. It also wants much greater flexibility in determining regulations in other areas. In time, we see the UK moving away from the orbit of the EU and towards that of the US.

A vote in favor of impeachment in the Democrat-controlled House would trigger a trial in the Senate where the Republicans have a majority. Mr. Trump’s removal from office would need at least 20 Republicans to vote for it. We see no chance of this happening.

Graph 1: British pound versus US dollar and price-based fair value (CPI & PPI basis)

The Phase 1 deal in US-China trade negotiations is now ready for signature

Phase 1 of a US-China trade agreement, designed to put the bilateral trading relation on a friendlier footing, has been negotiated and is ready for signature in January. The US will not introduce fresh tariffs and will reduce some existing ones while China has committed itself to purchase $50bn worth of US agricultural products. While we expect this Phase 1 deal will get implemented, this is not yet a total certainty. China’s vice trade minister Wang has stated the agreement must first be translated and checked by China’s legal experts.

Growth stabilization expected for the world economy

Assuming Phase 1 gets signed, and at least partially implemented in January, we believe international trade will get a boost and this should support the broader growth process.

Growth projections for 2020

We forecast the world economy will grow at a satisfactory 2.8% in 2020 following 2.9% growth in 2019.

Our regional and country growth forecasts for 2020 (with 2019 estimates in brackets) are as follows: US: 2.2% (2.3%), Euroland: 1.2% (1.3%), Switzerland: 1.7% (0.9%), China: 5.8% (5.9%), Japan: 1.0% (1.2%), UK: 1.0% (0.8%).

Investors should keep in mind that the world economy has never been subject to so much monetary and fiscal stimulus as is the case today. Widening US Budgetary deficits, China’s continuing ability to pursue a debt-led growth process and the very low interest rate policies of the central banks will probably combine to prolong an already very aged expansion (including in countries other than the US) into next year.

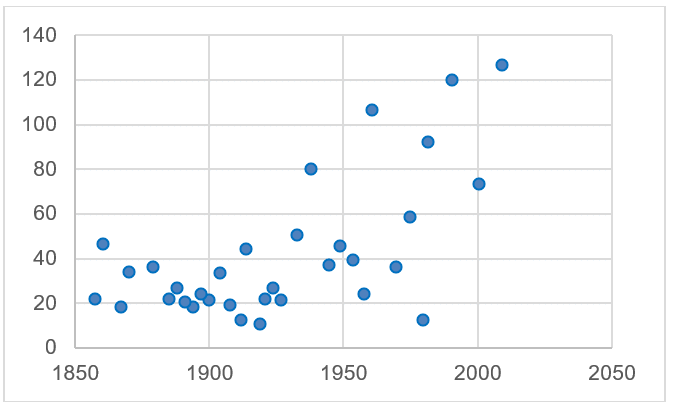

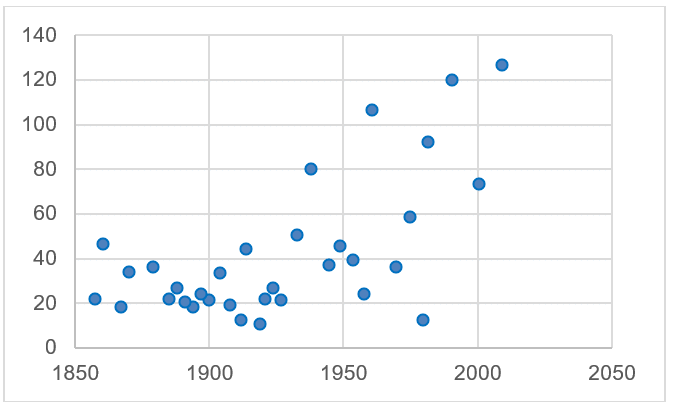

Graph 2 shows US economic upswings since 1858. The vertical scale indicates the length in months, the horizontal scale the date when each upswing began. On average, US economic upswings during this period have lasted 39 months. Given this history, it is often argued that the current upswing is now so old that chances are high it will soon fall apart. While this argument has some force, it is mitigated by several factors:

First, the US economy in particular is subject to extreme policy stimulation. This should be “front and center” in investor thinking. Eventually, there will be “pay-back time”, but probably not next year. Also, it is instructive to look closely at the history of US upswings.

Analysis of the data in Graph 2 shows that from 1858 to 1927 US upswings were relatively short, averaging just 22 months. Since 1927 they have tended to be significantly longer, averaging 64 months. We would make two further points. First, some post-1927 upswings have been far longer than any of those experienced prior to that date. Second, the volatility of the length of cyclical upswings has increased sharply. Prior to 1927, this volatility was around 9.7 months, or less than a year, but subsequent upswings have had a volatility of 36 months, or three years. While the current upswing certainly stands out for its longevity it is less remarkable than might at first appear, especially when viewed against the more recent past.

Graph 2: Length of US economic upswings since 1858 in months

Source: NBER

We wish our readers success in their investment decisions and “einen guten Rutsch!”/ a happy New Year!

Contact: Thomas Härter, CIO, Investment Office

Telephone: +41 58 680 60 44

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.