Executive Summary

- We expect the global economy to grow around 5.0% in 2021.

- US economic lockdowns are being scaled back rapidly due to the significant decline in caseloads.

- Europe, excluding the UK, is seriously lagging in its vaccine program and case numbers are rising once more. Given this, lockdowns are being extended or even reintroduced.The US is deploying much greater fiscal stimulus in response to the pandemic than Europe.

- The behavior of bond markets will likely force the Fed into a more decisive policy response.

- The process of rotation within stock markets looks set to continue.

- The US dollar continues its slight upward trend.

- Precious metals prices will flourish in a scenario of yield curve control.

Our macroeconomic assessment

Business cycle

- We expect global economic growth of 5.0% in 2021. Other key 2021 growth forecasts are as follows: US:+5%, EU: +3.5%, Japan: +2.5%, China: 8%, UK: +5.5%, Switzerland: +3%.

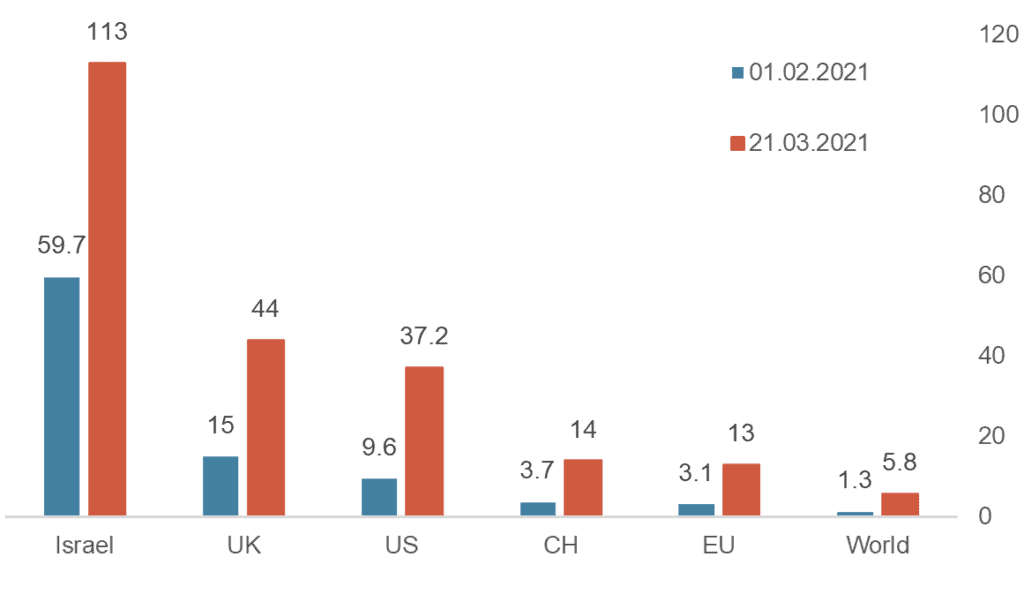

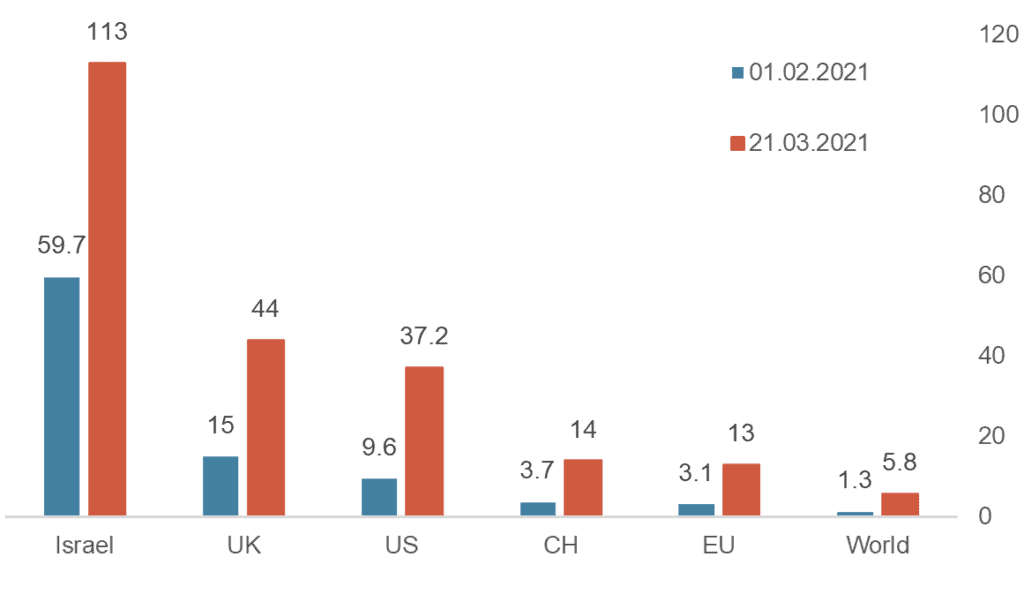

- The pandemic will have a deeper impact in Europe (excluding the UK) than in the US. In many EU countries there is a shortage of vaccines and distribution is bureaucratic and very inefficient. In the US, the vaccination rollout has gone much more smoothly and President Biden’s goal of having all adults eligible for at least one vaccination by May 1st looks achievable. This will probably prevent the US from experiencing a third wave of infections. In the EU, however, a third wave looks to have already begun and the EU will likely have difficulty in achieving its goal of vaccinating 70% of all adults by September 21st.

- The “growth gap” between the US and Europe will continue to widen in coming quarters.

COVID-19: Vaccine doses administered per 100 inhabitants

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Monetary policy

- Due to the rapid easing of restrictions, the US is seeing a strong increase in the hitherto pent-up demand for services and thus an increase in the velocity of money circulation could develop. As the new money created by the Fed starts to impact spending a temporary rise in inflation to over 3% is likely. Price components of the Purchasing Managers’ indices have in recent months already shown a steep rise. Investor inflation expectations, as revealed in the bond market, have also risen significantly.

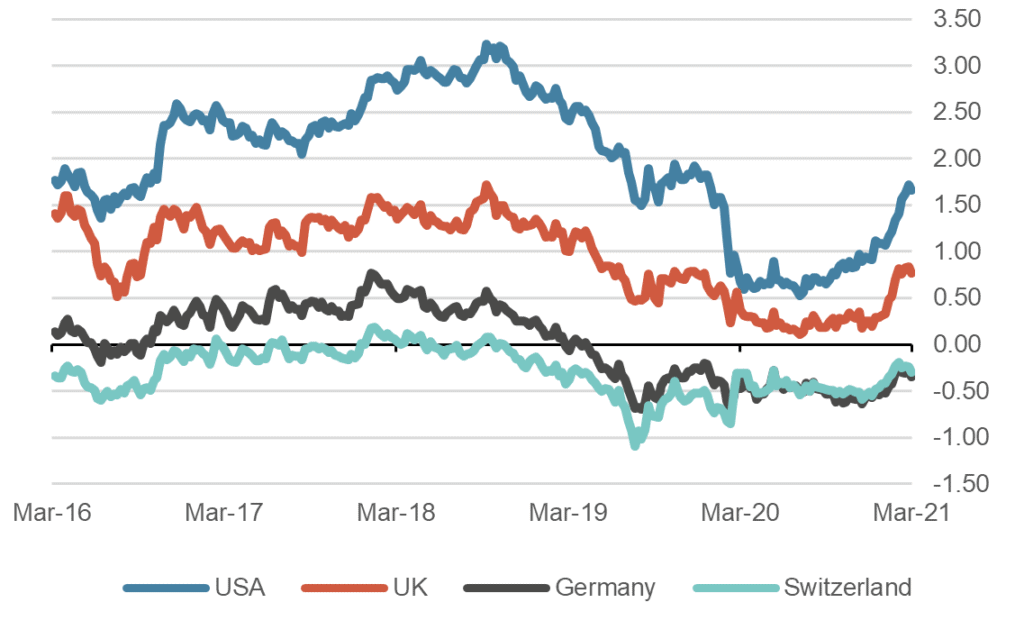

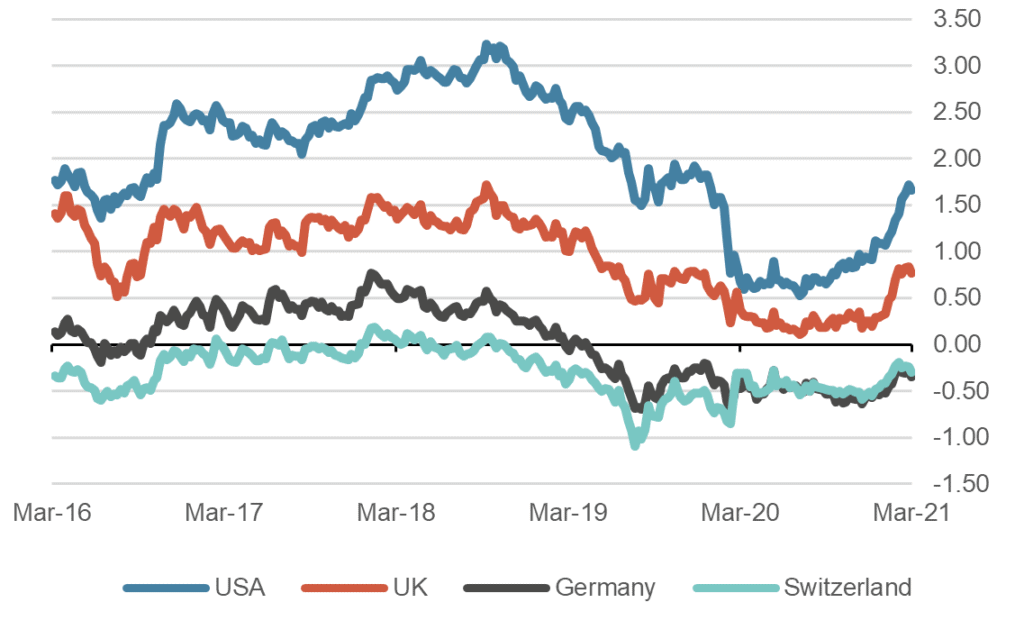

- Financial markets are worried about the rapid rise in US long-term interest rates. Fed Chair, Powell has once again has made it clear that, not only will interest rates remain low for the foreseeable future, but also that the Fed’s security purchase programs will continue. Nevertheless, we suspect such verbal attempts to influence investor expectations will not be enough in the long run. Sooner or later, financial markets will force the Fed and other central banks to act more decisively against rising long-term rates, increasing the proportion of security purchases at the long end of the yield curve or introducing controls over the entire yield curve.

Our investment policy conclusions

Bonds

- A consolidation in bond yields has emerged in recent trading following a period in which they had risen across all major regions. Markets have taken their cue from Fed Chair, Powell’s post-FOMC meeting comments that “some inflation” is good and that the necessary instruments (“tools”) are available to curb too strong a rise in yields.

- Despite this hint of YCC (yield curve control), the markets will continue to try to push yields up and force the Fed to respond more decisively. A chance to do this occurs almost every week, because the US Treasury now auctions immense quantities of paper with different maturities due to the gigantic financing needs of the Federal government. In the week ending March 26th for example, about $180 billion worth of 2, 5 and 7-year bonds were auctioned. Especially for the longer dated bonds, the appetite was notably lower than long-term averages.

10 year government bond yields last 4 years, in %

Source: Bloomberg Finance L.P.

Equities

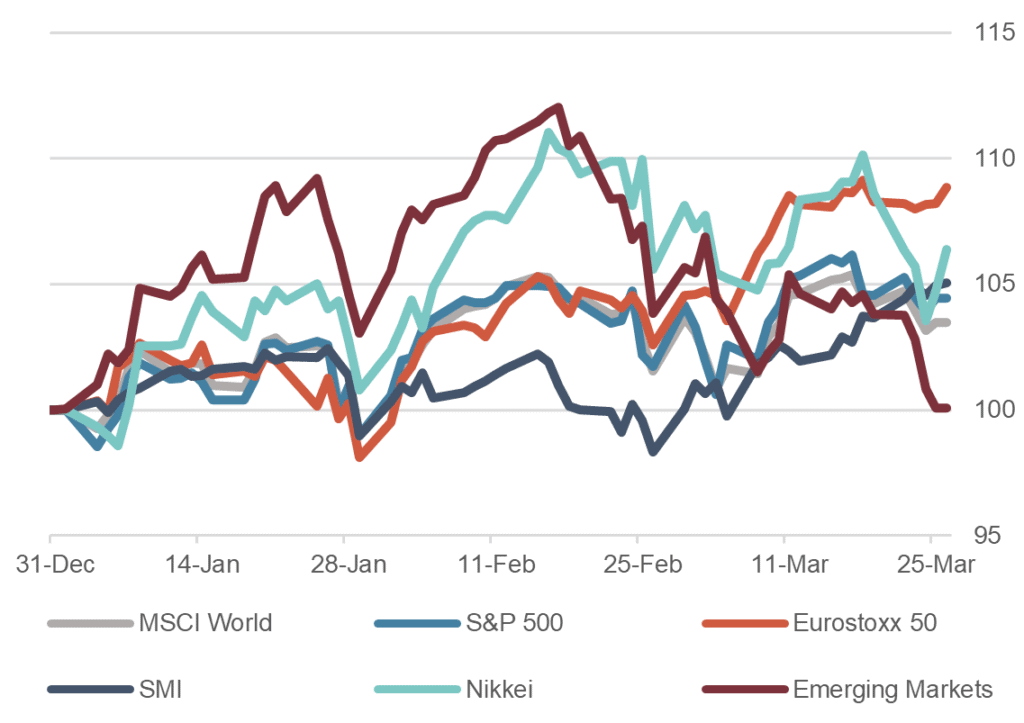

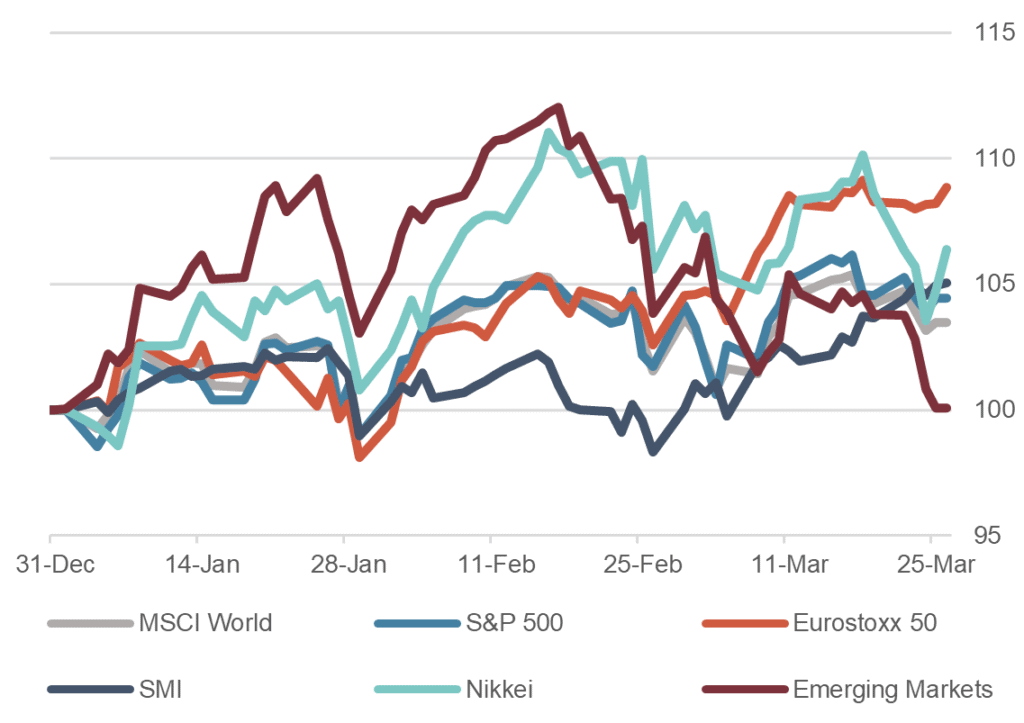

- There have been rotations within the equity markets in recent weeks. Anticipation of a cyclical upswing in the global economy and a steepening yield curve have impacted sector weightings in the indices. Technology stocks (“long duration” assets with high P/E ratios) were the relative losers while cyclical sectors such as banks, energy and industrials gained.

- This rotation has brought to the fore the question as to how strong the forthcoming upswing is likely to be. Are we at the start of a new and sustainable economic cycle or will we see merely the short-term satisfaction of consumer needs that have been pent up over the last few months due to the Coronavirus? This issue will determine the longer-term significance of current rotation trends within the equity markets.

Equity markets, perfomance year to date, indexed

Source: Bloomberg Finance L.P.

Forex

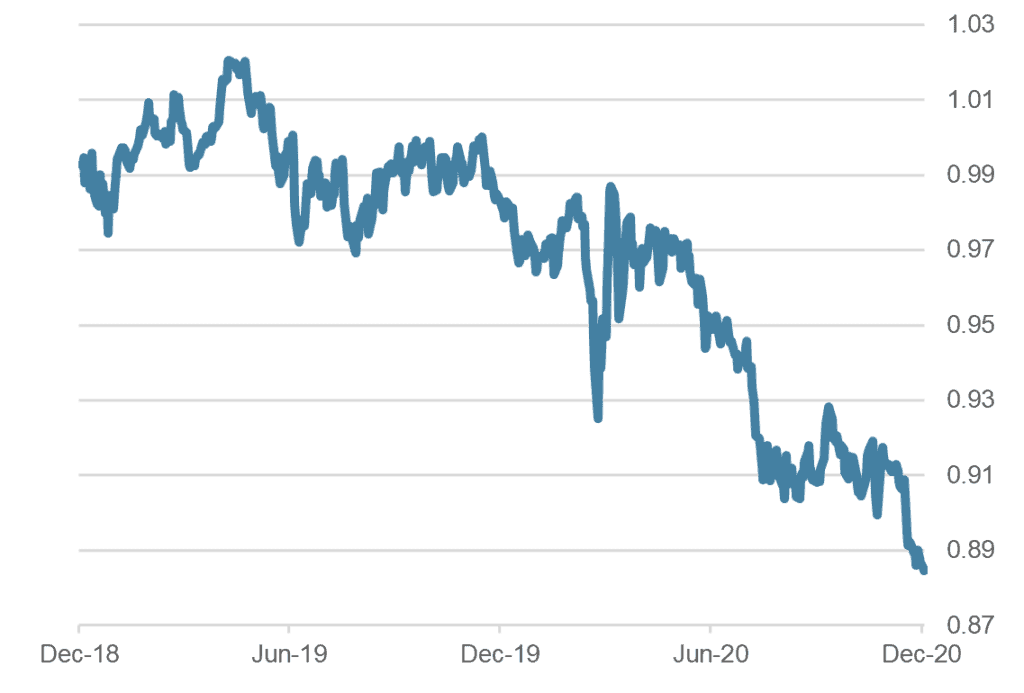

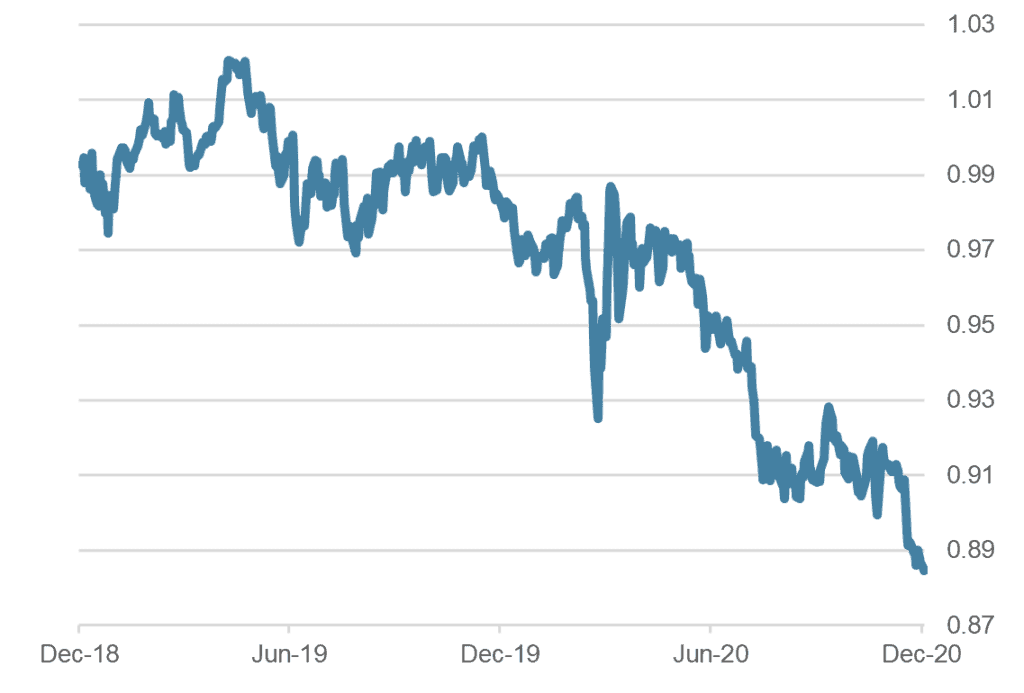

- The US dollar has continued its slight upward trend in recent days. Higher US bond yields and hopes and expectations for a recovery in the US economy have helped the dollar. Given the big consensus for a weakening dollar, further gains from here would be a surprise/perhaps its recent modest gains are unsurprising.

- Due to increased interest rate differentials between US dollar on the one hand and euro or yen bonds on the other, dollar investments are more attractive for investors in these currency areas than they have been for a long time. This factor may also have contributed to the dollar’s recent gains.

- The Chinese central bank will probably continue to reduce liquidity in the renminbi and thus continue to play its role in the Fed/PBoC “tandem”. But the escalating rhetoric between the representatives of the two superpowers must be watched closely. Current signs don’t point to an easing of tensions.

EUR/USD, last two years

Source: Bloomberg Finance L.P.

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.