Asset managers focus on vaccine and substance stocks

Independent asset managers in Switzerland expect a significant stock market boom in foreign equities in 2021. They also believe in gold as a stable investment. Almost half of the players want to be vaccinated against Corona.

Despite the economic downturn and the ongoing Corona pandemic, independent asset managers in Switzerland are entering the new year in good spirits, according to the latest Aquila Asset Managers Index (AVI).

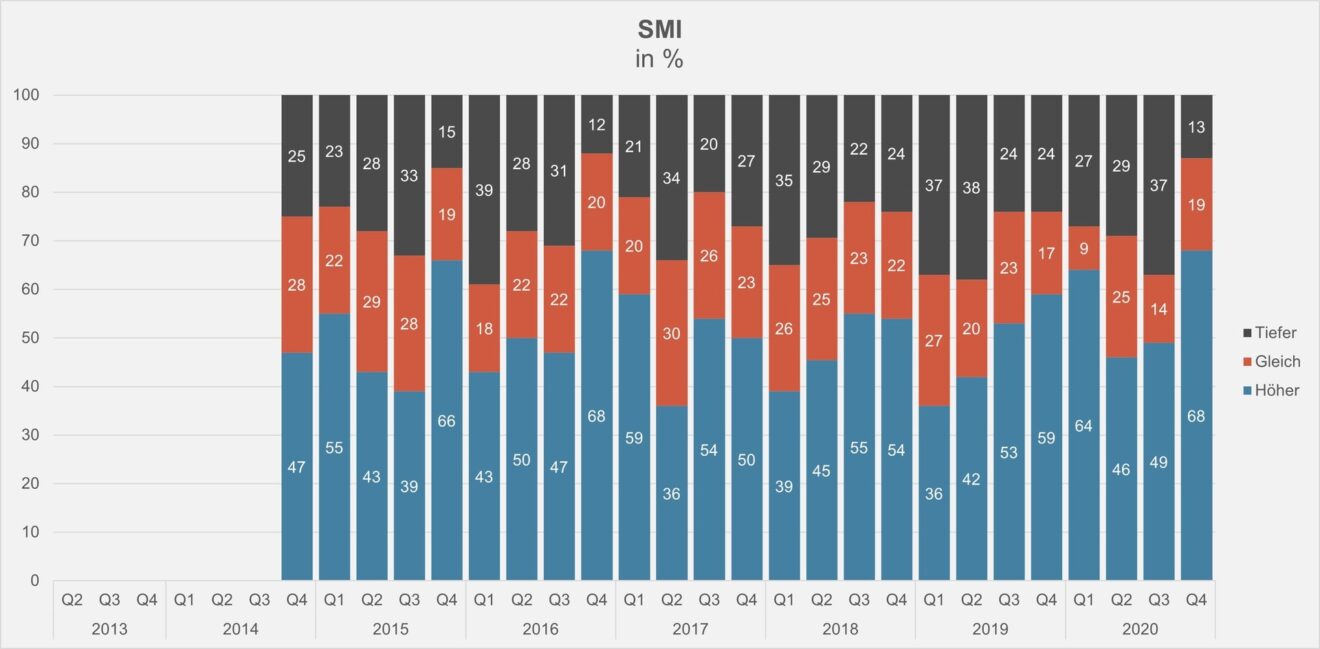

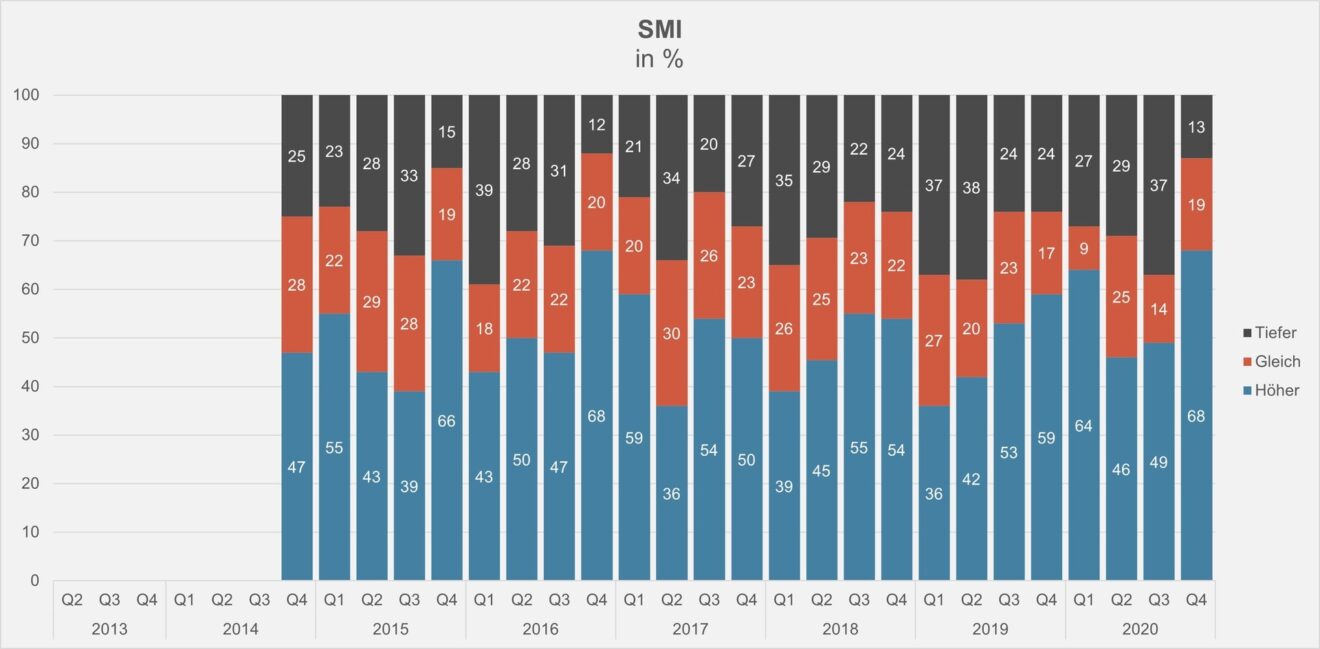

A good two-thirds of the players surveyed expect a global stock market boom in the next three months - especially in the EuroStoxx50 index (67 percent of survey participants) and the Swiss Market Index (SMI), where as many as 68 percent expect a significant gain (see chart below).

By comparison, three months ago only around 45 percent of respondents expected the stock market to rise further. The growing clarity in the race for the U.S. presidency and the vaccination process against the Corona virus that has now begun in many countries may have contributed to the general optimism.

Ready for vaccination

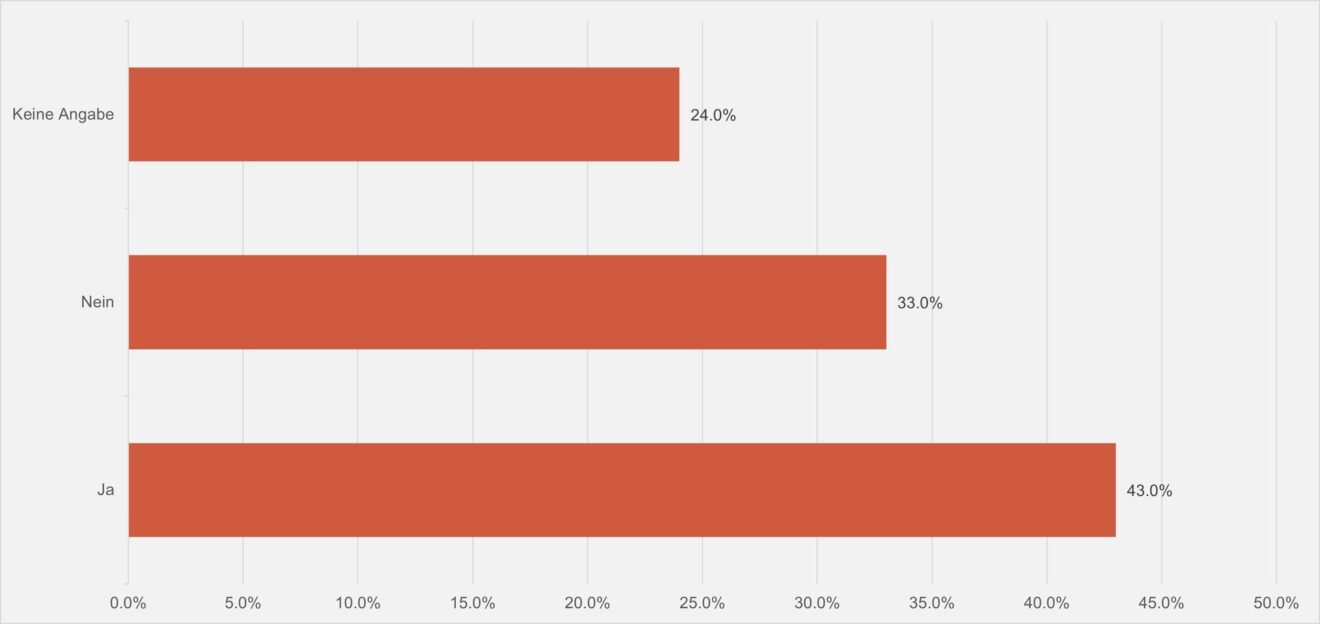

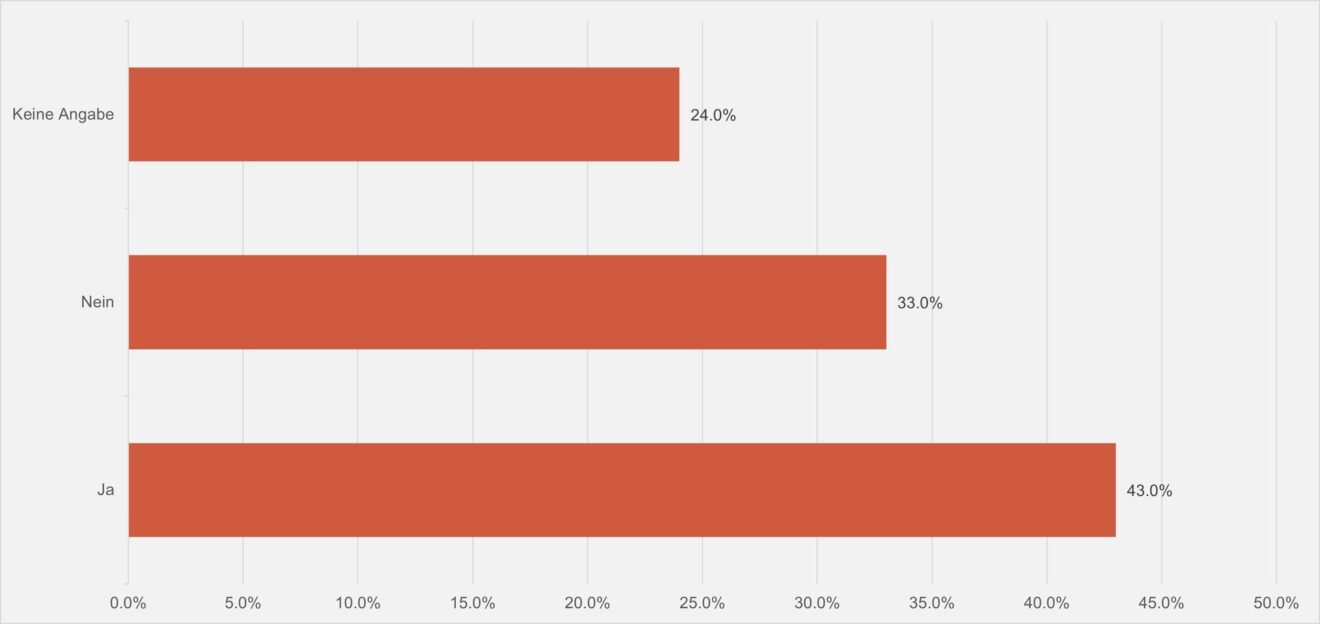

Of the asset managers surveyed, 43 percent want to be vaccinated, while 33 percent are against it. Around a quarter are still undecided (see chart below).

This is the result of the Aquila Asset Managers Index (AVI), which the Swiss Aquila Group publishes every three months in cooperation with finews.ch. The index summarizes various forecasts from independent asset managers in Switzerland. Almost 150 firms took part in the latest survey.

- Click here for the complete overview

"It has been shown that 2020 was a successful year for 'systematic' investors. The evaluation of the right investment strategy and a disciplined investment approach will continue to be the be-all and end-all in 2021," says Yves Hauser, head of investment at Zurich-based Finaport Group.

Indestructible belief in gold

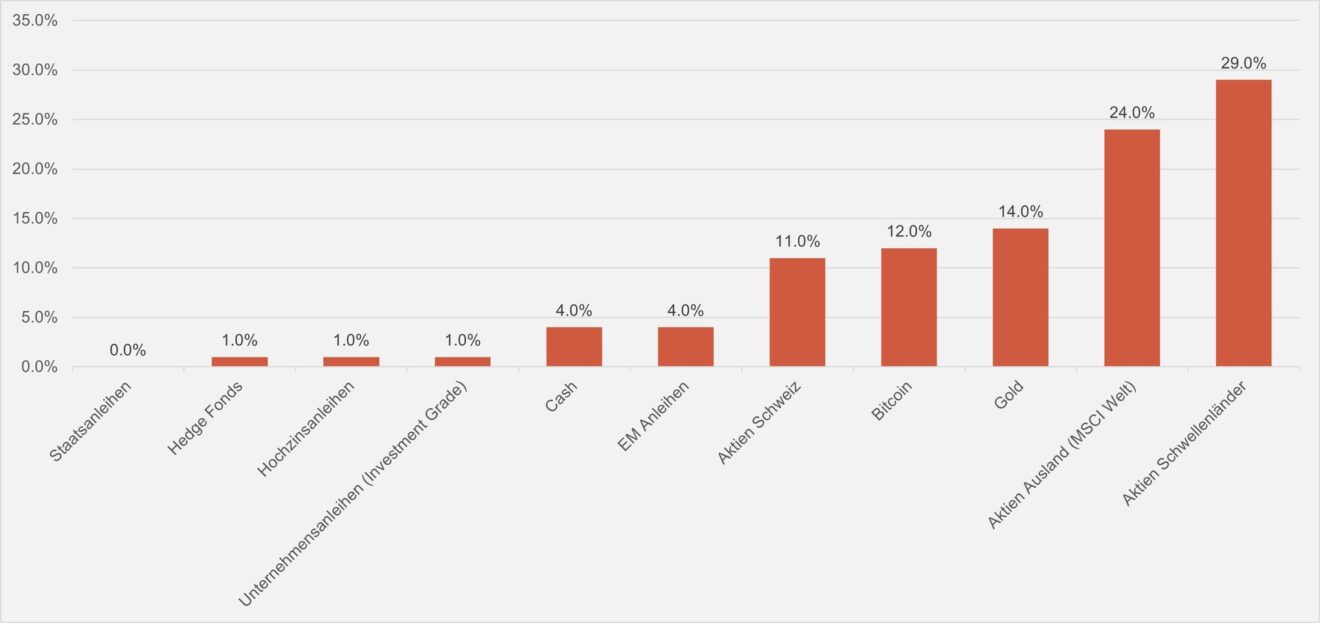

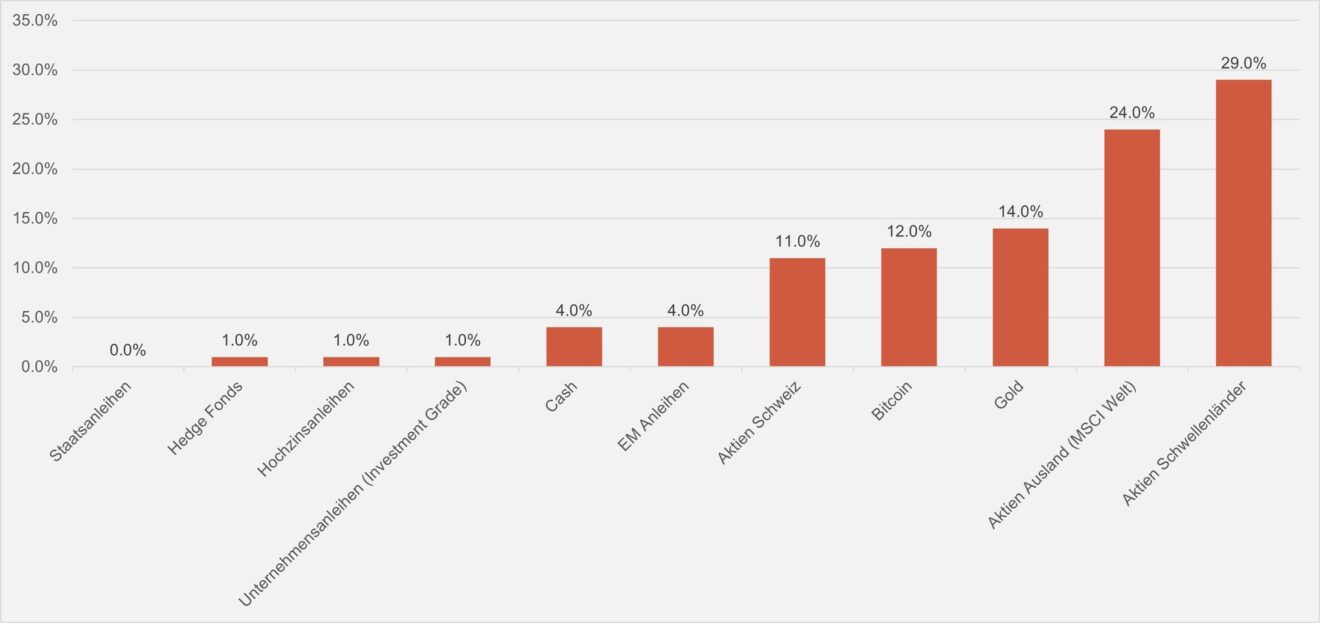

As the stock market rises further, 57 percent of independent asset managers are focusing on value stocks, while 43 percent want to remain loyal to growth stocks. The players expect the most potential in foreign stocks, namely from the MSCI World Index and from companies that generate a significant proportion of their sales in emerging markets. The survey participants are thus counting on the hoped-for economic recovery in Asia, where some countries seem to have been better able to contain the further spread of the Corona virus.

Many asset managers continue to believe in gold as an asset class, but investments in virtual currencies such as Bitcoin are now also increasingly popular (see chart below).

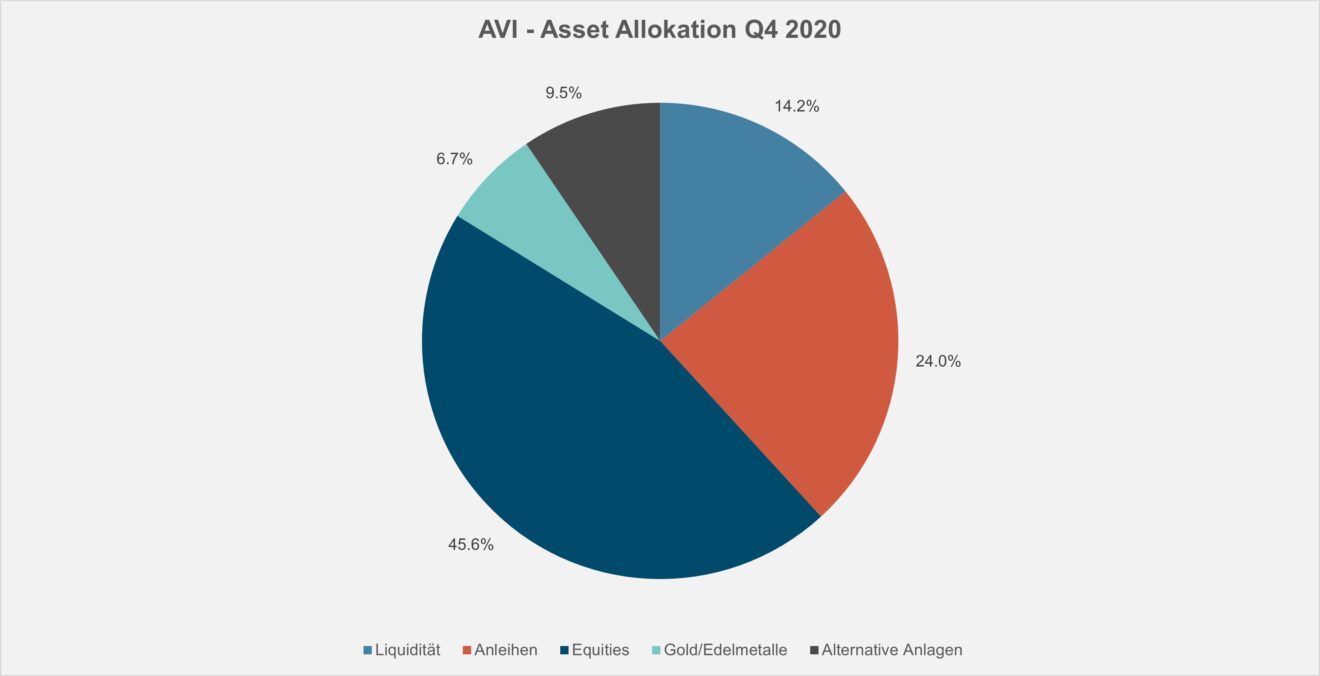

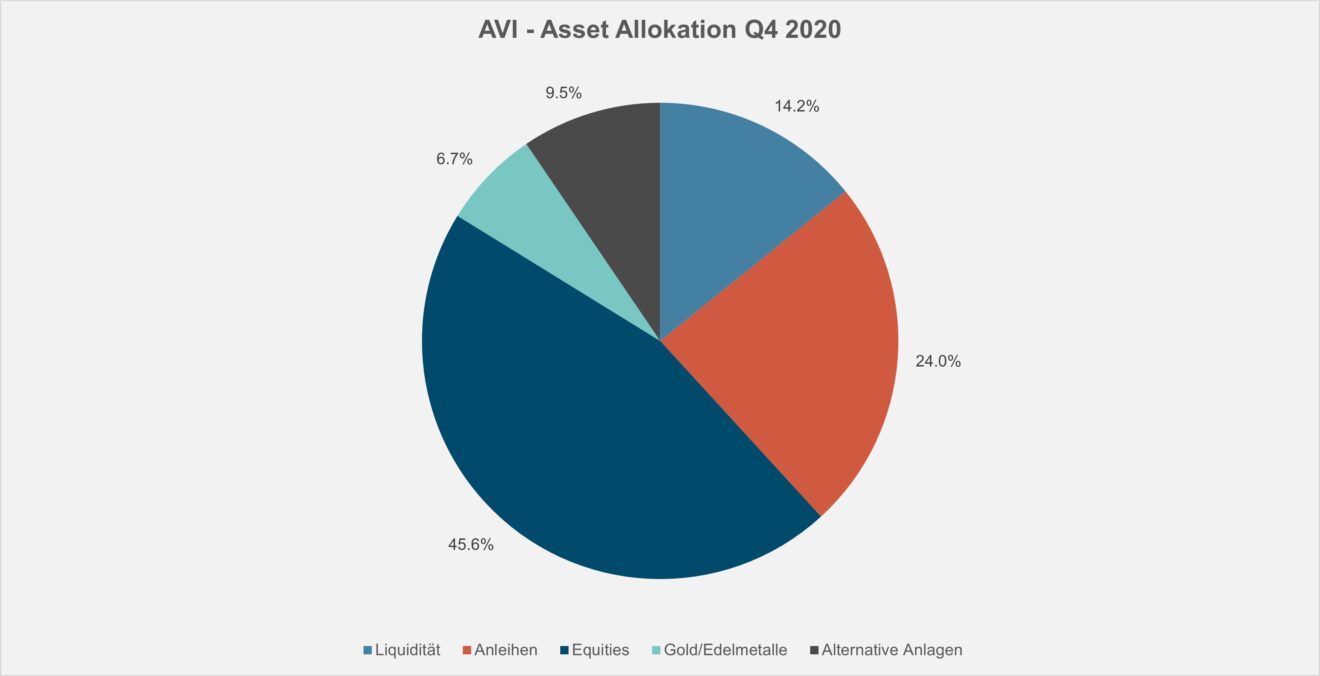

A look at the average asset allocation of the players surveyed shows that they reduced their liquidity from 16.3 percent to 14.2 percent compared with the previous quarter, to the benefit of corporate bonds (from 23.7 percent to 24 percent) and gold (from 6.7 percent to 8 percent). The share of equities remained unchanged at 45 percent at the beginning of the year (see chart below).

"The dominant view among investors and economists worldwide is that the economic outlook for 2021 is positive. The assessment is based on expectations of real assets, whose value has already risen since the depths of the pandemic crisis in March, but also of previously neglected sectors. However, the latest news about the Corona virus' mutation shows that 2021 will not be a walk in the park. What are the challenges?" says Martin Fankhauser, partner at the company Marfinance in Obergerlafingen in the canton of Solothurn.

Marked inflow of new money

Overall, independent asset managers can look back on stable (39 percent of respondents) or positive (29 percent) development over the past twelve months. In fact, 53 percent of the survey participants reported an increase in client portfolios, 43 percent of which were attributable to new money inflows.

Despite all the euphoria that obviously dominates at the beginning of the year. There are also cautionary voices. "The production and distribution of vaccines worldwide is a major challenge and will take some time," Fankhauser continues.

Rapidly growing debt

In addition, monetary and fiscal policy measures have so far kept the various economies afloat. Debt, however, continued to grow unabated. "How long will confidence in the reserve currencies last?" asks Fankhauser.

"The search for yield and performance will drive investors into ever riskier assets. The temptation to accept lower quality in portfolios and take higher risks is great - as is the bet that interest rates will remain low forever," warns the Marfinance expert.

The next AVI Index will be published in April 2021.

Contact: Nicolas Peter, Head Asset Management Phone: +41 58 680 60 42 Source: Finews AG, Zurich

Disclaimer: Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no undertaking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information provided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other transaction. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.

Disclaimer: Produced by Investment Center Aquila Ltd.

Information and opinions contained in this document are gathered and derived from sources which we believe to be reliable. However, we can offer no under-taking, representation or guarantee, either expressly or implicitly, as to the reliability, completeness or correctness of these sources and the information pro-vided. All information is provided without any guarantees and without any explicit or tacit warranties. Information and opinions contained in this document are for information purposes only and shall not be construed as an offer, recommendation or solicitation to acquire or dispose of any investment instrument or to engage in any other trans

action. Interested investors are strongly advised to consult with their Investment Adviser prior to taking any investment decision on the basis of this document in order to discuss and take into account their investment goals, financial situation, individual needs and constraints, risk profile and other information. We accept no liability for the accuracy, correctness and completeness of the information and opinions provided. To the extent permitted by law, we exclude all liability for direct, indirect or consequential damages, including loss of profit, arising from the published information.